Titan’s Iguana assay results confirm gold grades and widths

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

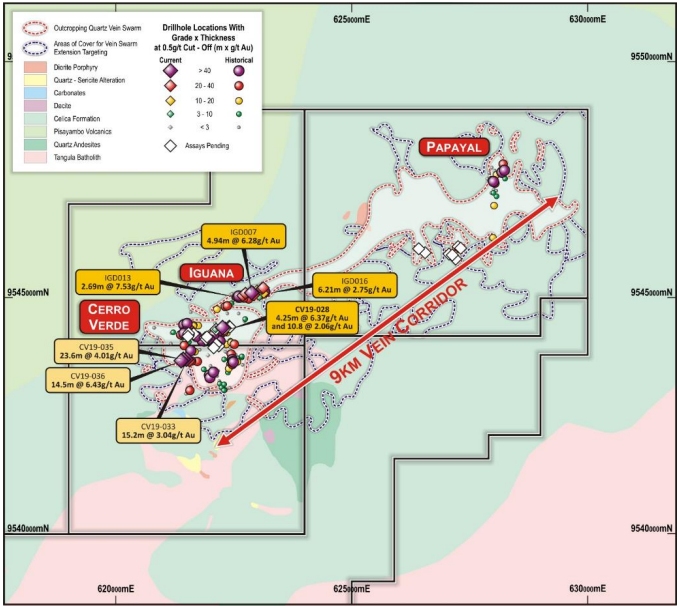

Titan Minerals Limited (ASX:TTM) has reported assay results for the Iguana Prospect that support the interpreted widths and extent of the Iguana vein corridor, hosting approximately 375,000 ounces of the existing 2.1 million ounce gold foreign resource estimation (Canadian NI 43-101 compliant) for the Dynasty Gold Project.

It is important to note that the information relating to Mineral Resource Estimates for the Dynasty Gold Project is a foreign estimate and is not reported in accordance with the JORC Code.

Dynasty is an advanced stage exploration project located in the Loja Province of southern Ecuador that currently hosts a foreign resource estimate of 2.1 million ounces averaging 4.5 g/t gold reported in compliance with Canadian NI 43-101 standards.

The project comprises five concessions totalling 139 square kilometres and includes three concessions as shown on the following map that received an Environmental Authorisation in early 2016 and is fully permitted for exploration and small-scale mining.

The Iguana Prospect is not a priority target for larger bulk tonnage potential, as is the case outlined in drill results from the Cerro Verde Prospect, where mineralised halos surrounding veins are delivering 3 to 5 times wider mineralised zones.

However, to define key structural controls for the high-grade shoots, and extensions of mineralisation both along strike and at depth within the context of the larger Dynasty Gold Project, the high-grade nature of the veining at the Iguana Prospect merits further investigation.

Reported results are for assayed intervals from the first 20 holes totalling 4,550 metres of the current 12,000 metre diamond drilling campaign.

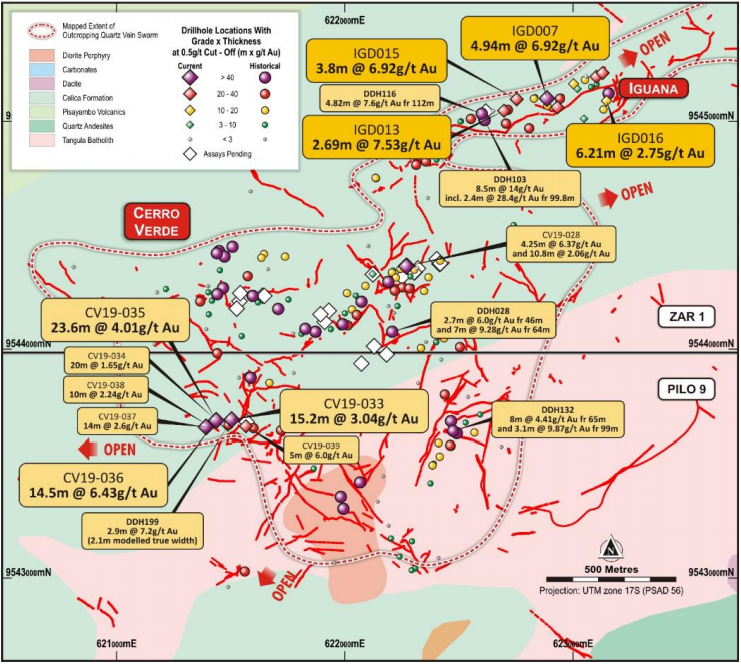

Some of the better intercepts in historical drilling at Iguana from levels of less than 100 metres included 8.5 metres at 13.9 grams gold and 55 g/t silver, as well as 6.7 metres at 4.1 g/t gold and 43 g/t silver.

Some of the assays just received from Iguana as shown in the following map included 2.7 metres at 7.5 g/t gold and 38 g/t silver, as well as broader intercepts such as 8.5 metres at 2.2 g/t gold and 11 g/t silver.

All drillholes intersect veining in the Iguana corridor

All reported drillholes intersect veining in the Iguana corridor, with 19 holes reporting significant intercepts across multiple vein structures.

Recent drilling focused on a 560-metre segment of the Iguana vein corridor, an initial step toward an 80 metre by 40 metre spaced drill pattern.

Overall, recent drilling has returned results similar in tenor and extent to historical drill results.

Additional detailed structural analysis that will increase confidence in linking recent drilling results to historical results is in progress.

Commenting on the significance of the recent results in the context of the broader Dynasty Project, Titan Minerals managing director, Laurie Marsland said, “Drilling at Dynasty is progressing well and despite some delays, is moving ahead across each of the prospects.

‘’Importantly, we are pleased to see assay results for Iguana confirm the grade, previous interpreted widths and extent of the Iguana vein corridor.

‘’Modelling work in support of the planned JORC compliant update to the resource estimate for Dynasty is well advanced.

‘’The team is looking forward to drilling activity progressing onto our priority target, the Cerro Verde Prospect area.

‘’Re-sampling at Cerro Verde has demonstrated the potential for a significant increase in the volume of material that will define the JORC resource at Dynasty.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.