A $10 billion CSG project is coming to QLD’s Surat Basin

Published 17-APR-2020 14:55 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Integrated coal seam gas (CSG) company Arrow Energy today confirmed that construction on the first phase of its Surat Gas Project (SGP) in southern Queensland is set to begin this year.

The announcement comes after the Queensland government's February decision to green light the $10 billion Surat gas project — the biggest resource project in the state in almost 10 years.

The decision will see Arrow bring up to 90 billion cubic feet per year of new gas to market at peak production, which will flow to Shell-operated QGC to be sold locally and exported through its Queensland Curtis Liquefied Natural Gas project on Curtis Island.

Arrow Energy CEO Cecile Wake said, “Today's decisions by PetroChina, Shell and Arrow demonstrate commitment to and confidence in Queensland and the Australian market at a time of global economic turmoil from COVID-19 and against the backdrop of sustained low oil prices.

“This significant investment comes at a critical time and will cement Arrow's position as a major producer of natural gas on the east coast.

“The Surat Gas Project is the first large-scale CSG project in Australia to be underpinned by a significant infrastructure collaboration and gas sales agreement, together with a suite of supporting agreements, which have been put in place between Arrow and the Shell-operated QGC joint venture.

“This agreement enables the use of capacity in QGC's existing gas and water processing, treatment and transportation infrastructure, reducing the impacts on landholders, communities and the environment and ensuring that more gas can be economically developed.”

While Arrow Energy is privately-owned 50/50 by Shell and Chinese National Petroleum Corporation-owned PetroChina, there are ASX-listed juniors that will likely benefit from operations in the Surat Basin.

Real Energy & Strata-X enter Surat Basin

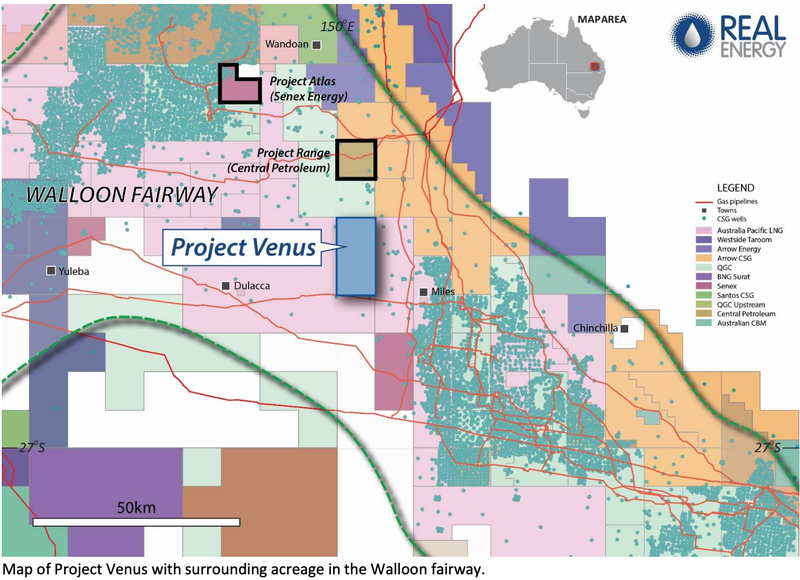

The Queensland Government recently granted title of the Venus Project permit ATP-2051, located within the main Walloon coal seam gas (CSG) fairway in the Surat Basin, to the 50/50 Strata-X Energy (ASX:SXA) and Real Energy Corporation (ASX:RLE) joint venture.

The project is immediately adjacent to gas infrastructure and is prospective for CSG over its entire permit area.

A recent independent review of the data within and around the permit certified a Prospective Gas Resource of 658 BCF (694 PJ) gross, 329 BCF (347 PJ) net to Strata-X in the Walloon coal seams in ATP 2051.

The Venus Project is adjacent to gas infrastructure, and the JV plans to expedite appraisal and conversion of resources to reserves in order to fast track development.

Real Energy will be the administrative and commercial operator while Strata-X, at least for the initial phase to predictable reserves certification, will be the technical operator.

Aligning with Strata-X appears to be an astute decision by Real Energy as Ron Prefontaine is the executive chairman of the group.

Prefontaine was the technical director of Arrow Energy and founding managing director of Bow Energy, both previously ASX-listed CSG companies that were taken over in 2010 and 2011, respectively, for a combined total of approximately $4 billion.

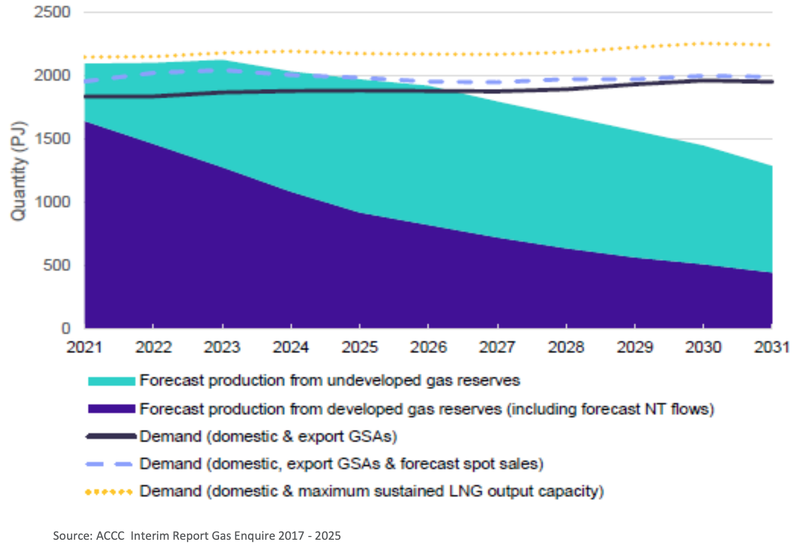

This comes as the Australian Energy Market Operator (AEMO) predicts a shortage of gas in the southern states during winter in 2024, unless more southern supply sources are developed, or pipeline capacity limitations are addressed.

AEMO Managing Director and CEO, Audrey Zibelman, said, “Supply from existing and committed southern gas developments is expected to reduce by more than 35 per cent over the next five years, despite the increase in newly committed gas projects over the last 12 months.

“The risk of peak day shortfalls could be resolved by a wide range of different options.

“This could include the development of new LNG import terminals, pipeline expansions, or new supply that could result from the Victorian Government’s decision to lift the ban on onshore gas exploration from July 2021.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.