Brown provides upbeat commentary on Project Venus

Published 24-SEP-2020 09:12 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Real Energy Corporation Ltd’s (ASX:RLE) managing director Scott Brown has provided some insightful commentary regarding the group’s joint venture operations in the Surat Basin.

The company also has 100% ownership of two large Cooper Basin permits in Queensland, ATP 927P and ATP1194PA.

However, the near-term focus is on the group’s Surat Basin interests, and on this note Real Energy is merging with joint venture partner Strata X, renaming the entity as Pure Energy, which will then transition to 100% ownership of Project Venus.

An independent expert has certified, on a best estimate basis, that Project Venus has a Prospective Gas Resource of 658 billion cubic feet (694 petajoules).

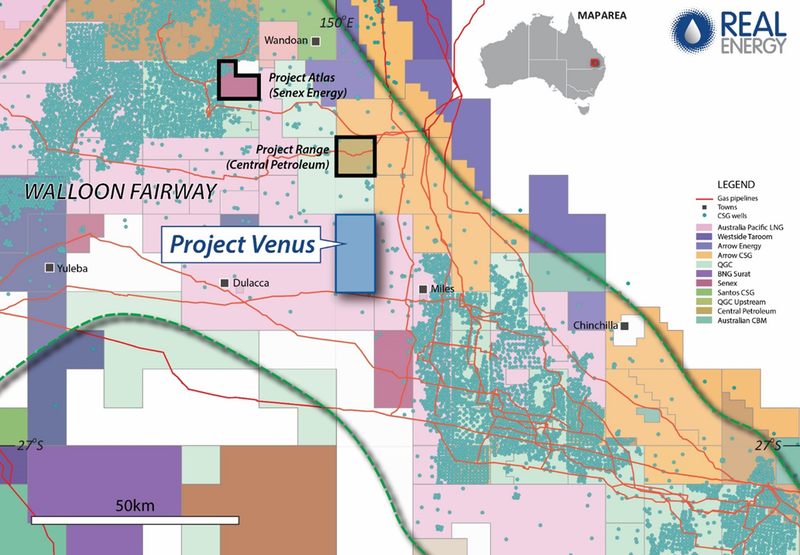

As indicated below, the location of this tenement is immediately adjacent to gas infrastructure and within a proven giant gas fairway, suggesting that the Venus Project has the potential to achieve early cash flows.

Commenting on the group’s strategy at Venus which incorporates the drilling of a new CSG well rather than opting to re-enter the Connor-1 well, Brown said, ‘’We think both Connor-1 and Venus-1 were good wells to consider and the Venus Project has considerable near-term upside having 694 pj of Prospective Resource.

‘’We believe with some success on this well we can deliver a meaningful Contingent Resource in the short term.

‘’While we determined Connor-1 was a good prospect there were some risks, indicating it was cleaner just to drill a fresh new well, potentially offering better upside value for not significantly more investment.’’

Brown discussed developments in the broader area, highlighting that Venus is located on the north-eastern part of the permit where the landowner said that Origin or APLNG is planning to drill just to the east on the same property.

On this note, Brown said, ‘’They obviously see what we see - tremendous upside and a coal seam that runs all the way through the Walloon fairway where there's thousands of wells that have been drilled and most of those are in production surrounded by major companies including QGC, Arrow and APLNG.

Certified reserves provide basis for further progress

If Venus-1 is successful, the company will use it as a pilot that would ultimately be rolled out.

The group would then drill another two wells to provide sufficient information to release a certified reserves estimate.

This would be a forerunner to signing a gas sales agreement ahead of moving to commercial production.

Using Senex Energy’s Project Atlas as an analogy, Brown said, ‘’With Project Atlas, Senex brought it into production after about two years of development, and this included construction of a pipeline and gas plant.

‘’Now they’re producing and making pretty good cash flow, which could be used as a template in relation to our strategy.’’

Pure hydrogen provides potential blue sky

Management has been running the numbers on Project Saturn near Miles and Project Jupiter which is close to Gladstone, both of which are situated in Queensland.

In relation to this initiative Brown said, ‘’We're looking at large-scale hydrogen plants at both locations.

‘’At this stage, Saturn would look to utilise gas not only from our own gas field, but we would look for gas from other projects in the area and utilise that to manufacture hydrogen which we believe there will be a market for locally.’’

‘’At Project Jupiter, we're looking primarily at making hydrogen from water so the company's been in discussions with potential off-takers and suppliers in the region.

‘’The initial economics of the projects have been very positive and concept studies are going to continue and we're hoping to complete it by the end of the calendar year so we'll have more to say in due course.’’

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.