Non-elective treatment profile provides Avita Medical with income stability

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

With the S&P/ASX 200 down as much as 130 points on Wednesday morning and a large percentage of Monday’s substantial rebound now lost, it may pay to scour the market for pockets of value.

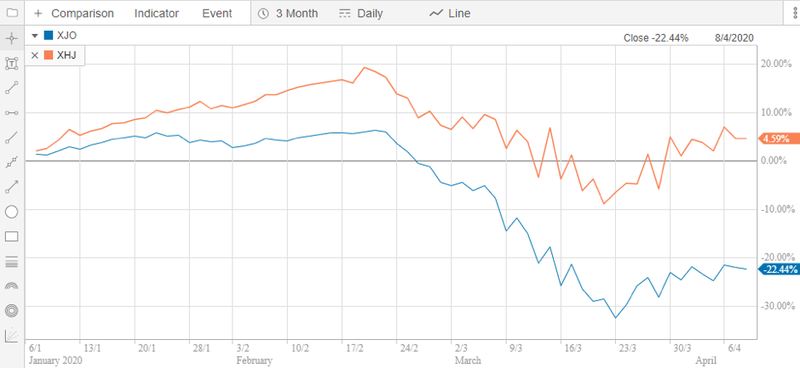

While also succumbing to the downturn in the broader market, the healthcare sector has substantially outperformed the XJO over the last three months, and in fact it is in positive territory to the tune of about 5%.

By comparison, the XJO is down 22%.

Though large cap Biotechs on the ASX such as CSL, ResMed and Ramsay Health Care have underpinned the strong performance, there are stocks worth targeting outside the blue chips.

One such stock is AVITA Medical Limited (ASX:AVH), a market darling from fiscal 2019, a period in which its share price increased by about 500% from 7.1 cents on July 1, 2018 to 42 cents on June 30, 2019.

However, there was more to come as the company’s shares doubled again in the eight months to February 2020, hitting an all-time high of 86.5 cents just before the market crashed.

Despite the company not delivering any negative news, its share price plummeted, trading below 40 cents in mid-March.

While Avita has recovered to some extent in the last fortnight, there still appears to be scope for upside, particularly in light of a positive trading update provided by management on Monday.

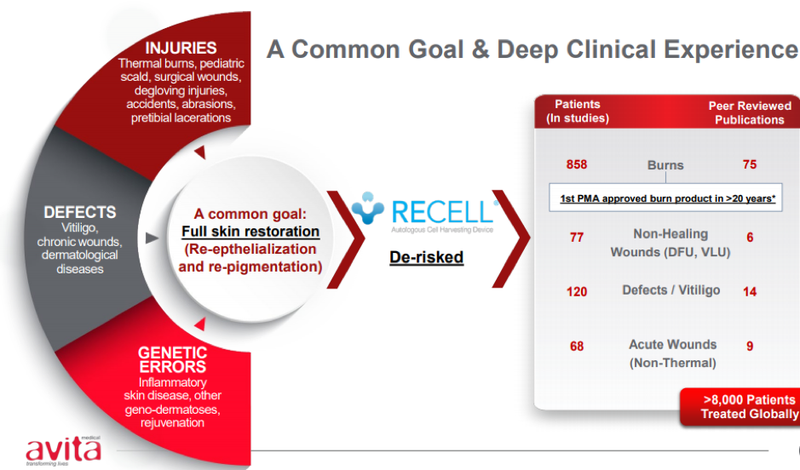

Technology has multiple applications

To provide some background, AVITA Medical is a regenerative medicine company with a technology platform positioned to address unmet medical needs in burns, chronic wounds, and aesthetics indications.

AVITA Medical’s patented and proprietary collection and application technology provides innovative treatment solutions derived from the regenerative properties of a patient’s own skin.

The medical devices work by preparing a REGENERATIVE EPIDERMAL SUSPENSION (RES®), an autologous suspension comprised of the patient’s skin cells necessary to regenerate natural healthy epidermis.

This autologous suspension is then sprayed onto the areas of the patient requiring treatment.

AVITA Medical’s first US product, the RECELL® System, was approved by the US Food and Drug Administration (FDA) in September 2018.

Compelling data from randomised, controlled clinical trials conducted at major US burn centres and real-world use in more than 8,000 patients globally, reinforces that the RECELL System is a significant advancement over the current standard of care for burn patients and offers benefits in clinical outcomes and cost savings.

This is backed up by the company’s strong sales growth which has continued into 2020.

March quarter revenue of $6 million represented a 21% increase compared with the December quarter and US RECELL sales were up 22%.

Quarter on quarter procedural volumes increased by 23%, and ongoing demand should be supported by the general categorisation of burn treatments as ‘non-elective’.

Providing investors with further confidence in the company’s ability to face any headwinds that do occur, the group had cash of $130 million as at March 31, 2020.

Setting aside COVID-19, this also leaves the company well-positioned to progress its research and development, as well as commercial distribution of its existing technologies.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.