Creso gains exposure to world’s largest legal medicinal cannabis market

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

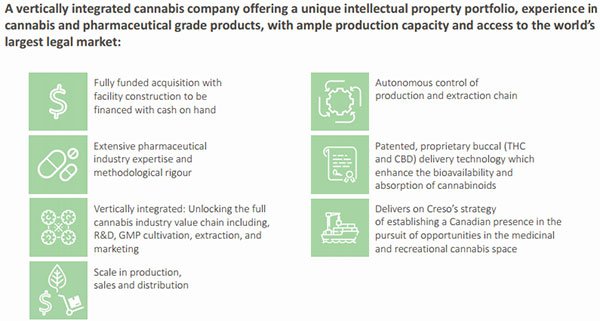

Creso Pharma Limited (ASX: CPH) has expanded into the Canadian market with the proposed acquisition of emerging Nova Scotia-based medicinal cannabis producer, Mernova Medicinal Inc (Mernova) for a total of C$10.1 million (A$10.2 million) in cash and equity.

This will see CPH become the only Australian cannabis company with direct exposure to the world’s largest legal medicinal cannabis market. The fully-funded acquisition also delivers on management’s strategy of establishing a Canadian presence while pursuing opportunities in the medicinal, and soon to be legalised, recreational cannabis space.

Of course, it should be noted here that Creso is still in its early stages and anything can happen here, so investors should seek professional financial advice if considering this stock for their portfolio.

Financial consideration for Mernova involves three milestone cash payments of C$1.8 million and three milestone issues of CPH’s shares to the value of C$8.3 million.

Milestone payments will coincide with settlement of the acquisition, planting of the first crop by Mernova and the granting of the sales licence to Mernova by Health Canada.

The acquisition brings operational benefits as it provides CPH with the ability to rationalise and vertically integrate its supply and production chain by building its own Good Manufacturing Process (GMP) cultivation facility.

Mernova is a privately held company based in Nova Scotia that has applied for a medical cannabis cultivation license under Health Canada’s Access to Cannabis for Medical Purposes Regulation (ACMPR) program.

The company has acquired a strategic parcel of land that is ideally suited for development of a medical cannabis growing facility. The construction of a 20,000 square foot facility is due to commence in the coming months, and CPH also intends to build a state-of-the-art carbon dioxide extraction facility at the site that is fully GMP compliant.

Strong barriers to entry with a strategic first mover advantage

The longer term plan is to expand the facility as Mernova is in the process of engaging a team of experts to design and construct the facility to a GMP standard. The company is in the final stages of a detailed review by ACMPR, a process that commenced in 2014. This demonstrates the barriers to entry for newcomers, highlighting the group’s early mover advantage.

Mernova is currently in the final stages of the review and expects to receive its licence to produce in the coming months. At this time it will be in a position to immediately commence construction of the facility. On completion of construction Mernova will access the market as a large-scale, high-quality producer of medicinal cannabis, leaving it well-placed to expand into the recreational market once Canadian legislation is implemented.

The benefits of these developments are numerous for a company such as CPH. As well as establishing a presence in the well-regulated Canadian market for its innovative animal and human health nutraceutical products, it now has the ability to vertically integrate its product line and efficiently manage the supply chain from cultivation through to distribution.

There are also financial benefits from being an early mover as licences are expected to become more expensive as quality standards increase.

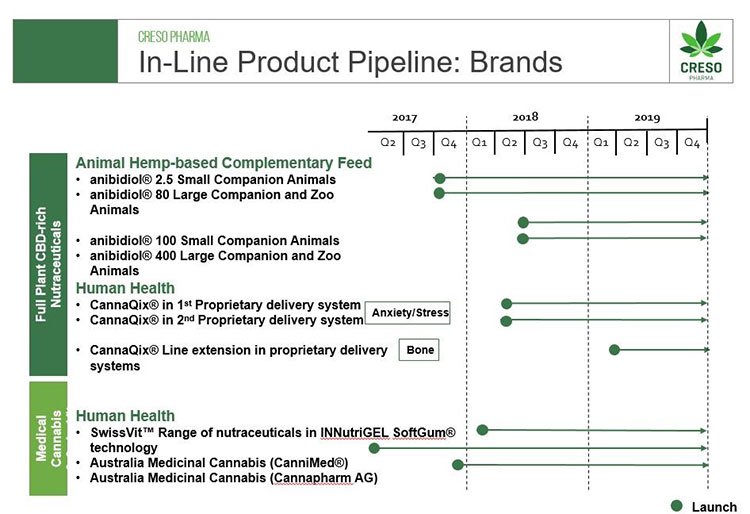

Importantly, CPH will be able to continue its ongoing innovation and development program which will see the launch of new products. The company is a leader in cannabidiol (CBD) innovation and develops cannabis and hemp-derived therapeutic-grade nutraceuticals and medicinal cannabis products with wide patient and consumer reach for human and animal health.

CPH already uses GMP development and manufacturing standards for its products as a reference of quality excellence with initial product registrations in Switzerland. It has worldwide rights for a number of unique and proprietary innovative delivery technologies which enhance the bioavailability and absorption of cannabinoids.

Key features of the well-regulated $1.3 billion Canadian market

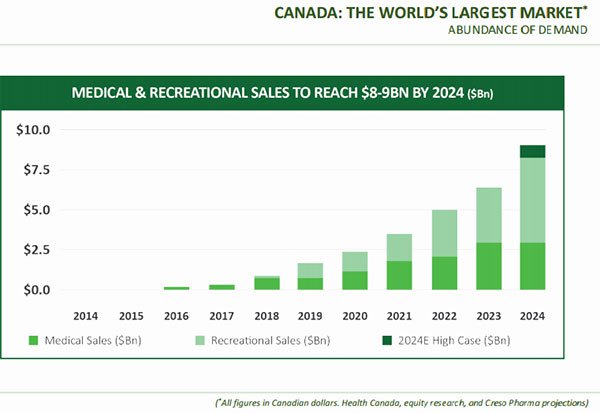

Canada is a well-regulated and growing market. There are currently 52 licensed producers operating under the ACMPR program, and Health Canada forecasts that there will be 450,000 medicinal marijuana patients by 2024, representing C$1.3 billion (A$1.3 billion) in sales.

In addition, the legalisation of the recreational market would immediately create significant opportunities for medicinal producers to expand into recreational production. The base retail market value is estimated at between C$4.9 billion (A$4.9 billion) to C$8.7 billion (A$8.7 billion), with significant industry growth expected following legalisation.

Reflecting on this backdrop, CPH CEO and Co-Founder Dr Miri Halperin Wernli said, “With this acquisition, we have delivered on one of the key pillars of our corporate strategy, establishing a Canadian presence and the pursuit of opportunities in the medicinal and the recreational cannabis space”.

She also highlighted the benefits of rationalising and vertically integrating supply and production through establishing a company owned GMP-quality cultivation and extraction facility, noting the strategic benefits of exercising the right to cultivate and manufacture CPH’s own innovative medicinal cannabis products.

The company will take the development of products to a new level as it also provides innovative proprietary methods of delivery. New products will be standardised in dose and formulation, in innovative and proprietary delivery technologies, providing patients with new therapeutic choices beyond smoking or vaping.

As indicated below there are numerous potential share price catalysts on the horizon.

CPH continues to pursue further opportunities in the Canadian market, when it comes to both local distribution and exporting to other countries such as Australia that already accept medicinal cannabis imports.

The company is well funded to pursue such initiatives with $9.23 million cash on hand as at 30 June 2017, enabling it to execute its medium-term objectives without any obligation to return to the market for additional funding.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.