Prescient trials show total eradication of cancer

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shares in Prescient Therapeutics Limited (ASX:PTX) surged 50% on Wednesday after the clinical stage oncology company developing personalised medicine approaches to cancer released promising news in relation to its Phase 1b study in patients with acute myeloid leukemia (AML) who are being treated with PTX-200.

Management said that it planned to expand the phase 1b study following an encouraging third complete response which represents total eradication of disease.

The company’s shares have more than doubled in the last fortnight after receiving a significant boost on November 14 when management announced that the first patient had been treated with the group’s anti-cancer drug PTX-100 in a phase 1b trial enrolling patients with multiple cancer types.

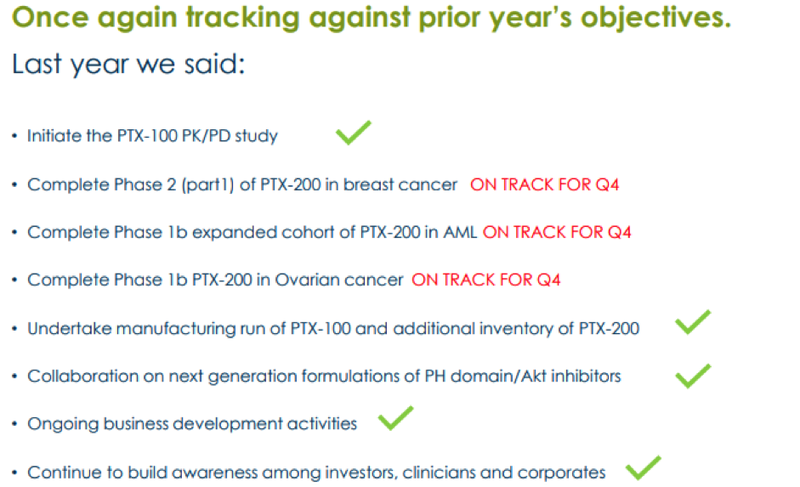

From a broader perspective, unlike many other smaller biotech companies, Prescient has a track record of delivering on its promises as outlined below.

PTX-200 is a game changer

While achieving these optimum levels of operational efficiencies are attracting investors to the company, it was yesterday’s news that really had a profound impact with the share price rerating occurring under all-time record trading volumes.

Three of a total of 15 patients experienced complete responses in the study in relapsed or refractory AML patients, which is a difficult to treat cancer population.

The three patients had between 25-35mg/m2 PTX-200, together with 200-400mg/m2 cytarabine.

PTX-200 is a novel PH domain inhibitor that inhibits an important tumor survival pathway known as Akt, which plays a key role in the development of many cancers, including breast and ovarian cancer, as well as leukemia.

Unlike other drug candidates that target Akt inhibition which are non-specific kinase inhibitors that have toxicity problems, PTX-200 has a novel mechanism of action that specifically inhibits Akt whilst being comparatively safer.

In consultation with the study investigators, Prescient is making a protocol amendment to change the dosing schedule of PTX-200 in relation to the administration of chemotherapy agent cytarabine with the aim of minimizing overlapping drug interactions.

In a previous Phase 1b study in acute leukemias using PTX-200 as a single agent no such side effects were observed, suggesting that the effects seen in the current study may be due to the overlapping interaction of cytarabine and PTX-200.

Enrolment re-start in 2020

Generally, most patients receiving treatment on the study by group have tolerated planned dose levels.

Transaminase elevation was observed in three patients, although only one was dose limiting.

The amendment will go through usual FDA and ethics committee reviews and the study should be able to re-start enrolment in early 2020.

Prescient’s chief medical officer, Dr Terrence Chew said, “The three complete responses observed are very encouraging in a hard to treat patient population.

‘’Through this protocol amendment, we aim to get more patients through more cycles of therapy, with the hope of expanding upon these responses.

‘’Our investigators are very supportive of these amendments, as they are encouraged by these results in a patient population that is very difficult to treat and who currently have few treatment options.”

The study is led by world-renowned leukemia expert Professor Jeffrey Lancet at the H. Lee Moffitt Cancer Center in Florida, and also includes Kansas University Medical Center and Yale Cancer Center.

Prescient is having success in one of the hottest sectors of the biotech market as evidenced by the following transactions over the last 12 months - with a market capitalisation of approximately $40 million, Prescient is certainly looking attractive.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.