Merger and acquisition activity heightens in healthcare sector

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shares in cancer immunotherapy drug developer, Imugene (ASX:IMU) rallied more than 7% on Thursday while the S&P/ASX All Ordinaries index plunged 65.5 points or 1.1%.

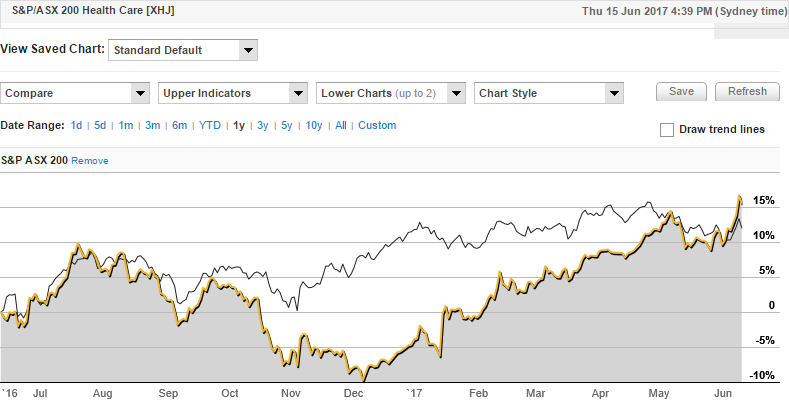

Moreover, the recent strong performance by the S&P/ASX 200 Health Care Index (XHJ) also came to a grinding halt as it fell 246 points, representing a decline of 1%.

While yesterday’s robust performance by IMU was promising on a standalone basis, it is a continuation of a rally that started early last week when the company’s shares were trading at 1.2 cents. Yesterday’s close of 1.5 cents represents an increase of 25%.

Of course, it should be noted that share trading patterns should not be used as the basis for an investment as they may or may not be replicated. Those considering this stock should seek independent financial advice.

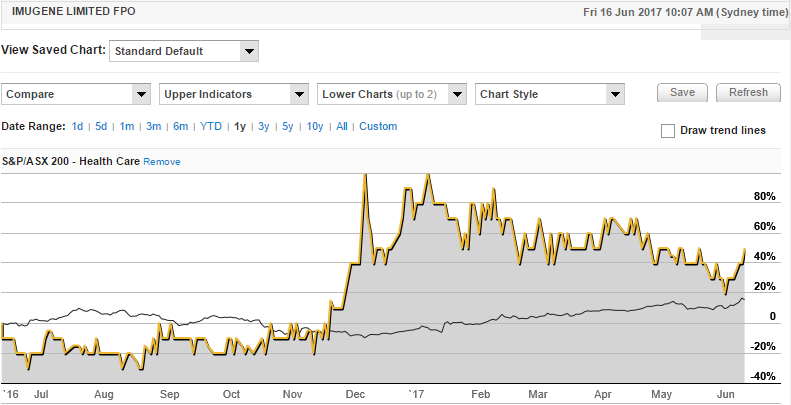

From a broader perspective, the XHJ (yellow line) was due for a rally, for the most part having trailed the S&P/ASX 200 index (XJO) over the last 12 months as this chart indicates.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

The recent break above the XJO can mainly be attributed to a strong performance from index heavyweight CSL which has surged nearly 10% since last week when it announced the US$352 million acquisition of a majority stake in Chinese plasma fractionator, Wuhan Zhong Yuan De Biologicals.

Not only does sector underperformance eventually provide the catalyst for merger and acquisition activity, but the commencement of such activity is often the line in the sand in terms of a more sustained across-the-board recovery.

The Australian health care sector has traditionally thrived through acquisition activity, led by the likes of CSL and other prominent players such as Ramsay Health Care (RHC) in the hospital sector, Sonic Healthcare (SHL) in the pathology and diagnostic imaging sector and Ansell (ANN) in the equipment and capital goods industry segments.

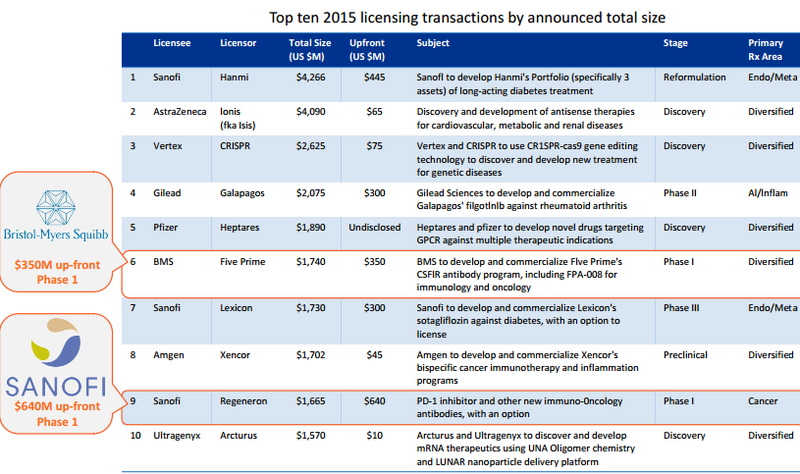

Global licensing deals to the value of $3.4 billion in antibody industry

The same dynamics have been at play in the global health sector. While deals aren’t necessarily the subject of a formal takeover, lucrative licensing agreements are struck whereby major pharmaceutical enterprises invest considerable funds in smaller companies in order to reap the benefits as licensee in the development and commercialisation of important new drugs.

These were the top 10 big pharma deals in 2015, 20% of which were in the antibody space, a significant statistic from IMU’s perspective, particularly if merger and acquisition activity and/or licensing deals gain momentum in Australia.

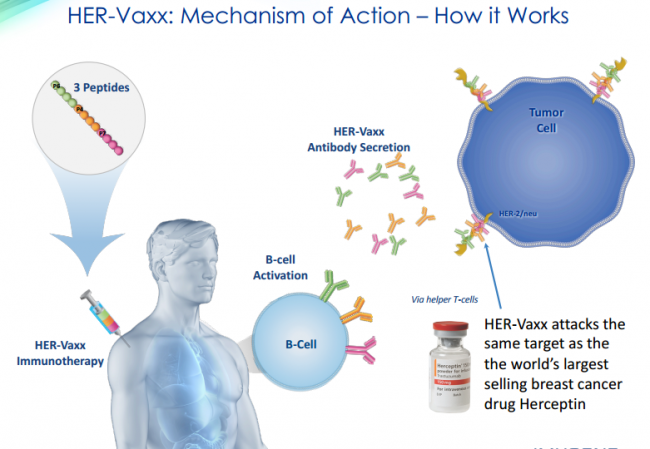

IMU is developing cancer immunotherapy drugs based on antibodies, focusing on B cell based vaccines in the fast growing field of Immuno-oncology.

Immunotherapy is the treatment of cancer with substances or drugs that stimulate the patient’s immune response, known as immunisation. Unlike chemotherapy, immunotherapy drugs do not target the cancer directly, rather they help the patient’s own immune system recognise and attack cancer cells.

Typical immune responses are B cells making antibodies to attack the cancer and T cells developed by the thymus to attack the cancer.

IMU has two compelling antibody programs and commercial opportunities including the HER-Vaxx peptide vaccine being developed for HER2+ gastric cancer. The following demonstrates how the drug is administered and the impact that it has, and as noted the similarities it shares with the world’s largest selling breast cancer drug, Herceptin.

IMU noted in January that interim phase 1B/2 data would likely come to hand in the first half of 2017, suggesting some promising news flow could be imminent. Furthermore, the final phase 1B/2 trial readout is expected in the second half of 2017.

Whether the recent run in the company’s share price is linked to confidence regarding the potentially positive nature of this data cannot be confirmed, but the timing appears to be on the mark.

While IMU is a microcap, it has strong institutional support. Most notable is Platinum Asset Management’s stake in the company which was increased from circa 6% to more than 9% in November 2016.

Of course this is still an early stage play and investors should seek professional financial advice if considering this stock for their portfolio.

The recent retracement in the company’s share price which is evident in the 12 month chart below can be attributed to a lack of news flow early in the calendar year, but as can be seen IMU has still outperformed the S&P/ASX 200 Health Care index over the period.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

During the six months between November and April there was a substantial outperformance by IMU, and as the chart indicates, the company appears to be at a stage where it could broaden the gap once again should the recent rally continue.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.