Immuron Announces A$5.1M Private Placement to U.S. Fund

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Immuron Limited (ASX:IMC; NASDAQ: IMRN) announced today it has finalised a private placement capital raising with a large US institutional investment fund. The terms of the private placement will raise IMC approximately A$5.1 million (before costs of the offer).

The placement will involve the issuance of 13,162,744 new ASX shares at A$0.39 per share, plus three new free-attaching options for every 5 new shares issued resulting in 7,897,647 new options being issued exercisable at A$0.468 per option, expiring five years from the date of issue.

Joseph Gunnar & Co., LLC and H.C. Wainwright & Co. acted as exclusive joint placement agents for the offering, which is expected to complete on March 15, 2018, subject to customary conditions.

IMC expects this capital raise to secure the future funding needs of the company’s other ongoing clinical programs, as well as support ongoing marketing initiatives surrounding the its flagship Travelan product — which has already experienced significant sales growth through the first half of financial year 2018.

CEO Jerry Kanellos commented on today’s news: “Immuron has received a number of recent offers for financial support following the release of the Company’s positive top-line results of its IMM-124E Phase II Non-Alcoholic Steatohepatitis (NASH) clinical study. We’re very pleased that we have been able to partner with this large US institutional investor for this raising and for them to take such a significant position in our Company brings stability and validation to the Company’s share register.”

Of course, it should be noted that Immuron is still a speculative stock and anything can happen. Investors should seek professional financial advice if considering this stock for their portfolio.

This capital raising follows hot on the heels of the company’s major announcement earlier this month that the results were in for its IMM-124E phase II Non-Alcoholic Steatohepatitis (NASH) clinical study.

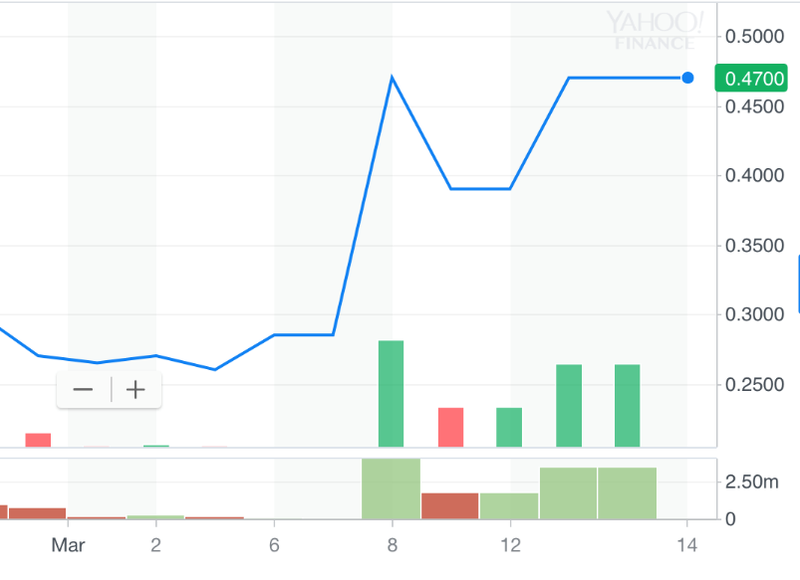

IMM-124E was shown to result in a statistically significant reduction of serum Lipopolysaccharide (LPS) in patients with NASH. The association between elevated serum LPS and the progression of NASH has been well-documented, and the major news resulted in a significant spike in IMC’s share price as the market took notice.

On the day of the release of results, IMC went from 28 cents to a high of 47 cents:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

As part of today’s announcement, IMC stipulated it does not intend to register securities or conduct a public offering in the US at this time, stating “This distribution of this press release may be subject to legal or regulatory restrictions in certain jurisdictions” and “Any person who comes into possession of this press release must inform him or herself of and comply with any such restrictions.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.