Creso Pharma delivers second shipment of cannaQIX® adding $320K to growing revenue base

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Creso Pharma Limited (ASX: CPH; FRA: 1X8) has completed all required importing and exporting procedures and successfully delivered a second shipment of cannaQIX® products to the subsidiary of Lupin International (NYSE:LUPIN), Pharma Dynamics South Africa.

As a company that prides itself on bringing the best of cannabis to better the lives of people and animals, management would be extremely encouraged with this repeat business, a true endorsement of product quality and operational performance.

One of Creso’s key goals is to bring pharmaceutical expertise and methodological rigor to the cannabis world as it strives for the highest quality in its products.

The group’s ability to succeed in this quest is paying dividends as it emerges as an important player in the development of cannabis and hemp-derived therapeutic, nutraceutical, and lifestyle products with wide patient and consumer reach for human and animal health.

Particularly over the last two months, Creso Pharma has been delivering on all fronts and with further momentum provided by positive regulatory changes to the industry, investors have flocked to the stock with its shares increasing ten-fold from 3 cents in late November to close at 30 cents in early December.

Today’s news centres on cannaQIX®, Creso Pharma’s range of cannabidiol (CBD) hemp oil-based nutraceuticals, which contain a broad spectrum of organic hemp oil extracts with CBD that aims to improve management of stress and to support mental and nervous functions.

Delivery follows the receipt of a second purchase order from Pharma Dynamics in October 2020 valued at CHF220,000 (approximately A$320,000), which has now been banked and adds to Creso Pharma’s growing revenue profile.

Collaboration with Pharma Dynamics paying dividends

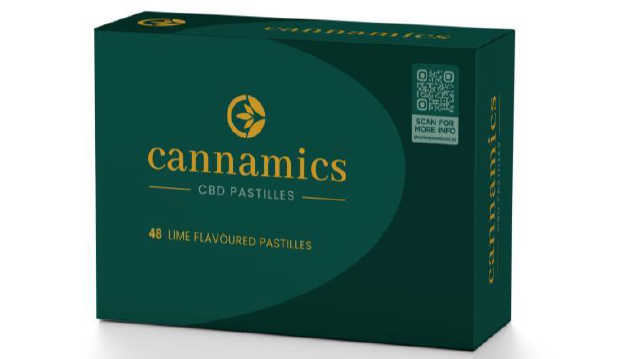

The delivery of the second purchase order follows the company’s successful launch into the South African market in collaboration with Pharma Dynamics which launched the cannaQIX® regular products as shown below during the June quarter of 2020, and this is being marketed under the ‘Cannamics’ brand.

Pharma Dynamics is a subsidiary of leading pharmaceutical company, Lupin International which is ranked as the fifth largest generic pharmaceutical company in South Africa.

The group provides high quality generic medicines at affordable prices and is well known for its investment in innovative wellness programs that “go beyond the pill” in helping patients manage their conditions and improve treatment outcomes.

Pharma Dynamics has a growing range of over-the-counter products include medications for cold and flu, allergy, and digestion, as well as immune booster wellness products.

Importantly, its products are consistently prescribed and recommended by leading doctors and pharmacists countrywide.

Points of distribution to be expanded

Pharma Dynamics distributes Creso Pharma’s hemp-based products across South Africa, with plans to extend the distribution to Namibia, Botswana, Zimbabwe, Swaziland, Lesotho, Angola, Mozambique and Uganda.

Creso Pharma is confident that additional opportunities will materialise in Africa in the coming months as management continues to work with Pharma Dynamics to establish a broader footprint in the region, paving the way for further purchase orders that are expected to grow in both size and volume.

Highlighting the swift timing of the second purchase order and delivery, management views this as a demonstration of a healthy relationship and positive patient response.

This underpins the company’s expectation of further purchase orders being received from this region in the short term in a more sustainable and consistent fashion, emphasising Creso’s current growth trajectory of recurring global sales as it enters new markets, enhancing the group’s recurring revenue model.

Recurring revenue is an important focus for investors

Establishing a record of recurring revenue will provide both financial stability and income predictability, key attractions for investors looking to gain exposure in an emerging industry where numerous players are not generating sales, and many are still struggling in terms of negotiating the regulatory environment.

This is obviously working in Creso Pharma’s favour, and contributed significantly to the group achieving the ten-bagger tag as its shares soared towards the end of 2020.

As at 31 December 2020, Creso Pharma retained a robust cash balance of over $6 million.

Since then, the company has received an additional $1.7 million following the exercise of options, giving Creso a healthy bank balance to accommodate the group’s current operations, as well as funding expansion into new markets.

The current sales and related revenues that have been announced are extremely encouraging, and Creso Pharma’s healthy bank balance further demonstrates the group’s strong financial foundation to continue to win market share, as well as being positioned to quickly capitalise on any potential further international growth opportunities.

Management provided notice that there were new opportunities on the horizon, and the company hopes to ratify these in the relative near-term, potentially providing further share price momentum.

Commenting on the significance of receiving a second-order from Pharma Dynamics and the scope for further sales, Jorge Wernli, commercial director said, “We are excited about the completion of this second order from Pharma Dynamics, which has underpinned a very successful launch of cannaQIX® under the Cannamics brand in South Africa.

“cannaQIX® has been developed using Good Manufacturing Practice standards and is standardised and user-friendly.

‘’Strength and formulation allow for precise dosage control, and the lozenge form is more palatable than many other oils on the current market.

‘’We have no doubt that it will continue to be well received by consumers in South Africa.

“We are very proud of having accomplished this delivery in spite of the current restrictions in place, mainly due to the COVID situation.

‘’We are looking forward to further growth throughout South Africa and other territories together with Pharma Dynamics.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.