Elixir just the tonic as Cottee targets the next QGC

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Elixir Energy Ltd (ASX:EXR) has notched up another important milestone at the company’s Nomgon IX Coal Bed Methane Production Sharing Contract (CBM PSC), receiving final environmental approval to commence its exploration program.

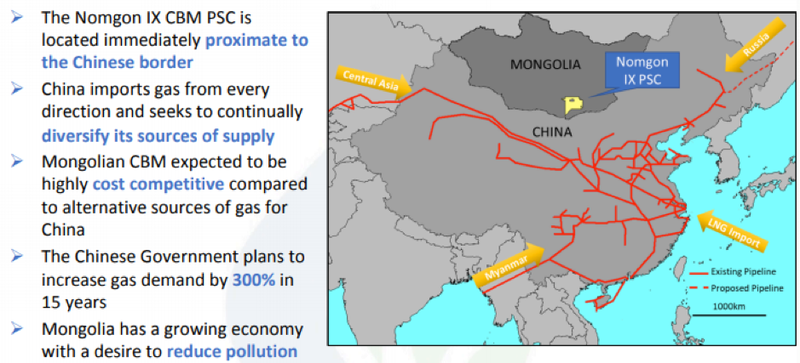

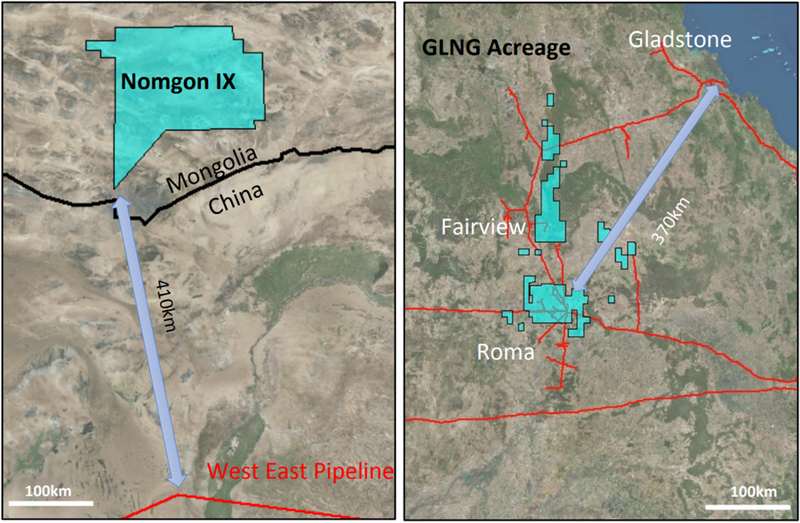

Nomgon is relatively close to the southern border of Mongolia and proximal to the rapidly growing and high-priced Chinese gas market.

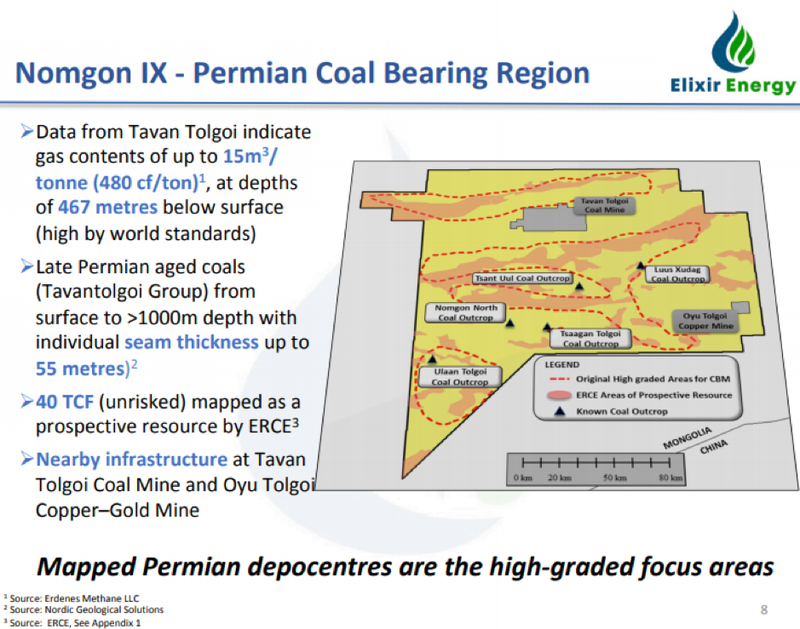

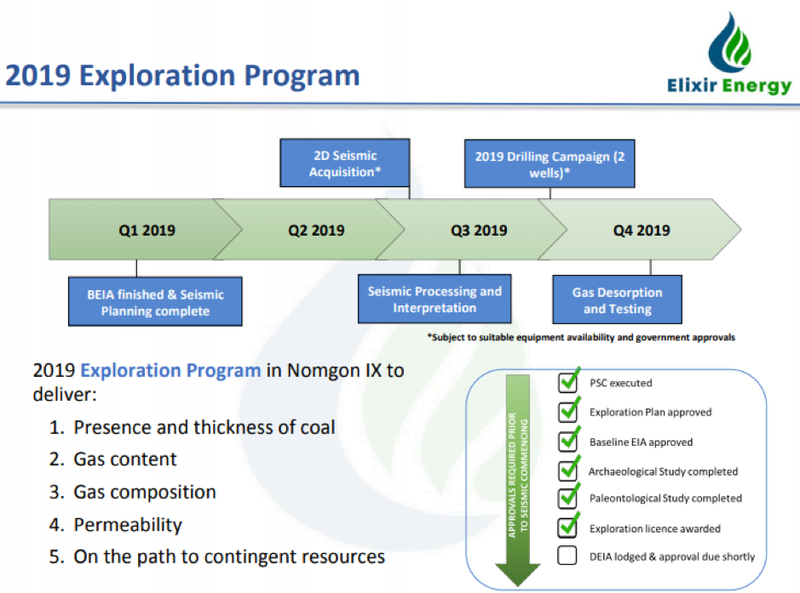

The company is targeting over 40 trillion cubic feet of prospective resources (best case unrisked), and receiving this approval paves the way for the company to commence its seismic and drilling program.

It shouldn’t be surprising that Elixir has been able to quickly achieve the following milestones, positioning the company to deliver market moving news in coming months.

The company has some heavy hitters and a wealth of experience on its board with former managing director of Queensland Gas Company (QGC) Richard Cottee in the role of non-executive chairman.

Cottee steered QGC from a $20 million minnow to a $5.7 billion takeover, and he also has a comprehensive knowledge of doing business in Europe having injected his vast corporate and operational experience into companies operating in that region.

Managing Director, Neil Young also has extensive experience with high profile energy companies, having been instrumental in building Santos’s (ASX:STO) coal seam gas business.

Importantly, he has worked in Mongolia since 2011 and was the driving force behind the acquisition of Nomgon PSC.

One of Young’s Santos colleagues in Stephen Keleman brings extensive technical and commercial experience in coal seam gas operations as non-executive director.

As indicated below, Elixir is a right time/right place story with the project not only situated close to China, but in reasonable proximity to the existing and proposed pipelines of the gas hungry region.

You can even see similarities in distances between the gas fields of Queensland and the east coast markets and what Elixir could be looking at in terms of tying into the West-East Pipeline that feeds into China.

As investors have joined the dots in recent months, Elixir’s shares have had a strong run, increasing nearly 80%, with promising signs of consolidation in a range between 3.5 cents and 4 cents over the last three months.

This indicates that there is confidence in management’s ability to build shareholder wealth as its corporate team has done in the past.

Consequently, Elixir is shaping up as a news-driven emerging story with multiple share price catalysts rather than just being a speculative trading stock.

All systems go at Nomgon

The company has advised its seismic contractor, Mongolian company Micro Seismic LLC, to mobilise the crew to the Nomgon IX CBM PSC in the South Gobi region and commence the acquisition of approximately 100 kilometres of new data aimed at further defining already identified coal seams within the productive CBM window.

Acquisition is scheduled to commence in approximately three weeks following Mongolia’s “Nadaam” holiday period.

The drilling tendering process is now at the formal contractor selection stage and Elixir expects to name the successful contractor shortly and execute a contract within a few weeks.

Drilling is planned to commence in or around September 2019.

No further significant Government approvals are required by Elixir in connection with the drilling program.

Highlighting the near-term nature of upcoming share price catalysts, Elixir’s managing director, Mr Neil Young said, “Elixir is naturally pleased to have passed the final regulatory milestone required before its fieldwork can commence.

“We are now preparing for our imminent seismic and drilling programs - which by the end of this year should have provided data (in the success case) to allow us to start to prove up contingent resources in the PSC”.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.