Creso and CanniMed Canada negotiate groundbreaking deal

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

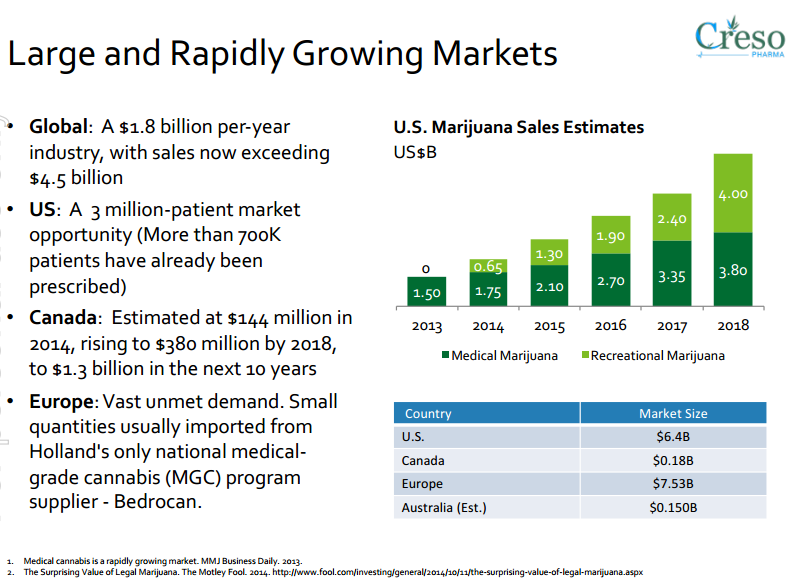

In terms of the agreement CPH has been appointed preferred distributor for CanniMed Canada in the European Union for the purpose of marketing all of the group’s medical cannabis brands to governments, authorised importers and distributors, institutions, pharmacies and individuals.

It is important to note that within the European market several countries including Germany and Denmark have already moved towards the legalisation of medical cannabis when recommended by a physician. Furthermore, countries such as Belgium and Austria have legislation in place to conduct clinical research.

CPH’s scalable revenue model sets it aside from many peers

Consequently, the potential to generate income from Prairie Plant Systems PPS products sold in the EU represents another revenue accretive development for CPH following the negotiation of several agreements in recent weeks. Importantly, this comes at a stage when many new industry entrants have long-range revenue visibility at best.

Given CanniMed’s high profile and 15 year growing history, this is a particularly important arrangement, and comes on the back of three other commercial agreements struck in the last three weeks which have resulted in CPH’s shares surging circa 35%.

It should be noted that this is an early stage company and it is impossible to predict share price responses, investors should seek independent financial advice if considering this company for their portfolio.

CanniMed sole GMP supplier for Health Canada’s initial medical marijuana program

CanniMed is licensed under the Access to Cannabis for Medical Purposes (ACMPR) and has the longest growing history as a result of the parent company, Prairie Plant Systems Inc, being the sole GMP supplier for the entirety of Health Canada’s initial medical marijuana program.

Consequently, the scale of distribution, supply chain optimisation and access to new markets facilitated by this agreement provide CPH with a significant boost in addition to bringing its range of human and animal cannabis derived products to market.

The two companies are an ideal fit, with CanniMed’s Chief Executive, Brent Zettl commenting, “Creso Pharma is the ideal partner to support our expansion into the European market as a result of their industry expertise in drug development, clinical research and contacts with influential medical centres interested in the implementation of clinical trials with medical cannabis”.

This was endorsed by CPH chairman, Boaz Wachtel who said, “Together we see tremendous opportunities to provide governments, medical cannabis patients and leading research institutions with standardised medicines that meet strict manufacturing guidelines, effectively supporting CPH’s near-term revenue generation”.

CPH continues to underpromise and outperform, providing share price momentum

Most recently CPH negotiated a binding letter of intent with a Swiss animal health company and Dutch veterinary product manufacturer and wholesaler. This followed the signing of its first distribution agreement in Central Europe, a development which will bring immediate revenue and cash flow.

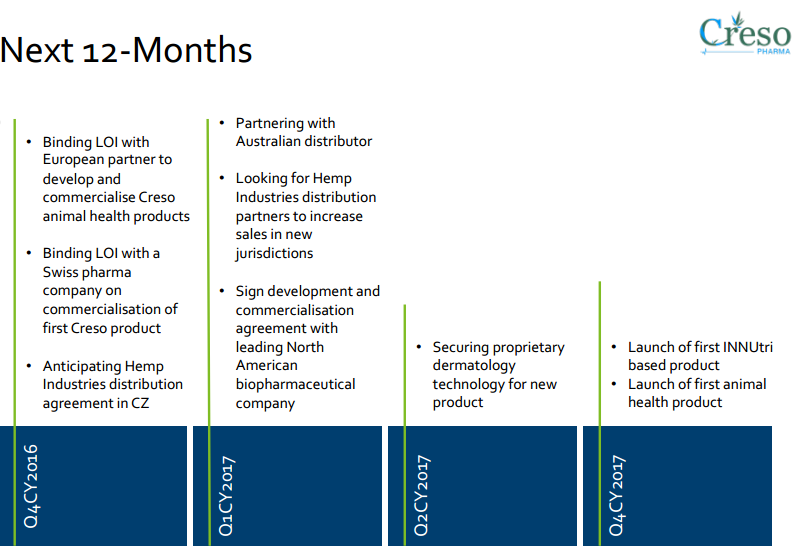

A little over a week ago (Creso positioned to penetrate US$40 billion veterinary health market) FinFeed said, “It is only relatively early in the fourth quarter and CPH has achieved two of its goals and with significant events potentially occurring over the next six months, including the anticipated first quarter 2017 negotiation of development and commercialisation agreements in the important North American biopharmaceutical market, there is scope for CPH’s share price to rerate strongly”.

Investors like companies that hit milestones either on or ahead of time and CPH is quickly establishing a reputation for doing just that.

As can be seen below, management is ahead of schedule, having flagged the identification of distribution partners to increase Hemp Industries sales in new jurisdictions, as well as the signing of a development and commercialisation agreement with a leading North American biopharmaceutical company, with both of these goals mapped out for the first quarter of calendar year 2017.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.