Alligator takes bite of uranium market

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Alligator Energy (ASX:AGE) is in a prime position to capitalise on the glowing uranium market, announcing today that it has acquired Cameco Australia’s remaining 41.65 per cent interest in the Beatrice Project tenements.

AGE now holds 100 per cent of the project. Beatrice is one of the highest quality and priority exploration targets for potential uranium discovery, which lies 13 kilometres directly east of the Ranger Uranium Mine — AGE’s previous geological and geophysical work on the BT12 target suggests it has the right structural and stratigraphic characteristic to host similar deposits.

AGE is an experienced exploration group with advanced uranium prospects in the Alligator Rivers Uranium Province (ARUP) of the NT, and has rights to earn an interest over nickel and cobalt tenements in the Piedmont region in Italy.

The uranium market continues to power forward, with completion in March this year of the first nuclear plant in the UAE, and continued uranium production cuts at producing operations.

According to a 2017 report by the World Nuclear Association, global nuclear power generation is now back and above where it was just prior to the 2011 Japanese tsunami, and nearly all through new plant construction in countries like China, India, Russia and the Middle East.

Recent uranium production cut announcements at Cameco’s McArthur River Mine in Canada and Kazatomprom in Kazakhstan earlier in 2017 have resulted in anticipated reduction in uranium inventories through 2018 and some improvement in the spot price. On top of that, a number of utilities will be targeting to renegotiate long-term contracts in the next 1-2 years, which bodes nicely for a return to sustainable pricing.

Russian lawmakers have also recently drafted legislation that will allow the country to ban or restrict imports of a slew of US goods and services — a move that could impact the US uranium market. The draft bill calls for a halt in trade between US nuclear power companies and Russia’s state-owned nuclear company, Rosatom.

According to uranium expert, Mike Alkin, the US uses 50 million pounds of uranium a year, and currently imports 95 per cent of that uranium.

All of this has potentially major implications for aspiring uranium producers like AGE.

However, how much of the market Alligator is able to corner is speculative at this stage and therefore, investors shouldn’t act on this fact alone, but should take all publicly available information into account and seek professional financial advice.

The purchase of the remaining interest in the Beatrice Project tenements is based on a nominal up-front cost, with a 15 year Cameco buyback option of 40 per cent based on discovery and definition of a JORC Resource of more than 100 million pounds of uranium.

This strategic transaction is in line with AGE’s plan to discover new high-grade uranium deposits within the ARUP region, consolidate its regional holding ownership, and maintain the relationship with Cameco.

AGE says it remains optimistic in the short to medium term for a fundamental shift in uranium price, and remains committed to low cost, effective and progressive exploration of its uranium assets to tap into on this expected improvement in the uranium market.

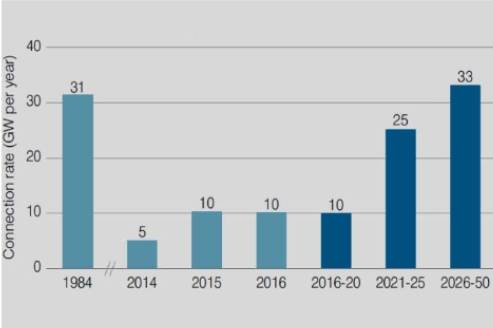

Connection rate of new nuclear power capacity globally, with future World Nuclear Association predictions

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.