2D data provides 88 Energy with new leads in Alaska

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

88 Energy (ASX | AIM: 88E) announced on Tuesday morning that it had progressed the interpretation of 2D seismic data acquired in early 2016, resulting in the identification of a number of promising conventional leads within the Brookian sequence.

As a backdrop, 88 Energy has a 77.5% working interest and operatorship in approximately 271,000 acres onshore the prolific North Slope of Alaska (Project Icewine). The North Slope of this region is host to the 15 billion barrel Prudhoe Bay oilfield complex, the largest conventional oil pool in North America.

88 Energy and its joint venture partner, Burgundy Xploration have identified three highly prospective play types that are likely to exist on the Project Icewine acreage, two conventional and one unconventional.

The large unconventional resource potential of Project Icewine has been independently verified, and it is worth noting that the project is strategically located on a year-round operational access road, only 35 miles south of Pump Station 1 where Prudhoe Bay Feeds into the Trans-Alaska Pipeline System.

In late 2015, 88E completed its maiden well at the project, Icewine#1, to evaluate an unconventional source rock reservoir play which yielded excellent results from analysis of core obtained from the HRZ shale. A follow-up well with a multistage stimulation and test of the HRZ shale, Icewine#2 is planned for the first quarter of 2017.

88E’s Managing Director, Dave Wall said in relation to today’s developments that HRZ remained the company’s primary target and the focus of its short-term activity, but there was no denying the significance of the interim results from the 2D seismic data acquired earlier this year.

However, these are interim results, so if considering this stock for your portfolio seek professional financial advice for further information.

While processing and interpreting the data has taken a little longer than expected he said the features are greater than anticipated and warrant further interpretation and analysis, the results of which will be announced later in the year.

Billion barrel discoveries in Brookian sequence

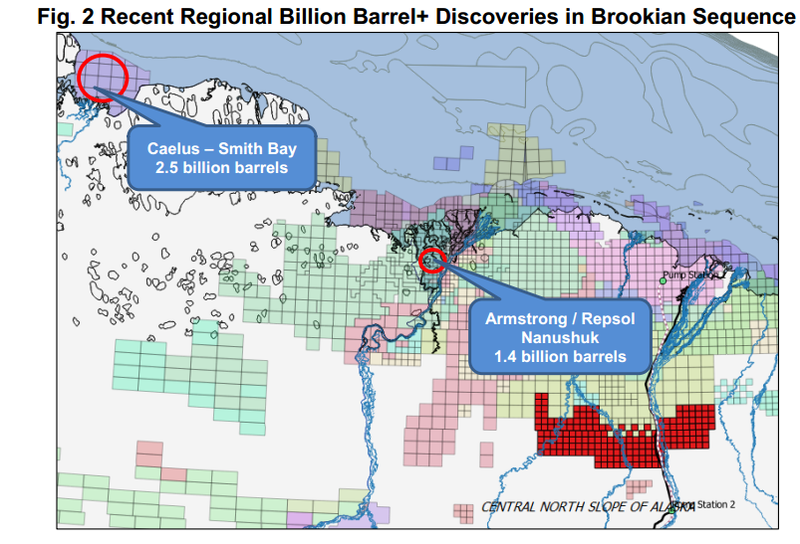

In relation to recent activity in the region, Wall said, “We expect the two recent billion barrel discoveries in the Brookian sequence by both Armstrong Oil and Gas and Caelus Energy to be a catalyst for increased industry interest in the region”.

New data provides 20 leads

While conceding that the recent discoveries weren’t strictly analogous to the Brookian play potential at Project Icewine, the discoveries highlight the significant conventional oil resource on the North Slope yet to be discovered through utilisation of modern seismic technology.

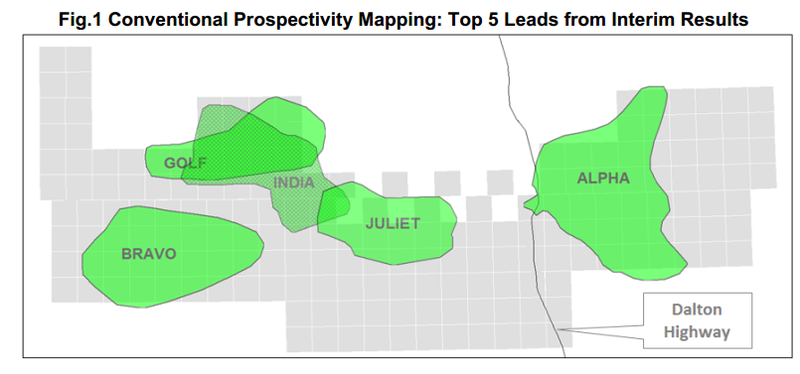

The fact that interpretation of the 2D data released today has presented 20 leads that have been provisionally mapped across the Icewine acreage is an indication of what may lie ahead. The group has identified five key leads that have been prioritised for early maturation from which future likely drilling candidates will be selected.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.