MMJ Phytotech’s role in the changing medical cannabis industry

Published 30-MAR-2016 15:54 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Legalisation and acceptance of medical cannabis as a cure or therapy for certain clinical ailments is gaining global traction.

As cities across the globe act to industrialise medical cannabis, several companies have begun to position themselves as first movers in product development and distribution.

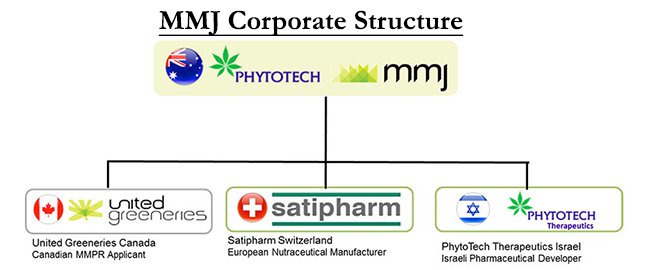

MMJ Phytotech (ASX:MMJ) is one such company establishing itself in this space.

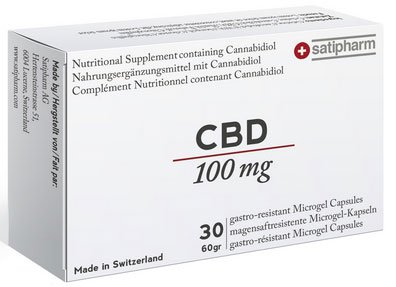

MMJ is developing quickly and has identified key priorities moving forward, one is to leverage its offshore operations in Australia by importing CBD capsules from Switzerland which are similar to those currently selling in Europe.

MMJ Managing Director Andreas Gideon told Market Eye is bullish about the Company’s Australian prospects.

“If our application is approved, this will mean that our CBD capsules will be available to Australian consumers within weeks of approval.”

In the meantime, MMJ is investigating potential partnerships with farmers, horticulturalists and Australian growing facilities in which complementary assets could create mutual benefits and an early foothold in the Australian market.

Gideon went on to tell Market Eye that “beyond growing partners, we are also exploring relationships with pharmaceutical processors, compounding pharmacies with established distribution channels and patient advocacy groups in order to enter the Australian market with maximum momentum.”

Offshore, MMJ recently received encouraging news with regard to the progression of the application for the licensing of its Lucky Lake facility in Saskatchewan.

The license approval process has now progressed to its next stage.

MMJ’s wholly owned Canadian subsidiary, United Greeneries owns the parcel of land on which Lucky Lake stands and it will be used to accommodate large greenhouse structures, which would be instrumental for the extraction of high-grade cannabis.

Lucky Lake can boost MMJ’s production capacity of dried cannabis flowers by up to 12,000kg per annum.

Once licensed, Lucky Lake will be integrated with the Duncan facility to expand its production by more than 1000%.

The Lucky Lake move comes shortly after the Canadian Federal Court passed legislation, known as the Allard Ruling, to amend or replace the current Marijuana for Medical Purposes Regulations (MMPR), which limits medical cannabis access and prohibits personal cultivation for patients with a prescription.

This ruling and the impending integration of facilities could position MMJ as one of the largest licensed producers in Canada.

The Lucky Lake application is at advanced stage and MMJ is now awaiting the examination of the proposed health, safety and security measures.

As a vertically integrated operator, MMJ believes it has first mover advantage in the industry with the ability to produce pharmaceutical-grade products that medical professionals can prescribe.

MMJ’s farm-to-pharma strategy allows it to protect its IP, whilst influencing each link in the value chain, including capturing the pharmaceutical grade product market.

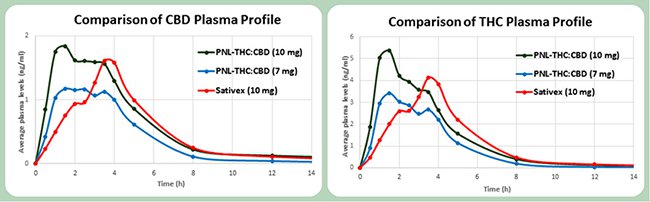

MMJ is currently conducting clinical trials on several potential products.

Dr Daphna Heffetz, CEO of Phytotech Ltd told Market Eye, “we have successfully completed Phase 1 clinical trials for both the PNL THC:CBD as well as the CBD 10mg and 100mg GelPell capsules, which returned superior results to peer products and paves the way to conduct Phase 2 studies for various clinical indications.”

Phase two trials will began in the second half of 2016, with Phase 3 studies beginning in the back half of 2017. Once completed the products tested should have the necessary approvals to be prescribed by doctors.

Looking forward, MMJ will continue its Phase 2 trials with a focus on spasticity, pain and MS and the Company will also begin importation of its existing Satipharm products into Australia.

The Company will also be bringing its Duncan Facility online.

Finally, MMJ’s Canadian operations will pave the way for the manufacture and sale of product into Australia.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.