88 Energy acquires strategically situated Umiat Oil Field

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Just days after 88 Energy Limited (ASX:88E; AIM 88E) confirmed that it was on track for the scheduled February spud of the Merlin-1 well at Project Peregrine, North Slope of Alaska, management has announced further promising news in relation to the purchase of the Umiat Oil Field, which is in close proximity to Project Peregrine.

Umiat is an historic oil discovery, made in 1945 in shallow Brookian (Nanushuk) sandstones, located immediately adjacent to southern boundary of Project Peregrine.

On 8 January, 88 Energy, via its wholly-owned subsidiary Emerald House LLC, entered into a Sale and Purchase Agreement with Malamute Energy, Inc and Renaissance Umiat LLC (Sellers) to acquire the Umiat Oil Field.

The consideration for the purchase was a 4% ORRI (overriding royalty agreement) and sub-summation of the liability for the abandonment of the Umiat-18 and Umiat-23H wells, drilled by Linc Energy in 2014.

The Umiat-23H well was flow tested at a sustained rate of 200 barrels per day with no water in 2014 by Linc Energy (max rate 800 barrels of oil per day).

Gross 2P reserves independently estimated at 123.7 million barrels of oil (94 million barrels attributable to 88E’s 76% net revenue interest) by Ryder Scott on 1 December 2015.

The estimated cost to abandon the two wells is approximately US$1 million, and the current conditions of the unit stipulate a well commitment by 31st August 2022.

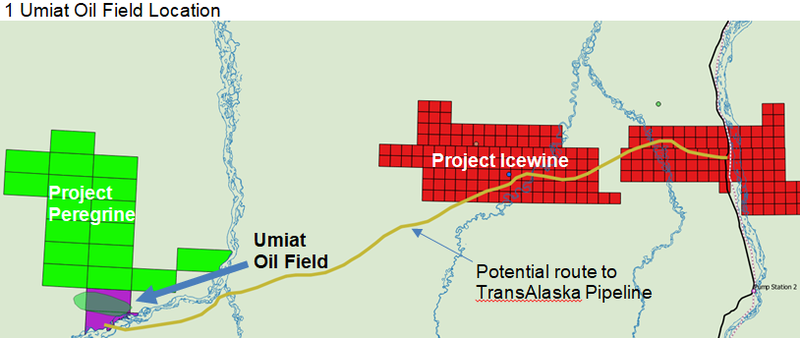

As indicated below, the Umiat Oil Field is covered by two leases comprising 17,633 acres, which are in a unit that was formed in September 2019 with an initial 10-year term.

This shows the close proximity to Project Peregrine, highlighting the potential for the company to capitalise on the additional holding, particularly if it has success when drilling the Merlin-1 and Harrier-2 wells in February.

Multiple wells positive for liquids and natural gas

Umiat was discovered in the mid-1940s with 11 appraisal wells drilled by 1953, several of which were tested.

Umiat-5 flowed 268 barrels per day on a 3-month test and Umiat-8 had a peak flow rate of 5.9mmcf/d of natural gas during a 4-day test.

Little work was done until 2014 when Linc Energy drilled two wells, Umiat-18 and Umiat-23H.

Umiat-23H was tested with a maximum flow rate of 800 barrels per day and sustained flow of 200 barrels per day.

Substantial environmental work was also done by Linc Energy in support of a potential future development.

It is important to note in terms of 88E’s broader strategy in the region that one of the routes for access to infrastructure for potential Umiat developments runs directly through 88 Energy’s Project Icewine leasehold where there are substantial independently estimated resources of oil and gas.

88 Energy will now undertake a full field review to determine at what oil price Umiat may be commercial as a standalone development.

In the event of a discovery at Project Peregrine, where drilling is imminent, it is expected that Umiat would contribute significant value to any development.

Commenting on the acquisition, as well as discussing potential scenarios, 88E managing director Dave Wall said, "Our operational activity at Project Peregrine has provided 88E with a unique position from which to acquire the Umiat Oil Field at an opportunistic price point.

The asset has potential to add significant value for shareholders, possibly as a standalone development, but certainly in the event that there is a material discovery in the imminent Project Peregrine drilling program.”

Energy stocks coming under the spotlight

It is important to note that the acquisition has occurred as the Brent Crude price has continued to surge, having increased by about 40% from approximately US$40 per barrel at the start of November to finish last week at a near 11 month high of US$56.36 per barrel.

LNG prices are also making long-term highs with Global LNG Hub recently highlighting a six-year high North Asian spot LNG price:

‘’North Asian spot LNG prices rose to a six-year high on December 28, while the market continued to focus on bare naked inventory levels in Japan. The S&P Global Platts JKM for February was assessed at 70.3 cents/ MMBtu higher day on day at $12.514/MMBtu.’’

There is the possibility of highly promising newsflow in coming weeks as the Talitha-A well, to be drilled by Pantheon Resources PLC (AIM:PANR) close to the northern border of the 88E central acreage position, is scheduled to spud in the first half of January 2021.

Several of the prospective horizons in Talitha-A are interpreted to extend into 88E acreage.

With numerous share price catalysts on the horizon and significant news emerging today, shares in 88 Energy should continue to maintain the upward trend, having increased some 50% in the last three weeks.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.