Rhythm Biosciences making progress in 1000 patient trial

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

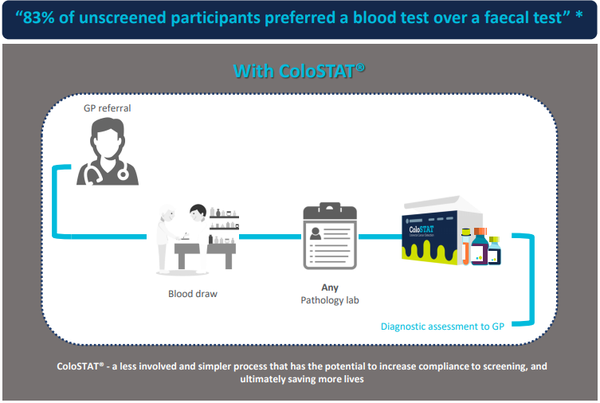

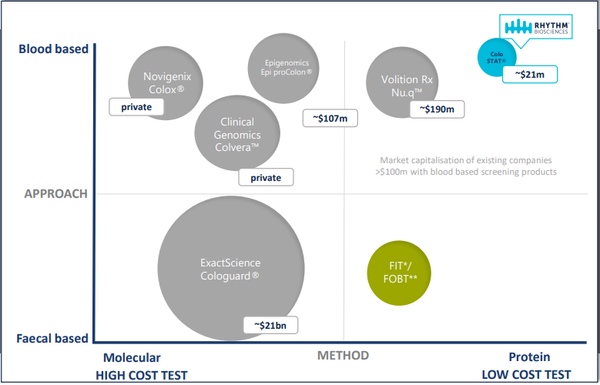

Medical diagnostics company Rhythm Biosciences Ltd (ASX:RHY) has continued to develop its global, low-cost, lifesaving blood test for the detection of colorectal cancer, ColoSTAT®, during the last quarter.

Following 13 years of CSIRO research, Rhythm acquired the intellectual property and technology underpinning the research, using commercially available kits, for the ColoSTAT® test.

This involved identifying several biomarkers that have been shown to change in concentration in the presence of colorectal cancer.

The mass screening market for people aged between 50 and 74 in the US, European Union and Australia alone is estimated to be more than $12 billion.

Rhythm continues to work with a number of global parties on the most effective test development, optimisation, validation and clinical utility of the reagents that will form the core components to the final ColoSTAT® test.

This work will be verified in a series of confirmatory analytical tests, making up Study 6.

The completion of the development, optimisation and validation of these tests will lay the foundation for the final kit development, production transfer, manufacture and sale of ColoSTAT®.

Appropriate antibodies now identified

Rhythm is confident that the appropriate antibodies have now been identified along with an informed development pathway for progressing the remaining reagents and test development making up the final commercial ColoSTAT® test.

Additionally, Rhythm has identified preferred suppliers, consultants, manufacturers and has established a clear sequence of events to de-risk the science and achieve successful registration.

The completion of the test optimisation, validation, kit development and transfer to manufacturer program, coupled with the clinical trial analytical results, will form key regulatory components for CE Mark (Europe) and TGA (Australia) for submission in fiscal 2021.

Management said that it is confident of the technology, the biomarker selection and the work of over 13 years of CSIRO research.

Royal Melbourne joins list of high profile trial hospitals

Earlier in the year, Rhythm advised that Adelaide's Lyell McEwin Hospital would be the first site for the company’s proposed 1,000-patient clinical trial (Study 7) of ColoSTAT®.

This was followed by Monash Health and the Alfred Hospital, both leading Melbourne hospitals.

Just recently, Rhythm added Royal Melbourne Hospital as the fourth hospital for the clinical trial.

Investors have acknowledged the significance of these developments in recent months with the company’s shares increasing by approximately 40% in June/July.

By the end of June, the first patients for the trial had been recruited by the Lyell McEwin and Monash Health hospitals.

Management expects the first patients to be enrolled by the Alfred and Royal Melbourne in the coming weeks, ensuring all four trial sites will be up and running.

Rhythm anticipates the recruitment rates to significantly increase over the next two quarters with the recent inclusion of the three large Melbourne hospitals.

Management, in conjunction with its trial partners and advisors, will continue to monitor the progression of patient recruitment which is on track to be completed in fiscal 2020.

Rhythm receives tick as ISO compliant

In May, Rhythm’s Quality Management System (QMS) was certified as compliant with the International Organization for Standardisation (ISO) EN 13485:2016 standard.

The assessment was conducted by British Standards Institution (BSI) Group, the business standards company and market leading UK Notified Body.

This was a major development for the company as EN ISO 13485:2016 is the internationally recognised quality standard that ensures the consistent design and development, production, storage and distribution of medical devices that are safe for their intended purposes.

Further, EN ISO 13485:2016 is recognised by the Global Harmonization Task Force (GHTF) and has become the model QMS standard for the medical industry.

It is the first step in achieving compliance with European and Australian regulatory requirements and a major milestone in the company’s pathway to market.

Certification with this standard demonstrates compliance to the laws and regulations of the Medical Device industry and enables Rhythm to be classified as a manufacturer of In Vitro Diagnostics and Medical Devices for its own and in-licensed products for worldwide registration and sale.

Several partnering discussions in progress

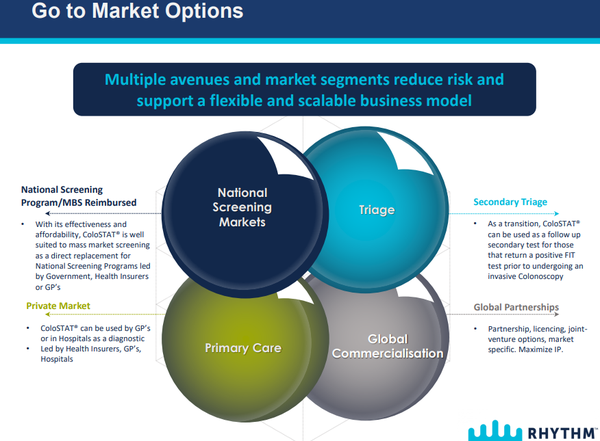

While the development of the final test kit remains Rhythm’s key task, management also continues to work on identifying appropriate partners for the global commercialisation of ColoSTAT®.

The technology and strategy have been well received by potential partner companies, and discussions with several IVD/pharma companies are ongoing.

In parallel, the ongoing development of a ”go to market” plan has commenced for Australia, identifying critical success factors to be met to ensure maximum uptake and sales of ColoSTAT®.

Rhythm is currently establishing relationships with key physicians, government and industry bodies.

From a financial perspective, the company is in a robust position, finishing the June quarter with cash of $4.7 million.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.