Austin achieves important milestone in progressing Pathfinder to production

Published 09-FEB-2017 14:38 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Austin Exploration (ASX: AKK), a group which has strategically situated oil and gas assets in Colorado, Kentucky and Texas has released its Maiden Reserves and Resources estimate for the Pathfinder project located in Colorado.

The first oil and gas reserves assigned to the Pathfinder project located in Colorado only represent 1800 acres of the company’s 15,773 acre tenement.

Assigned oil and gas reserves of 1.148 million barrels of oil and 451 million cubic feet of gas implies a net present value of approximately US$16 million.

However, extrapolating this valuation to account for all of the acreage indicates the net present value will be well north of US$16 million, potentially resulting in a share price rerating given the company’s market capitalisation is only $10 million.

Colorado acreage estimated to hold more than 30 million barrels of oil and 187.4 bcf of gas

Independent Oil and Gas Resources estimates the Colorado acreage to hold more than 30 million barrels of oil and 187.4 billion cubic feet of gas P90 (90% probability).

While this is definitely an inflection point in terms of progressing Pathfinder from exploration to production, it also leaves Austin much better positioned in terms of raising capital to develop the assets and fund further exploration.

On this note, Chief Executive Timothy Hart said, “This significant development gives Austin the ability to pursue project financing for large-scale and long-term field development for Pathfinder, the first time the company has been able to source such funding lines which today are attractively priced due to historically low interest rates”.

Resources and reserves to grow as Austin replicates adjacent oilfields

A significant proportion of oil and gas resources should convert to reserves as further drilling and development occurs over the remaining 13,973 acres, potentially providing share price momentum.

In terms of prospectivity, the Pathfinder project is situated directly adjacent to the active Florence oilfield that has produced 16.4 million barrels of oil.

Oil reserves show potential at Pathfinder

These results support management’s exploration strategy which was founded on the view that an active petroleum system extended to the west from the established Florence oilfield.

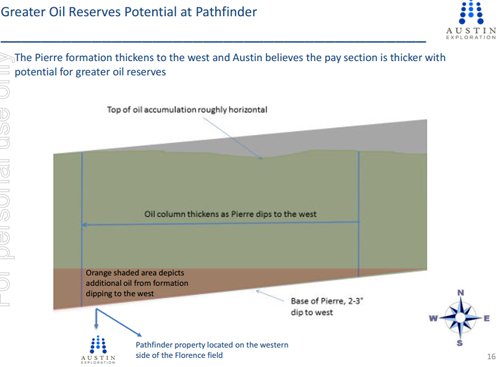

Furthermore, it has been proven that the formation is deeper and thicker and more prospective than the existing oilfield, a factor that will be taken into account as exploration aimed at growing resources and reserves is undertaken in the near term.

It is worth noting Austin also has interests in producing oil and gas wells in Colorado, Kentucky and Texas. The company finished 2016 debt free, as well as expanding its flagship property in Colorado and achieving first production success with its Colorado drilling campaign.

While 2016 could be considered a transformational year for AKK, the next 12 months is likely to see projects further de-risked and the company’s balance sheet strengthened by the injection of cash from producing assets recently brought on stream.

However, AKK is a speculative stock and therefore investors should take a cautious approach to their investment decision and seek professional financial advice.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.