American Patriot finalises second Texas oil and gas acquisition

Published 12-SEP-2017 10:48 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

American Patriot Oil and Gas (ASX:AOW) today announced its acquisition of additional conventional oil and gas assets in Texas – the veritable heart of the US oil industry.

Now well on the path to being cash flow positive by the end of 2017, AOW is demonstrating an emerging track record of success in execution by closing and funding conventional production deals.

The assets consist of 50 barrels of oil per day of conventional production with considerable upside scope.

The assets contain 300,000 barrels proven oil and gas (mboe) 1P reserves certified by independent reserve reports, estimated to generated US$11 million revenue with a PV10 value of $USD3 million acquired for US$430k.

These assets have been acquired out of Chapter 11 Bankruptcy from the major lender, Solstice Capital LLC.

This transaction represents the second part of the company’s recently announced acquisition. Combined with these other assets, this brings AOW well on track to achieving production of 300 barrels of oil equivalent per day by the end of the year, with 1 million barrels of proven oil and gas reserves certified by independent reserve reports.

Of course it should be noted that AOW remains a speculative stock and investors should seek professional financial advice if considering this stock for their portfolio.

This will generate approximately US$30 million revenue at current oil and gas prices over a period of time.

The assets are being acquired using existing AOW cash, as well as funding from a significant US based funder partnering with AOW to acquire these and additional future conventional assets.

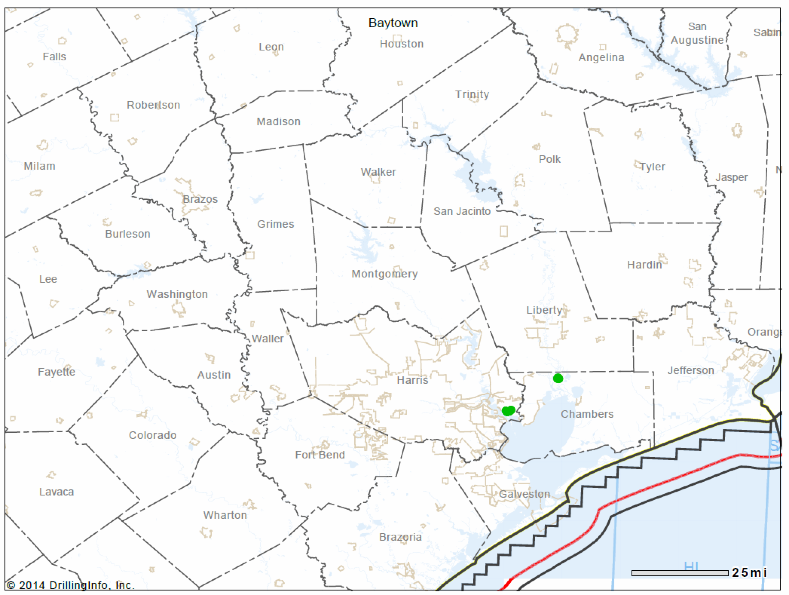

The Lost Lake and Goose Creek Oil fields acquired in this transaction are located in the Harris and Chambers counties, Texas.

Both fields are mature legacy assets with current daily production of 51 barrels of oil per day shut-in, with significant proven behind pipe pay that has not yet been exploited, with the ability to grow production significantly for minimal capital expenditure.

There is also substantial workover and behind pipe potential on the existing wells. Importantly, all existing infrastructure is in place, including pump jacks, tanks, batteries and piping.

The asset also requires minimal workover expenditure to bring these fields back to life, and the field consists of 37 recompletions and underdeveloped wells with significant potential in these mature legacy fields.

AOW will be operator of this asset, with the existing owner assisting with this process.

Notably, operating costs in this region are approximately $22/bbl, so the wells are economic down to a low oil price.

AOW CEO, Alexis Clark, said: “We have been working on this deal for almost 12 months as the asset moved into bankruptcy extending the timelines, so completion of the transaction is a satisfying outcome given the work involved.”

“Due to the distressed nature of the acquisition we have acquired the assets at a low cost entry point, with significant reserve potential and upside which the previous owner was unable to exploit.”

“We can quickly restart the 50bopd shut-in production at a low or minimal cost and generate immediate cash flow,” said Clark. “The upside potential is also readily achievable with workovers at low cost, which will double or triple production in the next 12 months.”

With a solid pipeline of deals in the works, AOW is now emerging as a noteworthy US oil and gas production company with an immediate and growing cash flow and reserve base in Texas, fully supported by its US-based funders.

AOW also has a number of additional transactions in its pipeline set to close in the second half of 2017, which will further accelerate its production growth and reserves. These will enable AOW to deliver on the strategy of aggressively building a producing conventional oil business with well over 1000 barrels of oil per day production in 2018.

AOW is now listed on both the US OTC QB market and the ASX, and will also be looking to up-list to a significant US stock exchange in the next 12 months.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.