88E reports encouraging evidence of oil in downhole samples

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

88 Energy (ASX:88E | OTC: EEENF) has today updated the market with regard to operations on the North Slope of Alaska.

88E has alerted the market to:

- Encouraging evidence of oil in downhole samples being investigated in laboratory.

- Additional fluorescence recorded at previously unidentified depths.

- Final payment of vendors in stock to be made.

Focusing on the first two points, 88E recently received and finalised its review of a report related to its downhole sampling program, undertaken during the logging of the Merlin-1 well.

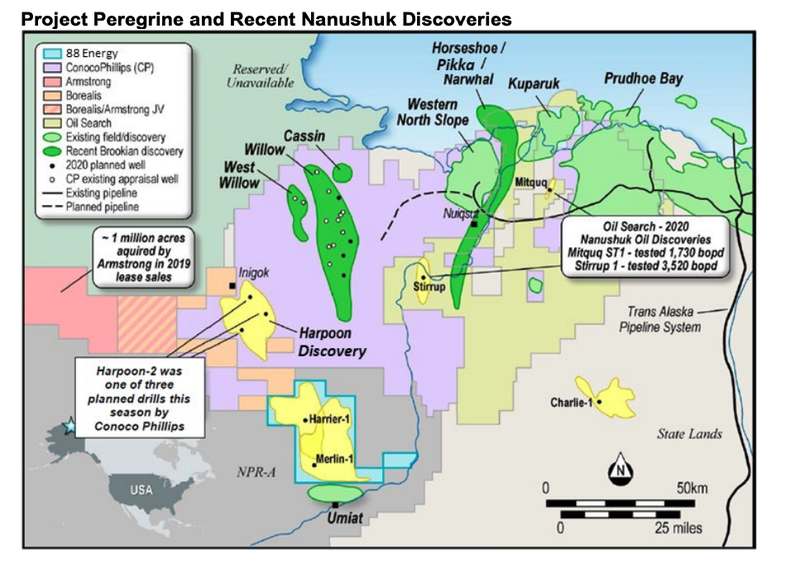

Merlin-1 is part of 88E’s Project Peregrine, located in the NPR-A region of the North Slope of Alaska. It encompasses ~195,000 contiguous acres and is situated on trend to recent discoveries in a newly successful play type in topset sands in the Nanushuk formation.

The Merlin-1 well was spudded in March 2021 and targeted 645 million barrels of gross mean prospective resource.

Drilling is now complete, and interpretation of results is underway. Note, that a second well, Harrier-1, is planned to be drilled in 2022 and is targeting gross mean prospective resource of 417 million barrels.

Encouraging results

Logging of Merlin-1 was conducted using Halliburton’s Reservoir Description Tool (RDT).

Observations from an optical fluid analysis sensor had previously indicated the likely presence of oil in the formation fluid across several of the depths that were sampled.

During recent drilling, the initial on-site results seemed promising, however due to technical issues testing of the two most prospective zones – which might have confirmed a large oil discovery – was hindered.

Over the last few weeks 88E has tested the samples they managed to procure, in order to record as much data as possible and interpret what was found.

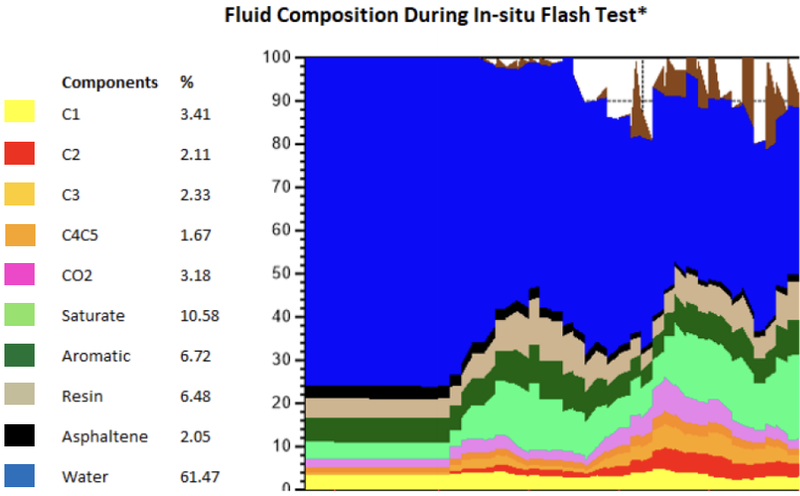

Looking at the raw data that has been processed and presented in a final report from the RDT logging run, results for two of the samples where the pressure was taken to below 100psi (atmospheric pressure is ~15psi), show the pressure in the third sample was only decreased to 403psi.

The key takeaway is that up to 70% hydrocarbon has been observed in downhole samples, when pressure was normalised close to that at the surface.

This kind of ratio is “indicative of a discovery”... however further investigation is required.

Oil on the horizon?

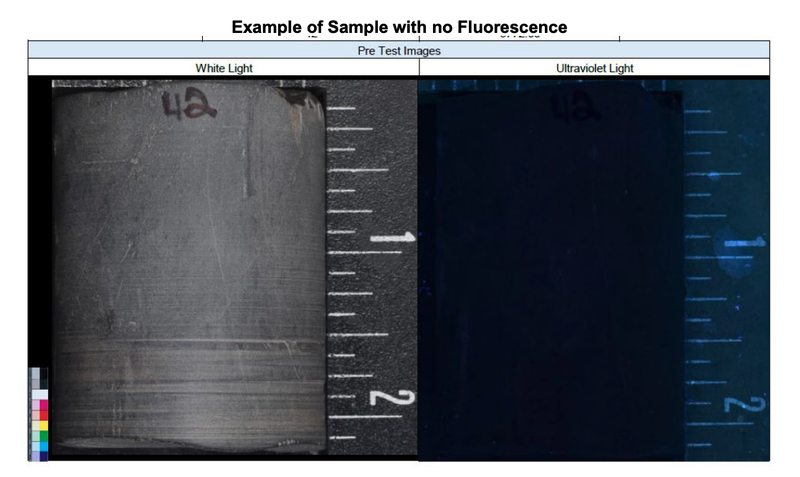

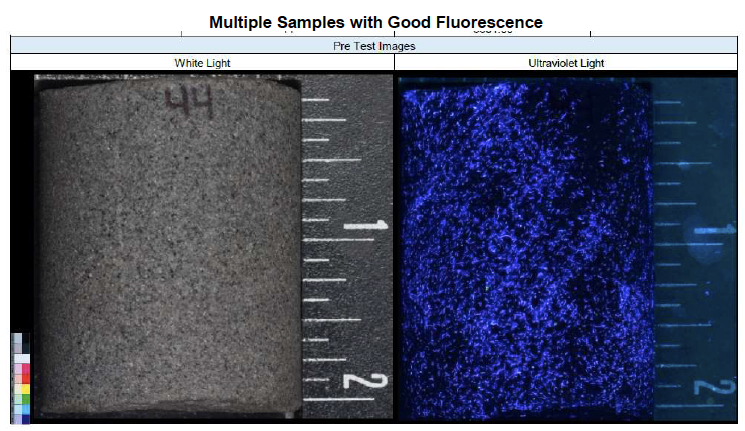

It should also be noted that if oil is present, then fluorescence will be evident under UV light. 88E undertook white and UV light photography, whilst preparing the side wall cores for further testing.

Multiple horizons were identified as having oil present during drilling via observation of fluorescence under UV light and also using solvent (or cut) to determine whether oil would leach out from the samples.

Several horizons have shown evidence of oil, which were not previously identified. These horizons, in addition to those already known to contain oil, will be the focus of further work.

It should also be noted that 18 of the most prospective samples were not included in those sent for analyses, as they have been set aside for special analysis related to any oil extracted.

Below you can compare samples with no fluorescence to those with good fluorescence.

What’s to come ahead of the Alaskan winter

88E has finalised the costs associated with drilling, with its net share coming in at US$9M and vendors agreeing to accept payment via 345M shares at $0.025, wrapping up the final invoices for Merlin-1.

This leaves 88E with a strong cash position ahead of another drilling event next Alaskan winter.

There are a few more lab results still to come through from Merlin-1 as well and we should see:

- Nuclear magnetic resonance imagery: to determine the ratios of free oil and water present, as well as porosity.

- Dean Stark tests: extracts the oil and the water from the sample to determine saturations.

- Final petrophysical interpretation: The results of all tests to date will then be integrated into a final petrophysical interpretation.

- Mapping of prospective pay zones: During Merlin-1 several prospective zones were encountered that had previously been unmapped.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.