Broker sees substantial upside in Immuron with catalysts imminent

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Immuron (ASX:IMC and NASDAQ:IMRN) is developing next-generation therapeutics derived from bovine colostrum, the so-called ‘first milk’ that is produced immediately after calving with the purpose of providing crucial elements of immune system protection to the newborn calf.

Acknowledging colostrum is such a rich source of immunomodulatory molecules, particularly polyclonal antibodies, which can have specific therapeutic properties, Raghuram Selvaraju, an analyst with New York-based research house, HC Wainwright & Co has initiated coverage of Immuron (ASX:IMC and NASDAQ:IMRN) with a buy recommendation and a share price target of US$15, a premium of 185 per cent to its current NASDAQ price of US$5.27.

It should be noted here that broker projections and price targets are only estimates and may not be met and share trading patterns should not be used as the basis for an investment as they may or may not be replicated. Those considering this stock should seek independent financial advice.

Selvaraju recognises the company’s prospects, particularly given the size of its target markets.

IMC has two clinical-stage candidates, one of which is IMM-124E, which is being aimed at liver diseases including non-alcoholic steatohepatitis (NASH) and non-alcoholic fatty liver disease (NAFLD).

The other key component of its portfolio is IMM-529, which is targeting Clostridium difficile-related infections (CDI), a hospital-acquired or non-socomial infection associated with multi-drug resistance.

IMC’s early-stage preclinical pipeline also comprises programs targeting central nervous system (CNS) diseases and neuropsychiatric conditions such as autism spectrum disorder (ASD) and other infections, including those caused by pathogens like Campylobacter and Shigella.

IMM-124E a possible company maker

While Selvaraju views the market opportunities for both IMM-124E and IMM-529 as substantial, he noted the former is by far the larger of the two markets with NASH alone projected to reach over US$25 billion annually by 2026 with a compound annual growth rate (CAGR) averaging 45 per cent over the next 10 years.

The analyst believes that peak sales could exceed US$1.8 billion, which conceivably would only be achievable with the assistance of a partner. However, he noted that IMC could self-commercialise IMM-529, a development that could deliver sales of US$180 million in a 2033 timeframe.

In terms of share price traction there are some interesting developments on the horizon. Selvaraju highlighted the fact that IMC is slated to report final topline data from the proof of concept Phase 2 NASH trial of IMM-124E within the coming weeks.

Given the company’s sub-$15 million enterprise value he believes the market currently gives IMC no credit for the program, suggesting even a hint of effectiveness in the trial could provide a substantial boost to the stock.

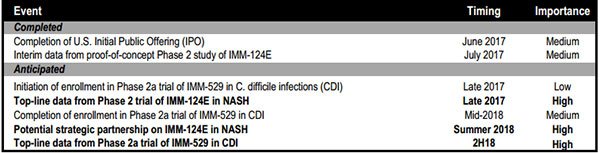

The following is a list of other catalysts compiled by Selvaraju that could provide share price momentum through to the second half of 2018, with the analyst having flagged the level of importance attributed to each event.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.