88E completes well design at Icewine#2

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Oil explorer 88 Energy Limited (ASX, AIM:88E) has announced well design completion on its Icewine#2 project and has released preliminary 2D seismic results.

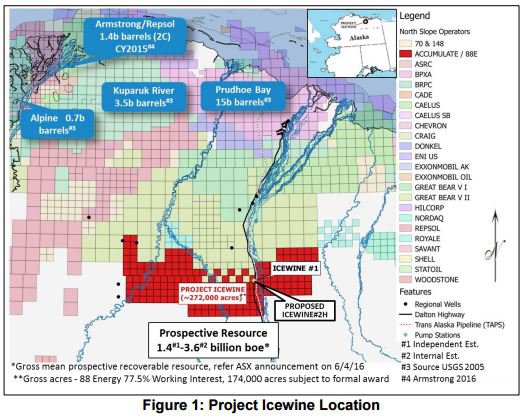

Located onshore North Slope of Alaska, project Icewine sits in a region known to hold significant oil reserves. Including the 15 billion barrel Prudhoe Bay oilfield complex, which is the largest conventional oil pool in North America.

The State of Alaska provides generous exploration incentives with up to 35% of exploration expenditure refundable in cash.

Together with joint venture partner Burgundy Xploration, 88E has completed the well design for its Icewine#2 project.

Well design at Icewine#2 completed and fully funded

It has been decided that a vertical well with a multi stage simulation would be better suited than the originally proposed lateral well.

The vertical well design will allow the joint venture parties to test production potential of the entire HRZ/HUE interval and seek a potential resource upgrade, with HRZ remaining the premier reservoir and primary target.

Along with an enhanced dataset for landing zone selection for future laterals and a more complex lateral completion, the drilling project is markedly de-risked allowing for increased availability of suitable rigs and as a result offer a more competitive tender process.

How competitive the tender process will be is undetermined thus far, so if considering this stock for your portfolio take this point into account with all other information and seek professional financial advice.

The new well design is estimated to reduce well completion costs by ~US$5M, as a result 88E is fully funded from its current cash position to finance Icewine#2.

Preliminary 2D Seismic Results

Processing of 2D data acquired by 88E using vibroseis (the recorded data from an upsweep or downsweep (increasing or decreasing frequency respectively) are added together and compared with the source input signals to produce a conventional-looking seismic section) is nearing completion with over two thirds of the Project Icewine acreage included in the data.

Initial observations of the data indicate the presence of seismic stratigraphic features that are consistent with a potential basin floor fan play fairway.

Interpretation of all the data, once processing has been completed, is anticipated to commence later this month, with results to follow in the weeks after.

Along with today’s announcement, 88E released a presentation to the market covering the company’s developments in further detail, the presentation can be viewed here.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.