Could This ASX Cannabis Stock Soar Amid the Coronavirus?

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

As fears surrounding the Coronavirus drive the markets down, one ASX-listed pot stock could triumph amid the COVID-19 crisis.

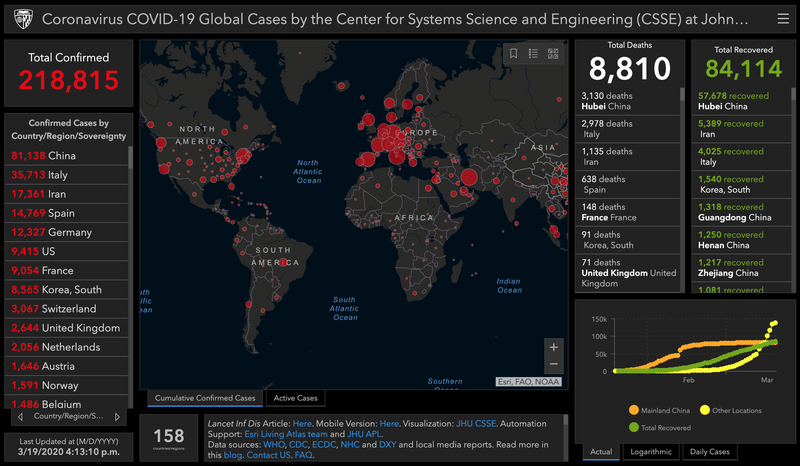

The Coronavirus, now known as COVID-19, emerged from Wuhan in China last December and has since sent shockwaves throughout the globe. Over 240,000 cases of COVID-19 have been confirmed worldwide, with the the actual number of cases is likely much higher and number of infected people rising daily.

The virus has been detected in more than 160 countries, with the majority of the cases to date reported from China, Italy, Iran, Spain, and Germany.

As of yet, no vaccine currently exists for COVID-19, and fears are rising around the continued spread of the disease, causing serious downturns on the stock market.

The world has been in a panic ever since the new Chinese coronavirus disease — which is now officially known as COVID-19 — began stoking fears of a global pandemic in early 2020.

Since the emergence of COVID-19, markets have suffered their worst falls since the global financial crisis of 2008.

Global investor sentiment has been severely dampened by COVID-19, and it's looking like this will continue for some time until further clarity emerges around the global Coronavirus crisis.

How Will Coronavirus Affect Pot Stocks?

Pot stocks have been experiencing a downturn for the latter half of 2019 and this has continued into 2020. Given that pot stocks don't exist in a vacuum, you can be pretty certain that the ongoing corona crisis isn't going to do any favours for the already struggling global cannabis market.

By that same token, in order to best wade through the current uncertainty regarding COVID-19 and how it relates to pot stocks, it helps to look toward the broader global market to see which stocks are weathering the current storm. One such ASX Biotech is Zoono, (ASX:ZNO), which produces antimicrobial products.

Zoono shares skyrocketed after the company stated that its Z71 Microbe Shield surface sanitiser was highly effective against the bovine Coronavirus in 2014, achieving 99.99% efficacy in just five minutes.

"Given the successful test results in 2014 and since Zoono is very confident that both products will have a level of efficacy against the current strain of the Coronavirus similar to that achieved previously," the company stated.

With many believing that Zoono's technology will be effective against the Coronavirus, investors flocked to the company and the share price rose from less than $1.0 in early February to as high as $2.44.

Great, but what's the connection to pot stocks?

Botanix Pharmaceutical's Antimicrobial Asset

When looking at a phenomenon like Coronavirus, we're reminded of the growing frequency of bacterial diseases and how they're becoming increasingly immune to current treatments.

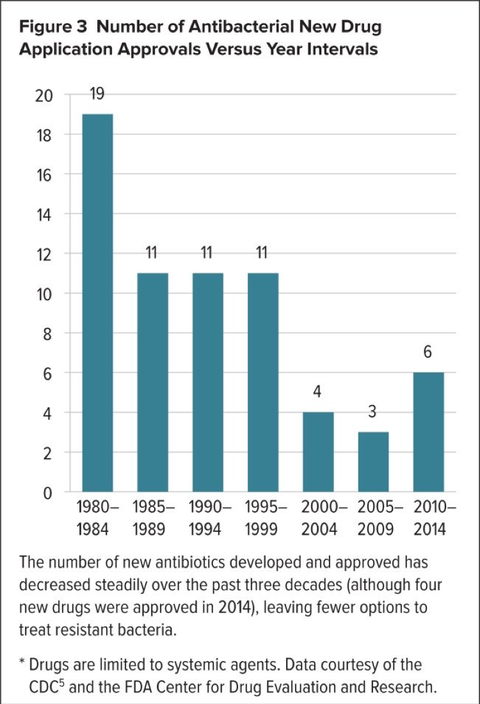

Due to the overuse of medication, bacteria have developed significant resistance to current antibiotic treatments. On top of this, antibiotics are said to remove more drug-sensitive forms of bacteria, leaving the more resilient forms to propagate.

This overuse of medication is occurring primarily because in many cases, they are being incorrectly prescribed. Studies show that antibiotic therapy is incorrect in 30% to 50% of cases. This alone can cause unnecessary antibacterial resistance and many fear this is precisely what will occur with regards to COVID-19.

This is why Botanix Pharma (ASX:BOT) could be a wise investment given the early evidence surrounding their antimicrobial product BTX 1801.

Similarly to Zoono, studies revealed that Botanix's drug, BTX 1801, was capable of tackling a range of different bacteria, among both humans and animals. Additionally, the synthetic CBD in Botanix's product kills bacteria within three hours and was shown to lessen the bacteria's ability to develop resistance to the antibiotics.

The cannabis-derived drug has so far proved effective against two superbugs, staphylococcus (staph infections) and methicillin-resistant staph Aureus (MRSA).

We've got our eyes on Botanix Pharma for a number of reasons, but with regards to the current Coronavirus climate, positive results around BTX 1801 are likely to stimulate a lot of investor enthusiasm.

In order to progress BTX 1801 trials, the company received a $50,000 grant from the Federal Government, and Botanix will be beginning phase 2 of the trials in late Q1 of 2020.

Should the results of Botanix's trial be positive, we may see cannabinoid formulas become a staple in addressing future bacterial diseases – and you can expect stock prices to rise at the same time.

Though Botanix isn't resting solely upon this formula either, as the company has several ongoing trials occurring, each targeting enormous addressable markets such as atopic dermatitis, acne, and rosacea. 2020 will see the progression of many of these trials and should any one of these formulas show promise, Botanix may be looking down the barrel of a billion-dollar formula.

Louis O'Neill is a writer based in Sydney with a focus on social and political issues. Having interviewed local politicians and entrepreneurs, Louis now focuses on cannabis culture, legislation & reform. Originally published on The Green Fund.

The Green Fund is Asia Pacific's preeminent media house positioned at the forefront of the global cannabis industry. Committed to driving the industry forward, we spotlight the sector from all angles, explore the companies and the players making headlines, and cover some of the biggest cannabis companies in the world.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.