88 Energy triples acreage position in Alaska

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

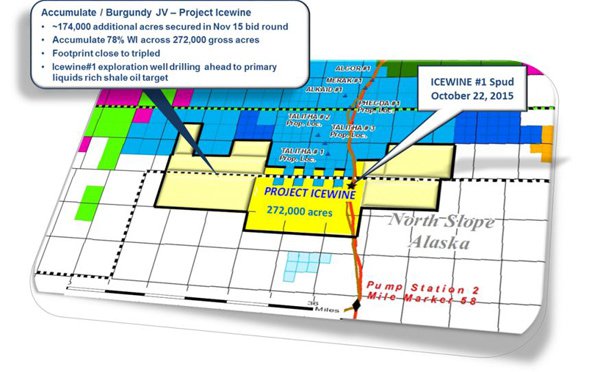

88 Energy (ASX:88E) has tripled its acreage position in Alaska in an attempt to capture upside from Icewine-1 and lure potential major oil companies to the party.

Together with its joint venture partner Burgundy Xploration, it has been announced as the winner of a bid for 174,240 acres adjoining its current Icewine acreage on the North Slope of Alaska.

This means the joint venture now has its foot (subject to final payments) on a contiguous acreage position of 272,242 acres in total.

The extra acreage 88E has picked up

Better yet, 88E said in a statement, the increased acreage position means that its target HRZ shale now has a recoverable estimate of a whopping 2 billion barrels of oil.

It previously had a high case of 813.2 million barrels of oil.

Previous drilling into the HRZ has shown porosity to be 18.4%, which is estimated to be about 50% better than the Eagle Ford Shale in Texas.

Drilling has been slightly delayed by technical issues, but it has been making steady progress since it was spud at the back-end of October.

Despite the well not reporting back any tangible results as yet, managing director Dave Wall told the market that the acquisition was made with an eye toward luring a major to the acreage.

“We do not want to prove up a play and then have someone else acquire a large portion of it,” he said.

“Whilst we do not have definitive data that the HRZ play will be successful, the option value associated with the success case versus the relatively small downpayment required is an opportunity than cannot be passed up.

“Any success at Icewine-1 will result in substantial industry interest, which we hope will lead to a highly accretive farmout in 2016.”

88E managing director Dave Wall has previously told Finfeed that an oil discovery at Icewine-1 may trigger a farm-in offer, saying that 88 Energy was “being watched quite closely by a number of parties.”

The JV secured the acreage with a downpayment of $US947,000 ($A1.33 million), or roughly 20% of the total.

The acquisition is subject to the rest of the payment being received by the Alaskan government, plus a $5.5 million acreage rental fee.

88E said it would undertake a “small” capital raising in light of the news, and this would include a share purchase plan component.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.