MMJ extends its Harvest One Cannabis investment

Published 12-MAR-2020 15:40 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Global cannabis investment company MMJ Group Holdings Limited (ASX:MMJ) today announced that it has extended a loan to Harvest One Cannabis Inc. (TSX-V: HVT).

The group has also reported its Net Tangible Assets backing at February 29 as $0.221 per share, for a total NAV of $48 million and a total portfolio including cash of $50 million. As of 29 February, the group’s market capitalisation was $22 million, which has now dropped to just under $20 million given the recent market volatility.

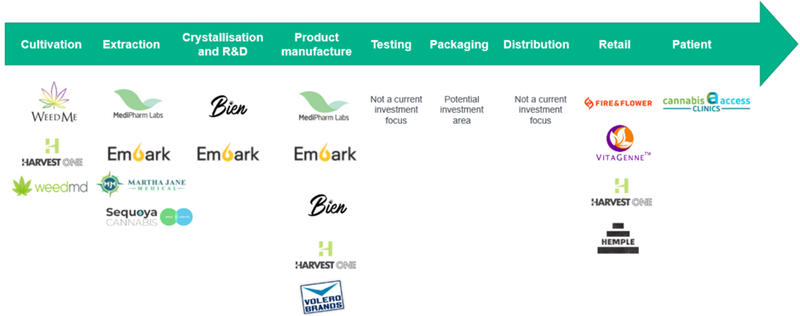

MMJ manages a portfolio of investments along the cannabis value-chain. It owns a portfolio of minority investments and aims to invest across the full range of emerging cannabis-related sectors including healthcare, technology, infrastructure, logistics, processing, cultivation, equipment and retail.

MMJ is the only listed Australian investment company which offers the opportunity to Australian investors to invest in unlisted and listed cannabis-related businesses in Australia and offshore.

The group has a proven track record in acquiring and realising considerable value from its cannabis related investments.

Since 2015, MMJ has created a significant number of investment opportunities from its connections in Canada and Australia in the private investment sector and realised exits when it is to the benefit of MMJ and its shareholders:

Here’s how MMJ’s investments sit across most of the cannabis and hemp value chain:

Harvest One Cannabis

MMJ allocate capital to potential market leaders, consolidators and takeover targets.

Harvest One Cannabis Inc. (TSX-V: HVT) is one such company that MMJ believes is significantly undervalued given its substantial cultivation and Cannabis 2.0 assets and are working closely with Harvest One to realise that intrinsic value.

The group today announced that it has reached agreement to extend the maturity date of the secured loan agreement with Harvest One. The loan, bearing interest at a rate of 15% per annum in the amount of C$2 million, was issued was on January 10, 2020, with the principal and accrued interest payable within 60 days.

The maturity date has now been extended by 90 days to 8 June 2020

In consideration MMJ will receive 17,083,333 warrants exercisable at a price per HVT share of $0.06 at any time until the earlier of a further extension or renewal of the loan, or two years (subject to approval).

MMJ is the largest shareholder holding 26% of HVT which is one of the largest investments within the MMJ cannabis and hemp portfolio.

Harvest One granted MMJ a security interest in all current and after acquired property of HVT and its subsidiaries, subject to certain permitted liens.

The extension of the maturity date will assist HVT to continue making significant progress in restructuring its operations and realising the sale of non-core assets. Harvest One is a global cannabis company that develops and provides innovative lifestyle and wellness products to consumers and patients in regulated markets around the world.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.