Creso pursues further commercialisation, certifications & partnerships to accelerate revenue growth

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The last six months has been a rollercoaster ride for shareholders in Creso Pharma Limited (ASX:CPH) with the company’s shares receiving a significant boost in June following a proposed takeover valuing the cannabis products group at 63 cents per share.

While this represented a 50% premium to the company’s closing price on June 6, 2019, when the Independent Expert’s Report was completed in the ensuing months the offer was deemed not fair or reasonable to Creso Pharma’s shareholders.

Creso Pharma and its suitor advised the market on 12 November that the scheme implementation agreement relating to the acquisition had been terminated.

The fact remains though that a takeover offer representing a substantial premium to the company’s share price of 42 cents was viewed by the independent expert as inadequate.

Unfortunately, a combination of negative sentiment towards stocks in the broader cannabis sector, along with perhaps a degree of disappointment regarding the failed takeover bid has triggered an exaggerated spate of selling with the company’s shares now trading at a 50% discount to their pre-acquisition price.

However, the takeover offer was and still is validation of the inherent strength of the company’s business

With CPH continuing to demonstrate its operational strength built around quality products and relationships with major players at all stages of the development, manufacturing and distribution chain, the company is looking stronger than ever.

When Creso Pharma’s impressive operational attributes are examined, you get a better feel for what represents fair value so that is a good place to start in determining whether this retracement has provided a buying opportunity.

Strong revenue growth as new products come to market

Management has said that it will aggressively pursue the further commercialisation of the remaining nine pharmaceutical-grade products in its current portfolio, key certifications and strategic partnerships and accelerating revenue growth.

Creso Pharma expects its growth plans will be supported by secure funding, increasing revenue, prudent cost management and experienced leadership as it strives to unlock the full value of its operations on behalf of its shareholders.

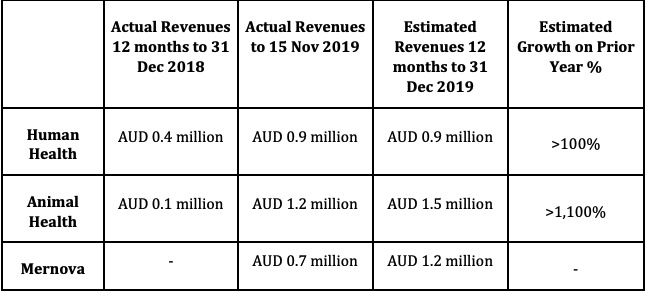

Indeed, the year-on-year revenue growth as outlined below augurs well for future, providing a sound base as new products are brought to market.

Creso Pharma believes the value of its fundamental operations continues to grow, supported by the company’s portfolio of products, established operations, corporate interest and market opportunities.

Creso Pharma has an innovative portfolio of assets and a leadership team with experience in ‘Big Pharma’.

It is confident in its ability to successfully commercialise its products and continue its global expansion.

By partnering with leading global companies in product development, manufacturing and distribution, Creso Pharma has been able to, and will continue to, accelerate the development and distribution of its products worldwide.

Product diversification works in its favour

Creso Pharma’s portfolio of cannabis and hemp-derived products focuses on the four key areas of therapeutics, nutraceuticals, animal health, and cosmetics.

The company currently has a portfolio of 13 products which have been developed with pharmaceutical expertise and methodological rigour by a qualified pharmaceutical team.

Four products have been commercialised, and are generating sales, and nine are pending commercialisation.

Of the 13 products Creso Pharma has developed, four products have been commercialised with two apiece targeting human and animal health.

All of Creso Pharma's products are made with standardised dosing and formulations through the application of pharmaceutical rigour, Good Manufacturing Practices (GMP) standards and proprietary, innovative delivery technologies.

In addition, they carry the well-known "Swiss Made" label that is synonymous with premium-quality products.

In human health, Creso Pharma anticipates signing with more commercial partners to expand the commercial reach of its two existing products cannaQIX® 10 and cannaQIX® 50 and to introduce the newly developed products in additional European countries.

The company is prioritising Spain, Portugal, the Scandinavian countries, Poland and Israel.

Creso Pharma’s launch of cannaQIX® 10 into South Africa is planned for the March quarter of 2020 as the first CBD based product to be commercialised as CAM (Complementary Alternative Medicine), followed by a phased entry into other African countries, as well as expanding to additional CBD based products with the same partner pharmaceutical company.

In animal health, Creso Pharma's partner Virbac is introducing the two initial anibidiol® products into further countries in Europe and will be launching Creso Pharma's new animal health products in the near future.

For both human and animal health, Creso Pharma has initiated its reach into North America, where it is in discussions with a number of potential partners to introduce all 13 products, human and animal, into selected US states.

In South America, Creso Pharma has filed its animal health products in Argentina and Uruguay together with PharmaCielo and is at the last stage of approval.

Commercial partners have been identified, terms negotiated, and a plan outlined for a long term collaboration on the existing range of products as well as on the new products that Creso Pharma has developed which are ready for launch.

Strengthening balance sheet to fund growth

Creso Pharma has secured funding to accelerate its global operations as a result of its refined strategy and reallocation of resources.

This fund raising has currently secured a total of approximately $5.03 million for the company immediately, through an issue of Convertible Securities to raise $3.45 million and the completion of a share placement through the issue of shares at a price of $0.191 to raise approximately $1.58 million.

Creso Pharma has also secured an additional drawdown facility for a further $2.7 million through the issue of convertible securities.

This brings the total funding currently available to the company to nearly $6 million with a further $3.85 million being potentially available, as the company readies itself for growth in 2020.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.