88 Energy raises cash for Icewine dreams

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

88 Energy (ASX:88E) has raised $3 million to institutional investors, and is aiming to raise an additional $2 million from shareholders as it seeks to fund its bold play in Alaska.

It told its shareholders after the close of trade on Friday that it had managed to tap institutional investors for $3 million through the issue of 300 million shares at 1c each – adding that the offer was “strongly oversubscribed”.

The raising comes in below the company’s 15% threshold, meaning that the deal will not need to be signed off by shareholders.

It also said that it will launch a share purchase plan open to all eligible shareholders to raise a minimum of $2 million, with shareholders able to pick up $15,000 worth of shares at 1c per share.

However it said should demand dictate, then it would seek to raise up to $7.35 million from the SPP.

Why 88 Energy is raising the cash

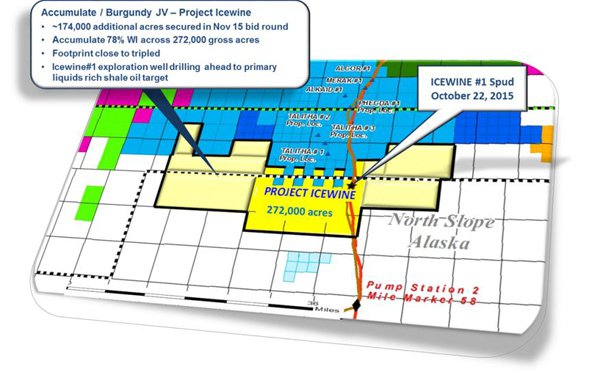

88 Energy is raising the money to fund a bold plan to triple its acreage position in Alaska, even before the well it’s currently drilling in Icewine-1 has hit target depth.

It made the announcement last week, saying that it elected to pick up the acreage to capture the full upside of Icewine-1 and possibly Icewine-2.

Its reasoning that a bigger acreage position would give it the scale needed to entice supermajors in the region to farm into the project.

“The acquisition of the additional acreage was considered strategically important ahead of the results of Icewine-1 as we feel that we have a competitive advantage in identifying where the play may work,” managing director Dave Wall told shareholders on Friday.

“The low oil price also meant that competition was scarce, resulting in an opportunity to create maximum leverage for our shareholders.”

The extra acreage 88E has picked up

The increased acreage meant that its target ‘HRZ shale’ now has a recoverable estimate of 2 billion barrels of oil within 88E’s remit, rather than a previous high case of 813.2 million barrels of oil.

Previous drilling into the HRZ has shown porosity to be 18.4%, which is estimated to be about 50% better than the Eagle Ford Shale in Texas.

Drilling has been slightly delayed by technical issues, but it has been making steady progress since it was spud at the back-end of October.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.