BDA finishes fiscal 2021 on a high

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Fiscal 2021 sales figures released by medicinal cannabis, CBD and hemp healthcare products company, Bod Australia Limited (ASX: BDA) could well be the catalyst for a substantial share price rerating given that they represent record medicinal cannabis sales growth during FY2021.

During the period, BDA dispensed a total of 12,187 products, which marks a 212% increase on the previous corresponding period (FY2020: 3,907).

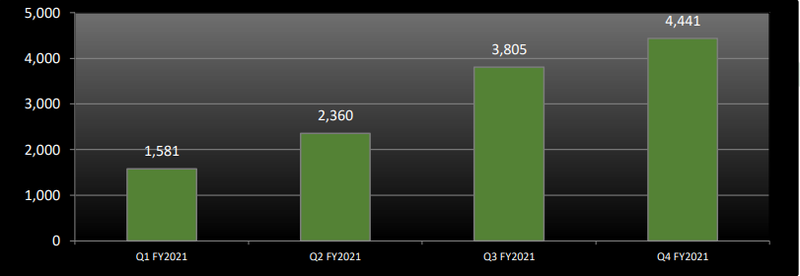

The company also delivered 17% quarter-on-quarter growth during the June quarter of fiscal 2021 following the sale of 4,441 units (March quarter FY2021: 3,805).

In a major achievement, BDA retained a 46% share of the total Australian market for full plant high CBD products during FY2021 based on data that was available up to and including May 2021.

Importantly, this was assisted by positive momentum during the last six months of the period.

The following graph illustrates the robust quarterly medicinal cannabis products sales by unit during fiscal 2021.

BDA benefiting from repeat business

Underlining the level of consumer loyalty, 65% of prescriptions sold during FY2021 were repeat prescriptions, highlighting the quality of the medicines and the ongoing satisfaction and benefits both patients and physicians are witnessing with the use of BDA’s medicinal cannabis products on a range of conditions.

The significant growth in prescription volumes was supported by the company’s ongoing educational initiatives with healthcare professionals, as well as BDA’s nationwide clinical study investigating the efficacy of Bod’s medicinal cannabis products when prescribed for debilitating conditions, including anxiety, insomnia and Post Traumatic Stress Disorder (PTSD).

In July last year, Bod commenced an Australia-wide, multi-clinic, open-label observational study into the effectiveness of its medicinal cannabis range, MediCabilisTM, for indications including anxiety disorders, insomnia and Post Traumatic Stress Disorder.

The study aims to collect data from 500 patients who will be prescribed MediCabilisTM over a 12- month period with the aim of generating insights into the efficacy of the product on patients suffering from particular conditions.

Management expects momentum to continue

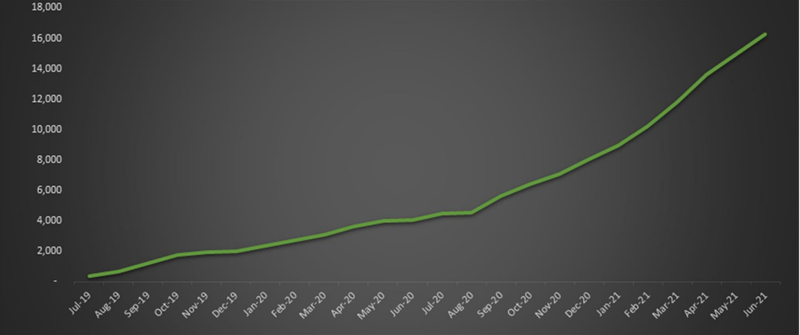

Bod has now sold a total of 16,267 medicinal cannabis product units since first prescriptions in 2019 and management expects this strong growth to continue over the coming months and beyond.

Medicinal cannabis sales will materially add to the BDA’s revenue profile, and the company is continuing to scale up operations across Australia and the United Kingdom to underpin its upward trajectory and increase overall market share.

The following graph shows the cumulative medicinal cannabis products sold since June 2019 with a particular highlight being the acceleration that has occurred in the last 12 months.

Discussing the impressive sales performance and pointing to opportunities and upcoming initiatives that are likely to support sustained momentum, chief executive Jo Patterson said, “BDA continues to achieve a very strong upward trajectory through its medicinal cannabis operations on both a quarter-on-quarter and a year-on-year basis.

"These sales will further contribute to the company’s growing revenue profile.

"During FY2021, the company maintained a near 50% market share for the total addressable market for high CBD products in Australia.

"While repeat prescriptions remained at a high level, Bod also increased its patient and doctor acquisitions through ongoing educational initiatives and its relationships with approved prescribers.

"We anticipate increased demand for our medicinal cannabis product suite over the coming quarter and beyond.

"A number of new products are currently being introduced and operations in the UK continue to scale pleasingly.

"We look forward to updating shareholders on further growth as it materialises.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.