A new dawn in the fight against Alzheimer’s

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Traditional treatments for Alzheimer’s have never been able to affect the underlying disease and have largely failed to disrupt the symptoms over time. New approaches to the treatment of Alzheimer’s disease are desperately needed to help the millions of patients not responding to current therapies.

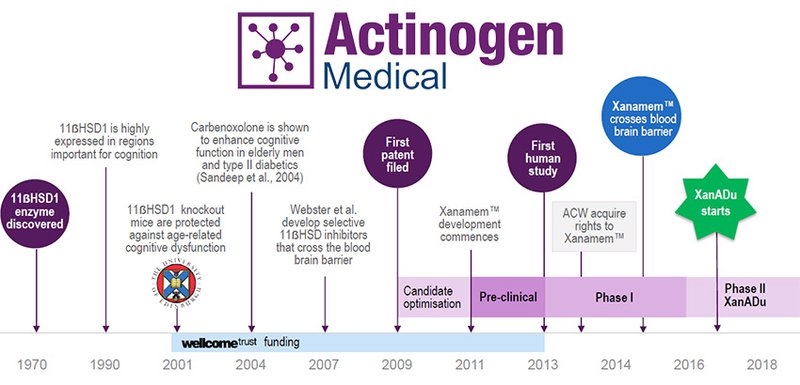

Actinogen’s (ASX:ACW) XanamemTM and the underlying ‘cortisol hypothesis’ is based on the theory that brain dysfunction is closely linked to the amount of cortisol being produce in particular areas of the brain. XanamemTM has been specifically designed to inhibit the excess production of cortisol, the “stress hormone”, in the brain. Recent global clinical research has repeatedly demonstrated that excess cortisol is associated with cognitive decline, and amyloid plaque build-up and neurotoxicity in the brain, the hallmarks of Alzheimer’s disease.

One of the first major hurdles in proving the efficacy of XanamemTM, was confirming the drug’s ability to cross the blood-brain barrier. ACW successfully achieved this milestone and has now launched an in-depth Phase 2 drug trial in mild Alzheimer’s disease, called XanADu.

ACW’s XanADu trial will attempt to prove up ACW’s cortisol hypothesis, but already, there are signs it may have solid basis.

A recent landmark study of cortisol and its relationship with brain dysfunction was presented at the Alzheimer’s Association International Conference (AAIC) in Toronto, Canada between 22-28 July.

This research was undertaken by the independent AIBL Research Group in Australia, demonstrating the clear association between excess cortisol and the development of Alzheimer’s disease.

The AIBL study was funded by various Australian government agencies and universities, including the CSIRO, and strongly endorses the cortisol hypothesis that underlies the development of XanamemTM as a treatment option for Alzheimer’s disease.

Remember, however the treatment is still in its early stages and therefore should only form one part of your decision to invest in this stock. Apply caution if considering this stock for your portfolio.

This AIBL data strongly endorses the development of XanamemTM, which has been specifically designed to inhibit excess cortisol in the brain. Data from the XanamemTM research program demonstrating that the drug is safe and that it crosses the blood-brain-barrier in concentrations to adequately inhibit cortisol production the brain was presented recently at the AAIC in Toronto.

Attending the AAIC was ACW CEO Dr Bill Ketelbey.

Dr Bill Ketelbey told the conference, “The findings from the AIBL study, linking excess cortisol with the development of Alzheimer’s disease provides further strong validation of our ongoing development of XanamemTM. Independent validation is clearly emerging that excess cortisol is a key target for treating the disease and our XanaADu trial aims to demonstrate that inhibiting cortisol in the brain with XanamemTM is an effective treatment option for patients with mild Alzheimer’s disease. It’s particularly exciting to receive this endorsement of XanamemTM’s novel mechanism of action as Alzheimer’s is a disease where new approaches to its management are desperately needed to help millions of people worldwide.”

ACW will begin an extensive series of presentations and data publications over the coming 6 months, advancing its “cortisol hypothesis” and publicising its research work. More publicity could potentially serve as price catalysts for ACW, currently priced at $0.074 per share and valued at AU$45 million by market capitalisation.

The past performance of ACW is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance and ACW is subject to market forces and unpredictable events that may adversely affect future performance.

ACW extends Xanamem patent as the Alzheimer’s fight continues

A potential breakthrough in the fight against Alzheimer’s has had its comprehensive patent cover extended by the United States Patents Office (USPO).

Actinogen Medical (ASX:ACW) received official confirmation of its patent for XanamemTM being extended until 2031 last month, in the United States.

The patent (US 9365564 B2) protects the use of XanamemTM for use in Alzheimer’s dementia and other related diseases associated with the inhibition of the 11-beta-hydroxysteroid dehydrogenase (11β-HSD1) enzyme. ACW says this extended patent cover is complimentary to previous approvals in most other major markets, including all European countries and the UK, Australia, Japan and China.

ACW hopes to progress its development of XanamemTM with a view of marketing the drug globally.

With gradual progress in the US regulatory stakes now being made, ACW is targeting the most lucrative Alzheimer’s market in the world today — the United States, which represents 50% of the global Alzheimer’s disease treatment market, as measured by annual spending by healthcare agencies.

The cost of treating Alzheimer’s in the US was estimated to be US$250bn in 2013, and forecast to increase to US$1 trillion by 2050, outstripping the cost of treating all other diseases.

In Australia, Alzheimer’s is now the second leading cause of death after ischaemic heart disease.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.