University of Sydney tips medical cannabis market bloom

Published 30-MAR-2016 15:34 P.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

A brand new hot off the press study into the Australian medical cannabis market reveals that the potential market size for medical cannabis in Australia will be A$100-150 million per annum, based on current market demand – and is “likely to continue to grow” according to the study.

The White Paper, entitled ‘Medicinal Cannabis in Australia: Science, Regulation & Industry’, was developed by the University of Sydney Business School’s Community Placement Program, as part of a strategic partnership with MGC Pharmaceuticals (ASX:MXC), an Australian biotechnology company already marketing medical cannabis products globally.

The study is the first of its kind in Australia, commissioned to analyse the Australian medical cannabis industry and the potential commercial opportunities likely to emerge in the domestic market. One of its key findings was that the industry would need to produce 8,000kg of medicinal cannabis per year to service current medicinal needs.

The paper examines international experiences and approaches, supply chain economics, quantities of cannabis required and potential regulatory dynamics. It also serves as a framework for the industry to commence engaging key stakeholders such as the Australian Government and the medical community.

The study has been published at a critical time with the Australian government currently at a crossroads as to how it will legislate for its operation and wider societal impacts. Cultivation of medical cannabis is on the verge of being legalised following recent law changes at the Federal level and supportive commentary from senior politicians including Malcolm Turnbull.

Commenting on the publication of the White Paper, University of Sydney Business School’s Michael Katz said, “We have an incredible opportunity to ensure that robust analysis and industry insight make a strong contribution towards the formation of this new industry in Australia. What’s exciting about this White Paper is that it brings together the university, the market and government – which is directly in line with the Turnbull Government’s vision for universities to be more engaged in the innovation strategy for the country.”

The White Paper concludes that “medicinal cannabis has the potential to help tens of thousands patients suffering from a wide range of medicinal conditions such as Multiple Sclerosis, Epilepsy, Cancer and Chronic Pain”.

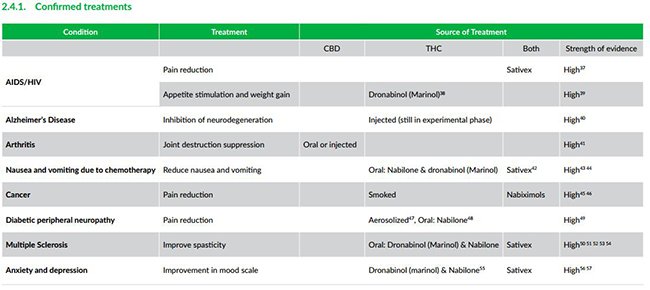

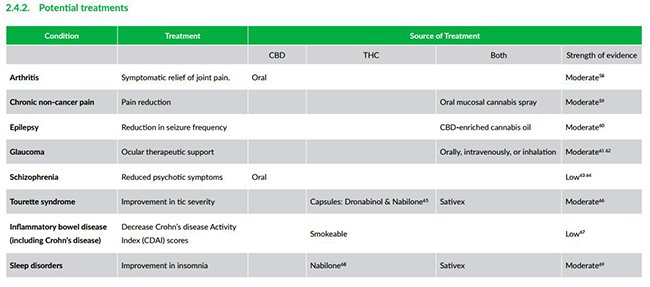

Medical cannabis has already proven its usefulness in treating ailments such as AIDS/HIV, arthritis and multiple sclerosis with a host of new potential treatments being developed by companies such as MGC and others.

In future, it is believed medical cannabis can be used to treat a wider range of ailments including glaucoma, schizophrenia and chronic pain.

Earlier this month, MGC Pharmaceuticals revealed an upcoming nasal drug delivery device to treat severe epilepsy. Having partnered with with Israeli medical company SipNose, MGC will now test how effective its nasal spray delivery device is for patients using medical cannabis.

MGC Pharmaceutical Co-founder and Managing Director Nativ Segev said, “The White Paper confirms to us the strong need for developing the medicinal cannabis industry in Australia, which is estimated to be worth A$100-150 million per annum based on the estimated current market demand”.

“MGC Pharmaceuticals is going to bring our international experience and unique genetic strains to bear on the Australian market, placing us at the forefront of an emerging industry that is poised to help tens of thousands of Australians suffering from a broad range of conditions”.

“In the future, we plan to expand this industry and our standing in it, by delivering robust clinical evidence and engaging in research and development to support the use of medicinal cannabis for a myriad of indications and conditions.”

MGC Pharmaceuticals Co-founder and Managing Director Nativ Segev (left) & Michael Katz from the University of Sydney Business School (right).

Under the new federal scheme recently introduced, patients with a valid prescription can possess and use medicinal cannabis products manufactured from cannabis legally cultivated in Australia, provided the supply has been authorised under the Therapeutic Goods Act and relevant state and territory legislation. The changes put medicinal cannabis in the same category as restricted medicinal drugs such as morphine.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.