88 Energy’s Charlie-1 well hits 3,500 feet

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

A severe market downturn combined with an oil sector rout will send blue-chips tumbling and cause absolute mayhem among smaller stocks.

Even big players such as Woodside Petroleum and Oil Search have already been decimated in the last month with their share prices falling from about $34.00 to $22.00 and $6.50 to less than $3.50 respectively, a near 50% decline.

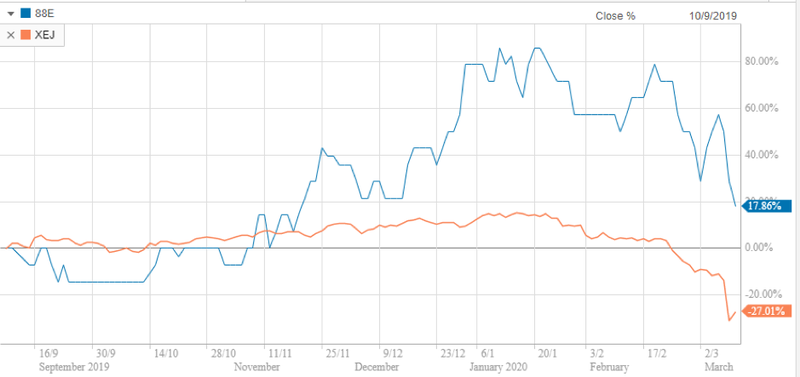

The negative sentiment is reflected in the S&P/ASX 200 Energy Index (XEJ) which has plummeted from about 11,000 points three weeks ago to close at 7267 points yesterday.

Of course, many smaller stocks in the energy sector that aren’t in production are seen as riskier plays, resulting in more significant falls.

However, one market minnow in 88 Energy Ltd (ASX:88E) has demonstrated that it can hold its own against both the big players and the broader index. Investors could see further share price support today after management announced on Wednesday morning that its Charlie-1 appraisal well had reached a depth of 3,500 feet, and that as planned it was now ready to commence drilling the production hole.

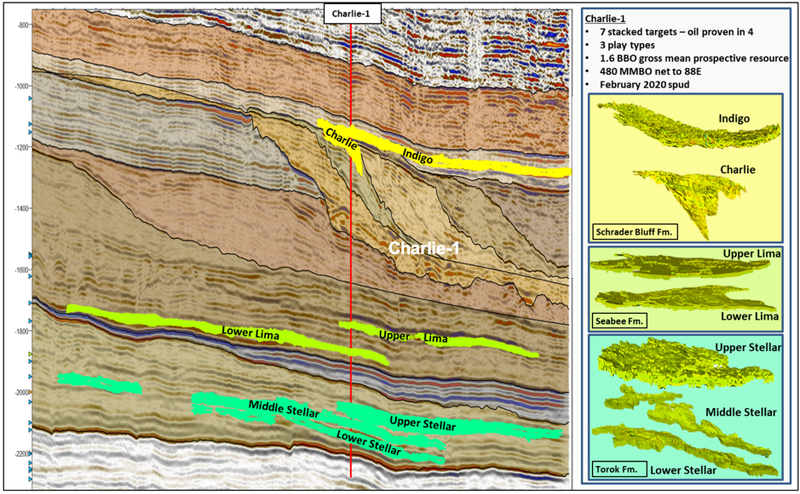

The Charlie-1 appraisal well is located on the Alaska North Slope, at the company’s Project Icewine where 88E along with its farm-in partner Premier Oil (LON: PMO) — is targeting 1.6 billion barrels of gross mean prospective oil resource potential, of which 480MMBO is net to 88E.

As indicated below (as at March 10, 2020), the company’s shares (blue line) are still up 18% over the last six months compared with a 27% decline in the XEJ (orange line).

Investors eagerly await Charlie-1

Management announced last week that it had commenced drilling the Charlie-1 well in Alaska, part of a project that has been four years in the making.

The Charlie-1 appraisal well has been designed as a step out appraisal of a well drilled in 1991 by BP Exploration (Alaska) Inc called Malguk-1.

88 Energy has undertaken revised petrophysical analysis, which identified what is interpreted as bypassed pay in the Malguk-1 well.

The company also completed acquisition of modern 3D seismic in 2018, in order to determine the extent of the discovered oil accumulations.

Charlie-1 will intersect seven stacked prospects, four of which are interpreted as oil bearing in Malguk-1 and are therefore considered appraisal targets.

88 Energy will operate Charlie-1, via its 100% owned subsidiary Accumulate Energy Alaska, Inc, with cost of the well to be funded by Premier Oil Plc up to US$23 million under a recent farm-out agreement.

Consequently, 88E has the backing of a financially robust partner that is funding the exploration well, while still remaining highly leveraged to an oil discovery. The total Gross Mean Prospective Resource across the seven stacked targets to be intersected by Charlie-1 is 1.6 billion barrels of oil (480 million barrels net to 88E).

Flow testing should be completed by April 2020, suggesting that it will be closely watched over the next month with the potential for further share price momentum as news regarding flow tests draws closer.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.