88 Energy provides operations update from Alaska

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

88 Energy Limited (ASX:88E) has this morning released an update on its projects located on the North Slope of Alaska.

The update primarily concerns its Project Icewine, with news that the company has begun production testing at the Icewine#2 well.

As at 17 June, “wellhead pressure was 370psi with a flowback rate of 166 barrels of water per day on a variable choke setting in order to manage wellhead pressure”.

A production log was run on 12 June and confirmed that all perforations were contributing to flow. Following that, as per 88E’s ‘flowback design’, nitrogen was then introduced gradually to the wellbore from 13 June, prior to “installation of the coiled tube velocity string, to artificially lift stimulation fluids in order to gain connectivity to the reservoir”.

The company has reported that the flowback rate stabilised at 200 barrels of water per day and then steadily declined to approximately 100 barrels of water per day, as per its expectations. Further, flowback at Icewine#2 well is now being run through the separator and gas chromatograph and is considered to be 100% stimulation fluid and gas, with the gross gas rate averaging 571mcf/d.

These figures and others reported by 88E are as expected by the company for this stage of the process. In addition, “salinity measurements of the flowback fluid indicate that connectivity to the reservoir remains limited” but this was anticipated.

88E reported that the “total clean up fluid returned (net of diesel for freeze protection and any other fluids introduced as part of the current operation) since commencement of flowback on 12 June is 820 barrels” and total fluid returned for the entire flowback operation, including last year, is now 6,353 barrels or 23% of the frac fluid injected. This compares to a target percentage return of at least 30%.

The Icewine#2 well is located on the North Slope of Alaska. 88 Energy, via its wholly owned subsidiary Accumulate Energy Alaska Inc, has a 77.55% working interest in the well.

The well was stimulated in two stages over a gross 128-foot vertical interval in the HRZ shale formation.

Prior to ‘winter shut-in’ last year, “20% of the stimulation fluids had been flowed back versus a projected minimum target of 30% to gain connectivity to the source rock reservoir”. Flowback commenced, on schedule, on 11 June 2018 to clean up stimulation fluids from the Icewine#2 borehole.

It should be noted 88E remains a speculative play and there is much work to be done, so investors should seek professional financial advice if considering this stock for their portfolio.

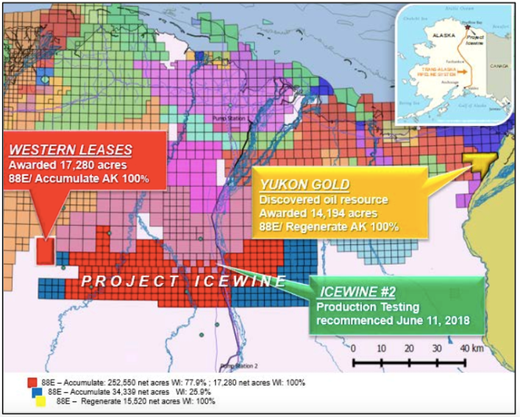

New Alaskan leases awarded

Via its subsidiaries Accumulate Energy Alaska Inc and Regenerate Alaska Inc, 88E has been formally awarded acreage it successfully bid on in the State of Alaska North Slope Licensing round December 2017.

The company has executed lease documents and returned them to the Alaska Department of Natural Resources, and has also transferred the necessary funds.

The below map shows the new leases awarded to 88E:

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.