AVD Expands Exploration in Peru and Plans to Raise Additional $4 Million

Published 02-JUL-2015 12:03 P.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Antilles Oil & Gas (ASX:AVD), has just published several key updates regarding their exploration activities in the Antilles region adjacent to northern Latin America. Following on from our previous story on AVD back in March, the company has since seen several developments relating to its operations.

AVD is pursing a two-pronged strategy for oil exploration, simultaneously exploring for deep water assets in the Antilles Region of South America and The Caribbean, while targeting near-term production onshore Peru.

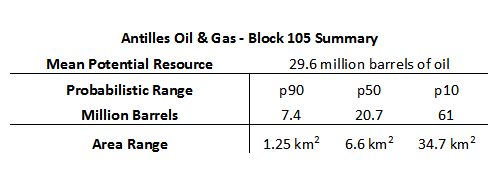

The first major update is that AVD’s prime location in the region (Block 105 in the Titicaca basin) has definitive hydrocarbon activity as shown by oil seeps carried out by geologists. Geologic surveys show one section of Block 105 containing 29.6 million barrels in prospective resources.

The prospect is close to the producing Pirin Oil Field and its extensive network of railway and pipeline communications. The company plans to shoot seismic surveys over the prospective resource and the wider area in the lead up to a drilling campaign.

Despite sustained pressure on global oil prices over the past 18 months, AVD is confident that its current exploration activities in the region (and beyond) can remain viable.

In a statement, AVD Managing Director David Ormerod said, “We look forward to testing the productive trend we have identified in Peru and the development of further potential resources from our exploration portfolio”. Adding, “With the Block 105 cost structure and available means of export, the identified potential resources can lead to attractive returns even in the current oil price environment”.

Exploration in Block 105 carries with it a royalty tax regime ranging between 5%-20% depending on production with a supplementary corporate tax rate of 32%.

Exploring Exploration

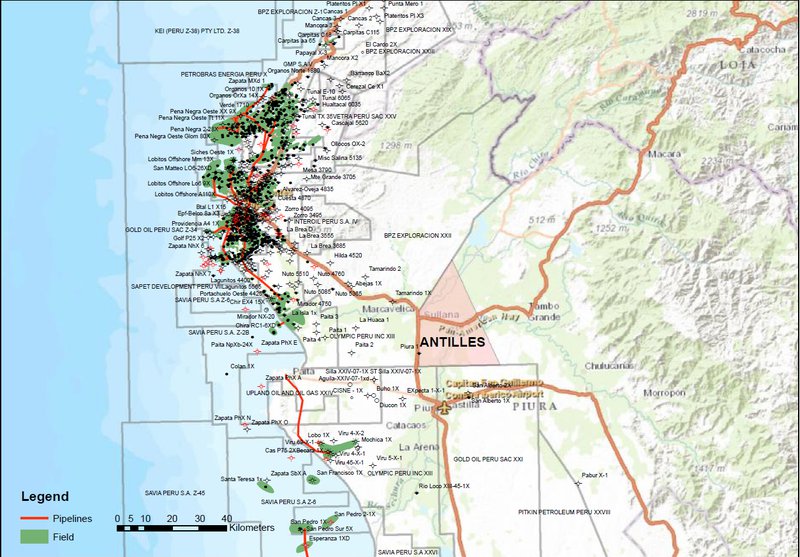

Aside from exploration in the Titicaca basin, AVD has also stepped up its efforts in the Sechura basin in north-east Peru by acquiring the right to a Technical Evaluation Agreement (TEA) for an acreage position in onshore Peru. AVD retains a 100% equity holding in the agreement with the site located within 50km of existing production.

The investment is an agreement with the regulator ‘Perupetro’ for the right to evaluate the area and move to an exploration license in future. The fiscal terms of the area are highly attractive with low associated costs and a network of major highways allowing export via road.

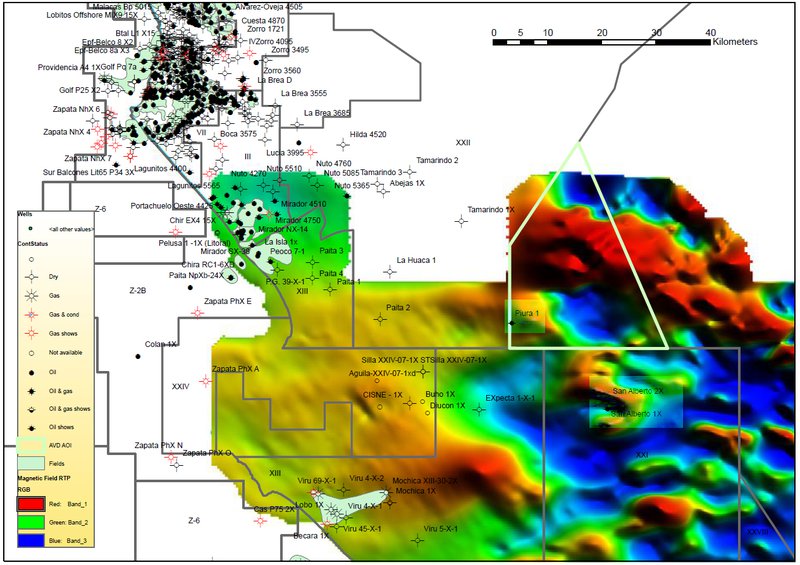

The Sechura basin has a proven track record for the existence of hydrocarbons for both oil and gas. The Puira-1 and San Alberto-1X sites have shown promising samples and likely existence of working hydrocarbon system which bodes very well for AVD given the proximity of their own fields. The TEA agreement involves evaluating existing data with an estimated expenditure of $400,000 over the next two years.

Map of magnetic response indicates a major high running through the centre of the block associated with an inversion tectonic trend – a positive sign for the presence of oil

Drilling for Capital

In order to support future exploration efforts, AVD is looking for additional capital to be conducted as priority over the coming weeks. In a recent announcement, AVD announced a Share Placement and Rights Issue to be completed by the end of June 2015, adding 44 million new shares to the existing 28.7 million.

AVD plans to offer an additional 3,387,000 shares to sophisticated and institutional investors at an issue price of $0.085 cents ($8.5c per share), raising $287,895. This will include a free option to exercise at 10c per share which expires on 31st January 2017.

For all other investors not included in the ‘sophisticated’ and ‘institutional’ categories, AVD is inviting shareholders to participate in a renounceable pro-rata rights issue to raise $3,747,328. AVD expects to issue a maximum of 44,086,216 fully paid ordinary shares at an issue price of 8.5c with an attached option to sell the new shares at 10c.

The new share issue is only available for ‘Eligible’ shareholders – investors that are registered and domiciled in either Australia, New Zealand or the United Kingdom. Any shareholder based outside of these territories must contact AVD’s official Nominee, to be announced in due course.

Eligible shareholders wishing to take up their Entitlement must ensure all necessary documentation is received by AVD’s share registry by June 11th 2015.

AVD plans to raise over $4 million before the end of the year in order to drill a well in block 105 (on-shore) or conduct a seismic survey and seismic reprocessing.

The Bigger Picture Offshore

As AVD pushes forward with its on-shore drilling efforts, their off-shore plans are also full of optimism given the recent natural gas discovery off the coast of Columbia by ‘Petrobas’.

The gas discovery was made at the Orca-1 well, drilled in the Tayrona Block about 40 kms offshore La Guajira province, bordering neighbouring Venezuela.

The deep-water discovery shows the presence of an active hydrocarbon system below the ocean floor and likely to add confidence to AVD’s long-term approach of conducting high value deep water Atlantic Margin type exploration with moderate risk.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.