AVD teams with US$250M geophysics company to bid for Caribbean acreage

Published 21-OCT-2014 09:19 A.M.

|

5 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Antilles Oil and Gas (ASX: AVD) has linked up with the US$250M market cap Norwegian marine geophysics company Polarcus (OTCMKTS:PLCS) to jointly search and bid for acreage in the Caribbean.

Capped at $6.5M, AVD is chasing large scale, deep-water oil resources. It’s now focused on securing high potential acreage, with the aim of attracting a farm-in partner to ultimately drill. AVD is searching in basins with proven hydrocarbon potential or moderate risk / high reward areas.

AVD is led by founder David Ormerod, who selected the offshore Moroccan acreage that ultimately led to a US$215M farm-in deal for Pura Vida Energy (ASX: PVD). Ormerod was a founder of PVD and led that company’s charge into Morocco – ahead of the industry.

Polarcus (OSE: PLCS) has agreed to work with AVD to find prospective sites in the Caribbean and help bid on and then develop them. This comes after AVD recently forged a partnership with US firm AGR FJ Brown Inc. to provide drilling support for any bids it makes in the Caribbean.

AVD says having the backing of a world-class 3D seismic and drilling team will give it a stronger position when it bids for acreage with governments in the Caribbean.

It’s currently reviewing acreage across this largely undeveloped energy region including offshore Colombia, Trinidad, Cuba and Panama.

Polarcus to have 25% stake in any Antilles bid

AVD will form a Joint Study and Bid Group (JSBG) with Polarcus to acquire and analyse 3D seismic data in highly prospective regions with a Caribbean focus.

This data will be used to identify acreage suitable for bidding and Polarcus may take a 25% stake in any joint bid with AVD as the operator.

Polarcus is a pure play marine geophysical survey company that boasts a fleet of eight 3D seismic vessels. It’s forged a solid track record of sourcing high-end seismic imagery that’s used to evaluate potential prospects and improve the chances of exploration success.

AVD Managing Director David Ormerod says the partnership will allow for rapid development when a successful acreage bid is made. “Antilles looks forward to successful acquisition of new acreage in the prospective trends we have identified with Polarcus and the rapid development of our exploration portfolio.”

US driller also to back AVD bids

And on the drilling side, AVD has a similar agreement with AGR FJ Brown Inc., a US-based drilling company that has completed over 500 well projects across the globe in the past 13 years.

Under the agreement AGR will provide drilling support to AVD on the acreage opportunities it identifies. MD Ormerod says having AGR on board will make any bids it makes far more effective.

‘AGR is an experienced and highly respected operator in the oil and gas industry,’ he says. ‘Antilles believes this agreement will allow more effective engagement with governments in the region for direct negotiation on potential license areas.’

AGR has a global reach, operating in every major oil hub around the world providing Design Engineering, Well Construction, HSE and Project Management Services. It recently delisted from the Oslo Stock Exchange and is now fully owned by private equity firm Silverfleet Capital. AGR posted a profit of over US$11M in 2013.

AVD management team’s track record

AVD’s plan in the Caribbean is to attract a large farm-in partner with a view to drill for large scale resources.

The management team has done this sort of thing before, particularly Managing Director and founder David Ormerod who also founded Pura Vida Energy.

Ormerod identified offshore Morocco as a high potential oil region ahead of the industry and now believes industry attention will soon be drawn to the Caribbean.

Ormerod was responsible for Pura Vida Energy’s entry into Morocco – ultimately leading to a successful US$215M two well farm-in deal that Pura Vida secured with Freeport McMoRan for its offshore Moroccan acreage.

Ormerod was also instrumental in leading Karoon Gas (ASX:KAR), now capped at $850M, to secure acreage in the Santos Basin offshore Brazil. This acreage was farmed-out to Pacific Rubiales, and led to the drilling of three wells – two of which were significant discoveries. In addition, Ormerod has worked with BHP to develop deep-water wells in major global offshore regions.

Assisting Ormerod in the hunt for prospective Caribbean acreage is Non-Executive Director Gary Grubitz, a man with a long track record of successful offshore oil projects. He has over 30 years experience in the industry and has worked with BHP in the Gulf of Mexico, driving the discovery of multiple new plays resulting in multi-hundred million barrel deep-water discoveries.

Both men will be hoping to repeat their successes with AVD. Now that AVD has assembled exploration and drilling support for its Caribbean acreage bidding effort from much larger companies, the coming months could see news of a successful bid.

High potential offshore regions in the Antilles and beyond

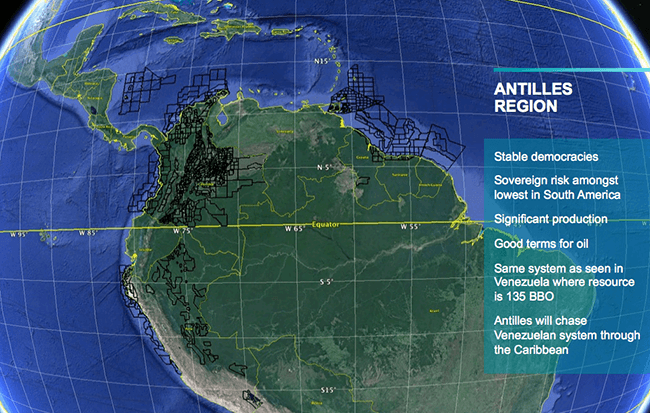

The Antilles region AVD is targeting for exploration and drilling is split into three areas – The Greater Antilles, The Lesser Antilles and the Central America Antilles.

These regions cover the Caribbean islands from Cuba and Jamaica down to Trinidad and the coast of Venezuela and across to Colombia and Nicaragua. The nations in the area have stable democracies and their sovereign risk is considered amongst the lowest in South America.

It’s a large region that’s highly prospective for oil and gas, yet little offshore development has happened to date. Venezuela has around 135BBO while Trinidad has around 13TCF of gas and 1BBO. Further afield, Colombia is reckoned to have resources of 2.4BBO and Peru 15.4TCF of gas and 663MMBO.

AVD has identified the Antilles as the world’s next growth spot for offshore oil and gas development and is looking to acquire prospective acreage in the coming months.

Next moves for AVD and its exploration team

AVD is expected to select acreage in Caribbean in the coming months.

Its exploration agreement with Polarcus will enable it to source and acquire high quality offshore 3D seismic surveys and identify strong prospects it can then bid for with the company’s backing.

Acreage bids will be made to various governments in the Antilles region and also having driller AGR FJ Brown Inc. on board will strengthen AVD’s position by showing it can develop the sites it wants immediately.

AVD is also in the midst of an $8M capital raise with an issue price of $0.20. At least $3M has already been received. AVD has extended this offer to October 31st as it remains in discussions with additional strategic investors.

This money will help AVD accelerate its search for Caribbean acreage.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.