SVD appoints high profile executive Chairman to progress WA gold-nickel projects

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

There have been important board changes at ScandiVanadium Ltd (ASX:SVD), most notably the appointment of highly experienced resources executive, David Frances as executive chairman.

The appointment of Frances strengthens ScandiVanadium’s board and management team and is representative of the group’s intent to extract maximum value from its quality asset portfolio.

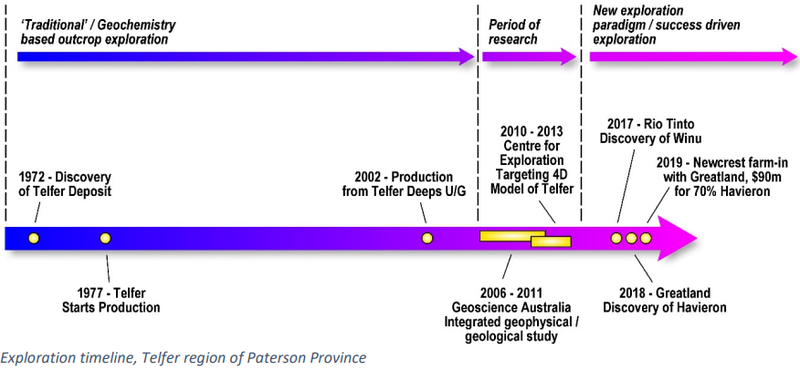

The company has recently acquired the Pascalle Gold Project, located in the heart of the Paterson Province within 14 kilometres of Newcrest Mining’s (ASX:NCM) 32 million ounce Telfer Mine. SVD has also acquired the Gnama Nickel Project in the Fraser Range Nickel Belt.

Renewed exploration of the Paterson Province in recent years has resulted in significant discoveries, including Greatland Gold’s (AIM:GGP) Havieron Discovery (results included 275 metres at 4.8 g/t gold and 0.6% copper) and Rio Tinto’s (ASX:RIO) Winu Discovery (results included 681 metres at 0.49% copper and 0.33 g/t gold).

As a Perth-based international mining executive with nearly 30 years of experience in discovering and developing assets in Australia and Africa, Frances’ appointment brings a new level of West Australian experience to the board and extensive expertise in developing exploration projects, positioning the company well for future growth.

Frances has demonstrated his ability in taking projects from exploration to development and on to production, and it is also important to note his corporate experience.

Frances also brings corporate and capital markets experience

Frances was responsible for acquiring and recommissioning the Dikulushi copper-silver mine in the Democratic Republic of Congo (DRC) and relisting on the Toronto Stock Exchange with a market capitalisation of approximately $250 million, completing the world’s largest base metals capital raise and IPO in 2010.

His past experience includes chairman and managing director of ASX listed Tawana Resources and Winward Resources, which was acquired by Independence Group Ltd (ASX:IGO) in 2016.

More recently, he has served as managing director for Dakota Minerals and executive chairman of Tiger Resources.

Commenting on the substantial benefits that Frances brings to the company, former chairman Brandon Munro said, “We are delighted to have attracted an executive of the calibre of David Frances.

‘’He is a proven operator with highly attuned corporate acumen and excellent geological skills.

‘’David’s enthusiasm in joining the company at this stage in our journey speaks volumes to the potential of ScandiVanadium’s assets.”

The timing of the appointment couldn’t be better — as Frances noted, a renewed understanding of the Paterson province makes the Pascalle Gold Project a highly prospective tenement, perhaps presenting the executive with a new challenge of taking a project from exploration to production.

Reflecting on previous experience in Western Australia, Frances said, ‘’Having previous exposure to the Fraser Range as managing director of Winward Resources, I can also appreciate the obvious prospectivity of the Gnama nickel project.

‘’I am very happy to be involved with gold and nickel in two world-class provinces.’’

With the appointment of David Frances as executive chairman, Brandon Munro will move from non-executive chairman to non-executive director. David Minchin will move from managing director to executive director.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.