MMJ receives superior counter offer for United Greeneries and Satipharm

Published 03-NOV-2016 15:19 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shares in MMJ Phytotech (ASX: MMJ) traded as high as 24.5 cents on Thursday morning, representing an increase of nearly 10% compared with the previous day’s close of 22.5 cents. The surge was driven by the receipt of an unsolicited offer from Harvest One Capital Corporation to acquire United Greeneries Holdings and Satipharm AG on superior terms to the Top Strike transaction.

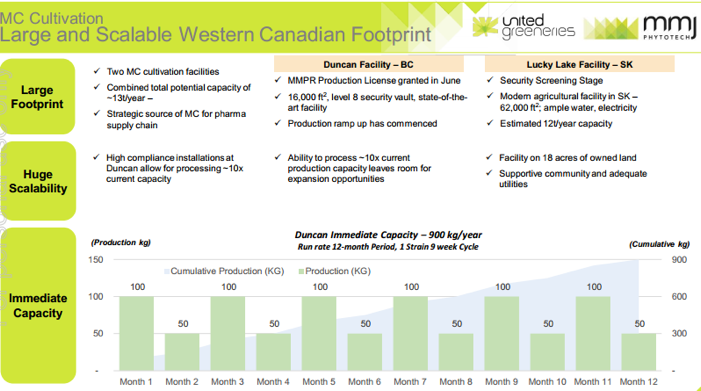

As a backdrop, MMJ is a medical cannabis company which aims to commercialise medical grade cannabis (MGC) and high potential cannabis based therapeutic products to the rapidly growing international market with regulated medical cannabis laws.

To provide some perspective on the proposed counter-offer, on September 28 MMJ signed a binding term agreement with TSX-V listed company Top Strike Resources to sell its 100% shareholdings in UG and Satipharm to Top Strike.

Consideration for the United Greeneries assets implied by the Top Strike offer was C$40 million. Harvest One’s counter offer represents a valuation of C$42 million.

Summing up the benefits of the latest offer, MMJ’s Managing Director, Andreas Gedeon said, “The Harvest One proposal offers a number of compelling advantages, including a materially higher valuation for the United Greeneries and Satipharm assets, which is a significant endorsement of MMJ’s assets and development strategy”.

MMJ does, however, represents an early stage play in this market and investors looking at this stock for their portfolio should seek professional financial advice.

One of the key underlying benefits of accepting the Harvest One offer would be access to Canadian capital markets, as the principals behind the group were formally principals of Potash One Inc, a vehicle which sold for C$430 million in 2011.

The group would also bring useful operational expertise with a lead consultant and shareholder of Harvest One having extensive experience in the Canadian cannabis sector.

He was also instrumental in raising capital for one of the earliest companies licensed to produce medical marijuana pursuant to Canada’s Marijuana for Medical Purposes Regulations (MMPR) in September 2014.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.