Prescient reports blockbuster results in breast cancer

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Clinical-stage oncology company Prescient Therapeutics Ltd (ASX:PTX) has today announced its most significant clinical milestone to date — the highly encouraging results of its PTX-200 Phase 1b Breast Cancer trial.

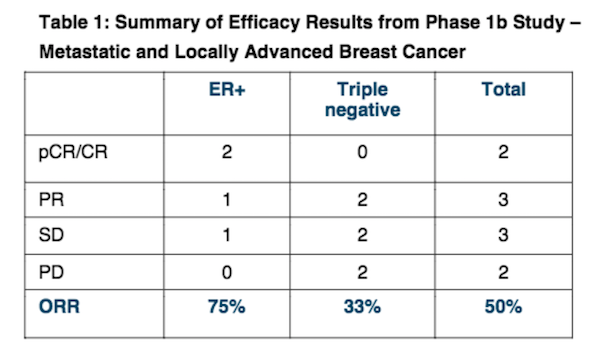

Patients evaluable for efficacy in the PTX-200 Phase 1b breast cancer trial showed an overall response rate of 50%, against the predicted industry average response rate of 25% with only chemotherapy drug paclitaxel.

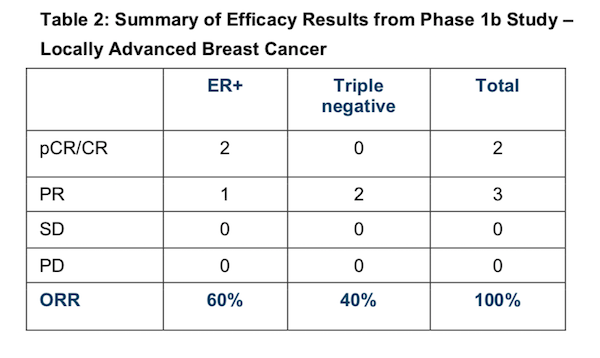

In the five patients with locally advanced disease, two (or 40%) had pathologic complete responses — meaning total eradication of cancer — and three patients had an Overall Response Rate (ORR) of 100%.

The Phase 1b trial evaluated PTX-200 in combination with paclitaxel in women with HER2-negative breast cancer, including ER-/PR- (triple negative) and ER+ breast cancer. The results were particularly favourable for women with ER+ breast cancer — with a ‘pathological complete response’ (pCR) of 50% and ORR of 75% in this category, as shown below:

Of patients with locally advanced disease, which is PTX’s focus for the Phase 2 study, there was a total of two pCRs (40%) and three PRs (60%) for an ORR of 100%, as shown below:

Of course, it should be noted that PTX is still a speculative stock and anything can happen. Investors should seek professional financial advice if considering this stock for their portfolio.

More detail on PTX-200 trials

The Phase 1b trial was undertaken with the leadership of renowned breast cancer specialist Professor Joseph Sparano, MD, and the H. Lee Moffitt Cancer Center in Tampa (Moffitt) at the Montefiore Medical Center, Albert Einstein College of Medicine in New York.

The Phase 1b dosed 28 patients in total, resulting in 10 patients who were evaluable for clinical response — of these, five had locally advanced disease and five had metastatic disease.

PTX is currently in a Phase 2 trial for women with HER2 negative locally advanced breast cancer, with five of the patients of the Phase 1b study qualifying for assessment of Phase 2 data.

The company’s Phase 2 trial will be in 26 patients using a “two-stage Simons MinMax Design”. This means that, provided at least three pCRs are observed in the first 11 patients of the Phase 2 trial, it will expand to include a further 15 patients. At this stage, PTX already have two pCRs within the first five patients, leaving it in a good position to eventually expand the Phase 2 trial.

For the purposes of the PTX-200 trials, assessment of disease falls into several different categories according to a patient’s response to therapy:

• Pathological Complete Response (or Complete Response) (pCR or CR): meaning complete eradication of cancer from the patient;

• Partial Response (PR): partial but not complete eradication of cancer;

• Stable Disease (SD): cancer has not progressed, but neither has it diminished; and

• Progressive Disease (PD): cancer has progressed.

To put PTX’s results into perspective, for women with locally advanced ER+ HER2 negative breast cancer, typical expectations are pCR rates of 16% (11-22%) and ORR of 25%.

In PTX’s Phase 1b trial, the ORR was 50%, and in the five patients with locally advanced diseases, 40% had pCRs, and three had an ORR of 100%.

About Prescient

PTX is at the forefront of cutting edge research that aims to better target drug therapies to improve outcomes for the patient — in terms of effectiveness in killing cancer cells, as well as reducing treatments’ toxic side-effects.

It is currently in human clinical trials with two innovative drugs which ‘turn off the switch’ that would otherwise allow cancerous cells to grow via the important Akt and Ras pathways.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.