Prescient’s PTX 200 receives Notice of Allowance for US patent

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Clinical-stage oncology company Prescient Therapeutics Ltd (ASX:PTX) has received a Notice of Allowance for a new patent covering its lead clinical compound PTX-200 for the treatment of ovarian cancer in the United States.

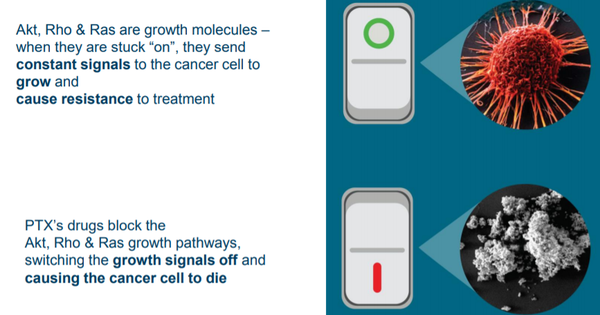

This drug candidate inhibits an important tumour survival pathway known as Akt, which plays a key role in the development of many cancers, including breast and ovarian cancer, as well as leukemia.

Unlike other drug candidates that target Akt inhibition which are non-specific kinase inhibitors that have toxicity problems, PTX-200 has a novel mechanism of action that specifically inhibits Akt whilst being comparatively safer.

Investors have warmed to Prescient since mid-July with its shares increasing 20 per cent from 9.6 cents to a recent high of 11.5 cents.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Targeting large ovarian cancer market

This latest patent adds to Prescient’s broad patent estate, and provides the company with intellectual property protection covering its lead compound for the treatment of ovarian cancer and a sub-population of patients with a tumour or cancer cell that over-expresses Akt.

It should be noted there that PTX is in the early stages of its research and investors should seek professional financial advice if considering this stock for their portfolio.

The American Cancer Society estimates 22,240 women will be diagnosed with ovarian cancer in 2018 in the US.

The Australian Institute of Health and Welfare estimates over 1,600 Australian women will be diagnosed with ovarian cancer in 2018.

Few treatment options once resistance starts

Ovarian cancer often becomes resistant to first line therapy of carboplatin, and once it does, there are very few treatment options for patients.

Prescient is seeking to reverse treatment resistance for these women by administering PTX-200 to block the Akt pathway that contributes to resistance, in combination with carboplatin.

This current Phase 1b trial is being undertaken at the H. Lee Moffitt Cancer Center in Florida under the leadership of Dr Robert Wenham, Chair of the Department of Gynecologic Oncology.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.