BPH poised to benefit from drilling of Baleen target

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

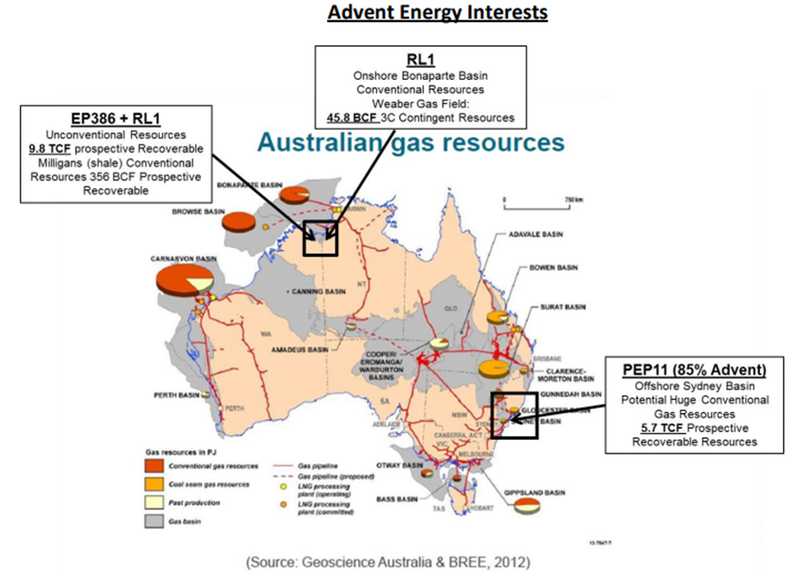

BPH Energy Limited’s (ASX:BPH) investee Advent Energy Ltd has submitted to the National Offshore Petroleum Titles Administrator (NOPTA) an application to enable the drilling of the Baleen drill target in the PEP11 permit offshore NSW.

Advent, through wholly owned subsidiary Asset Energy Pty Ltd, holds an 85% interest and is operator of the permit.

BPH Energy is the second largest shareholder in Advent Energy Ltd (Advent) with a direct interest of 22%.

Bounty Oil and Gas NL (ASX:BUY) holds the remaining 15%.

The PEP11 Joint Venture has reviewed the work program and now proposes to proceed with the drilling of a well at Baleen subject to approvals from NOPTA and other regulatory authorities and financing.

An application is being made to NOPTA to change the current permit conditions to proceed with the drilling.

Bounty and Asset Energy are now moving to a drill ready status for PEP11.

The current permit expiry date is in March 2021, but the application to NOPTA includes the extension of the permit title for up to two years to enable the drilling and includes an application for the removal of the requirement for a 500 square kilometre 3D seismic program.

The Joint Venture will further update the market on the timing of these approvals when details are available.

Targets believed to hold massive gas resources

The PEP11 project lies in the offshore Sydney Basin adjacent to the NSW coast, extending from Sydney to Newcastle and situated in Commonwealth waters.

The PEP11 project comprises significant structural targets believed to hold multi-trillion cubic feet natural gas resources.

PEP11 is supremely located to potentially supply gas into the east coast gas market.

The gas supply crisis on the east coast of Australia has created a significant market opportunity to raise the funding to drill with the objective of developing the PEP11 project, and management is now engaging with investors to fund this drilling.

As a means of assessing the industry outlook, the Australian Competition and Consumer Commission (ACCC Gas Enquiry 2017-2020 Interim Report April 2019) has confirmed that domestic wholesale gas prices have risen two to three times higher than historical prices, and the 2020 average of expected LNG netback gas price is around $9 per gigajoule.

BPH noted that this has put many trade-exposed Australian manufacturers under extreme pressure.

There is also continuing uncertainty about the longer-term supply outlook.

The Gas Statement of Opportunities (GSOO) released in March 2019, cited a warning from the Australian Energy Market Operator (AEMO) about potential supply shortages emerging on the east coast within five years, particularly in the southern states.

Advent with JV partner Bounty Oil completed a 200-line kilometre 2D seismic survey in PEP11 in the second quarter of 2018 at Baleen as a precursor to drilling of this target approximately 30 kilometres south east of Newcastle.

PEP 11 covers nearly 4600 square kilometres of the offshore Sydney Basin immediately adjacent to the largest gas market in Australia and is a high impact exploration project.

The permit area remains one of the most significant untested gas plays in Australia.

Importantly, the PEP JV has demonstrated considerable gas generation and migration in the offshore Sydney Basin, with the previously observed mapped prospects and leads being highly prospective for gas.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.