88E prepares to commence drilling at Icewine

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shares in 88 Energy (ASX/AIM: 88E) have surged nearly 20% in April, spurred on by a recovery in the oil price after the stock price came off in line with the dip below US$50 per barrel that occurred in March.

It should be noted that share trading patterns should not be used as the basis for an investment as they may or may not be replicated. Those considering this stock should seek independent financial advice.

Another significant catalyst has been newsflow regarding 88E’s upcoming commencement of its Icewine #2 project located onshore the North Slope of Alaska, and this has the potential to provide ongoing share price momentum.

On the score of the oil price there is no getting around the fact that it will have a significant impact on 88E’s share price performance, but looking to the future this is more likely to have a positive impact rather than placing a drag on the company’s valuation.

Based on Hartleys analyst, Simon Andrews’ modelling, an oil price of US$40 per barrel is a breakeven point. Hence, the circa 6% increase in the oil price that has occurred in the last week from sub US$50 per barrel levels to more than US$53 per barrel is an incremental increase that drops straight to 88E’s bottom line.

Although, broker projections and price targets are only estimates and may not be met.

88E closes the gap against the Nymex Oil price

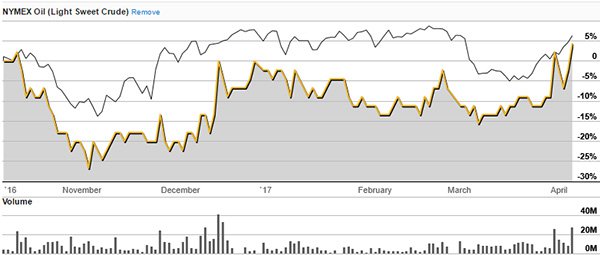

The following six-month chart demonstrates the company’s share price performance against the Nymex Oil light sweet crude price.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

This is an important period to examine because there has been significant price volatility in the oil price during the period which has generally resulted in a negative overreaction in 88E’s share price.

What has also led to an exaggerated underperformance compared with the commodity price for the bulk of this period is the fact that the Icewine project has been on hold over the traditional peak winter period. With a lack of exploration information and preparation for drilling occurring in recent months there hasn’t been any news flow to drive the share price.

Icewine to spud in next fortnight

However, with management confirming yesterday that the spud is on schedule for the week beginning April 24, and stimulation and production testing is on track to commence in June/July 2017, investors are positioning themselves for some regular and potentially share price moving positive news flow.

Consequently, the significant gap between the company’s share price that persisted for the majority of the last six months has now been closed, and in fact a three month chart shows an outperformance by 88E against the Nymex price.

There has been early support in in the first half hour of trading on Tuesday with the company’s shares hitting a six month high of 4.8 cents. While there is a significant band of sellers between 4.8 cents and 5 cents, a break above this level could spark interest from technical investors.

Although again, share trading patterns should not be used as the basis for an investment as they may or may not be replicated. Those considering this stock should seek independent financial advice.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.