Discussions with management suggest it could be buy time at Sacgasco

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shares in gas producer and explorer, Sacgasco (ASX:SGC) have traded in a volatile fashion over the last few weeks, but investors haven’t been disappointed. Given the group is on the verge of releasing results from a potentially game changing well, there are bound to be plenty of investors pondering whether it is time to wade into the stock or take a profit.

The good news for SGC is that the majority of money has been with the former with the few retracements that have occurred in the course of surging some 150 per cent from 9 cents a month ago to a recent high of 23 cents, resulting in some of the highest volume buying in the company’s history.

Investors may have another chance to buy into a dip with the company’s shares pulling back to 15.5 cents on Wednesday. This was under comparatively weak volumes and didn’t appear to be related to any particular news flow, but it has provided a buying opportunity.

Of course, historical data in terms of earnings performance and/or share trading patterns should not be used as the basis for an investment as they may or may not be replicated. Those considering this stock should seek independent financial advice.

Though management released some news regarding testing procedures at its Dempsey 1-15 this was mainly to do with the logistical side of the group’s operations and in no way related to the results of upcoming test results.

Sacgasco prepared for high reservoir formation pressure during testing

However, FinFeed took the opportunity to catch up with SGC’s Managing Director Gary Jeffery. We discussed the extremely positive developments that have occurred over recent weeks and the bigger and better things that may be expected from the drilling of nearby wells.

In terms of Dempsey 1-15’s current status though, it is business as usual with Jeffery saying, “Dempsey 1 is entering a very exciting stage as we gear up to test the multiple zones that were identified during the drilling phase and we have contracted a workover rig that can deal with the anticipated high reservoir formation pressure that we expect to encounter”.

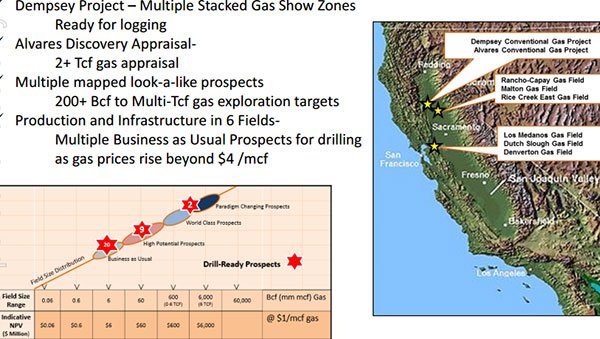

Jeffery confirmed that Dempsey 1-15 is a breakthrough well and a potential game changer for the Sacramento Basin, as well as SGC. With a stake of 50% in the project, immediate access to the existing pipeline infrastructure and broader regional asset ownership, SGC has unparalleled leverage to what could evolve as a re-evaluation of many of its assets that have exposure to surrounding territory.

The exploration and production profile of SGC’s assets as outlined above indicate that the company is punching above its weight, particularly given its conservative market capitalisation of circa $40 million.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.