Elixir delivers seven successful wells in 2020, with 2021 even more promising

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Elixir Energy Limited (ASX:EXR) has provided a promising update on its 100% owned Nomgon IX CBM PCS, located in the South Gobi region of Mongolia, just north of the Chinese border.

Harking back to the group’s recent progress, early in the month the Nomgon 5S re-drill appraisal strat-hole well reached a total depth of 450 metres this and it has since been logged and remediated.

A total of 47 metres of net coal was intersected.

At this point, the Hutul 1S exploration well was drilling ahead with management anticipating that it should reach total depth and be logged by mid-November.

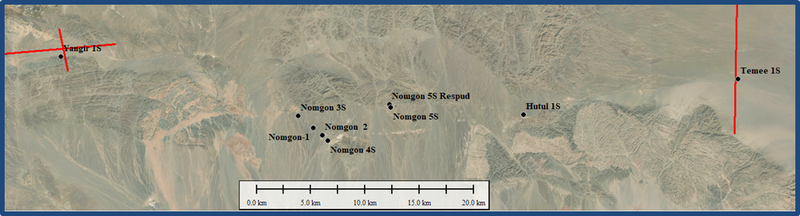

The Hutul 1S strat-hole well (located 19 kilometres to the East of Nomgon-1) was drilled to test a possible extension of the Nomgon sub-basin.

It reached a total depth of 560 metres and intersected 6 metres of coal.

Further tests and analysis are required to better define the resource and whether it is an extension of Nomgon, but on the face of the facts available at present management views this as ‘’a promising find.’’

Yangar 1S well intersects 27 metres of gassy coal in new sub-basin

In an extremely important development, the Yangar 1S strat-hole well (see map below), currently being drilled in a potential new sub-basin located some 24 kilometres to the north-west of Nomgon-1, has intersected 27 metres of coal to date.

As of Thursday morning, the well was at 344 metres and is drilling ahead.

Elixir’s well site geologist has observed very active gas bubbling from coals recovered to surface and in the mud-pit.

This is considered unusual and highly promising in coals at relatively shallow depths, and this may extend upwards the company’s overall view on the potential CBM window in the PSC.

Management will now follow up with an appraisal program in the Yangir sub-basin next year, likely commencing with a fully tested core-hole.

Elixir delivers seven successful wells in 2020

Elixir’s drilling program in 2020 has delivered seven wells that successfully intersected material coals over a total west to east distance of 43 kilometres.

COVID prevention measures in Mongolia have recently been escalated following instances of community transmission for the first time in the country.

At this stage, the situation is somewhat fluid but it seems likely that the company’s planned final strat-hole for 2020 will be delayed.

Commenting on Elixir’s achievements in 2020 and fleshing out what lies ahead in 2021 managing director Neil Young said, ”Elixir’s vision is to discover material quantities of gas just north of the Chinese border.

‘’Our strategy to achieve this is to utilise low-cost CBM exploration and appraisal tools in potential multiple sub-basins in our vast PSC.

‘’In the course of 2020 alone we have now identified two such sub-basins and made material progress in appraising one of these.

‘’We look forward to continuing to implement this successful ‘rinse and repeat’ process in the years ahead.”

China focus becomes increasingly relevant

Regarding Elixir’s strategy of building a portfolio of resources that could provide a platform to sell gas into China, a recent announcement by the country’s President is extremely encouraging.

With China being a leader in energy usage, President Xi Jinping’s statement in October in which he committed to net zero emissions by 2060 was embraced by those striving for a transition to carbon-neutral energy solutions.

China currently generates more than half of its electricity from coal, but natural gas is increasingly being used in the country for heating and transport.

An uptick in demand for natural gas in China would be extremely positive for Elixir Energy.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.