Regeneus inks agreement with high profile Japanese life sciences group

Published 03-MAR-2020 13:27 P.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Clinical stage regenerative medicine company Regeneus Ltd (ASX:RGS) has signed a non-binding memorandum of understanding (MOU) with Kyocera Corporation (Kyocera, TYO:6971), a diversified Japanese-based manufacturer with a strong position in the life sciences industry.

The news is a major re-rating for the company as moves towards commercialising its lead stem cell platform technology, Progenza, in Japan. As part of the MOU, Regeneus receives approx. $1.4 million up front.

This news was also well received by the market, reflected in the 19% increase in Regeneus' share price in a day when the broader market was down around 3% at midday.

Japanese giant eyeing Aussie technology

Kyocera’s life sciences business is prominent and they are a major Japanese producer of medical and dental products, including artificial joints for the knee and hip. The company is listed on the Tokyo Stock Exchange, and it has a market capitalisation of approximately 2.5 trillion Japanese yen (AU$35.6 billion) - almost triple the size of Cochlear.

As a regenerative medicine group using stem cell technologies to develop a portfolio of novel cell-based therapies, Regeneus has plenty to offer Kyocera.

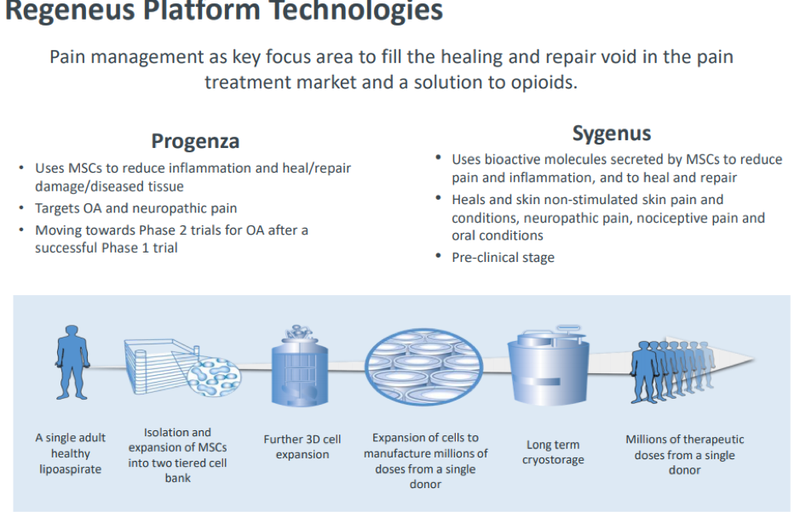

More specifically, the company’s regenerative therapies seek to address unmet medical needs in the pain market with a focus on neuropathic pain, including osteoarthritis and various skin conditions, with its platform technologies Progenza and Sygenus, with the former being of particular interest to Kyocera.

$1.4M upfront payment paves way for commercial agreement

As part of the MOU, Kyocera will provide an upfront payment of 100 million Japanese yen (~$1.4 million) to Regeneus for the rights to a subset of research knowhow for Progenza. This is a demonstration that Kyocera recognises the potential of Regeneus’ technology platform.

Kyocera will also conduct comprehensive due diligence related to Progenza before progressing to a conditional commercial agreement for the company’s lead technology.

At the conclusion of due diligence, Kyocera will provide an additional 100 million Japanese yen upon meeting the criteria outlined in the agreement, which is refundable if an agreement is not executed.

The upfront payment from Kyocera helps Regeneus expand its pipeline and fund its innovative technology to commercialisation.

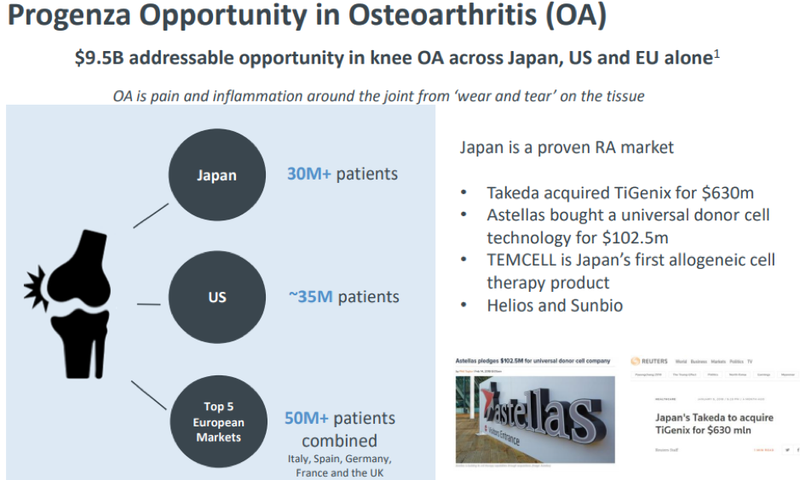

Considering osteoarthritis is a $9.5 billion addressable opportunity and Japan alone has more than 30 million patients with osteoarthritis, Regeneus is well positioned to capture the market with this latest announcement.

Latest in string of regenerative medicine deals

Regeneus’ announcement is the latest in a string of successful deals Australian regenerative medicine companies have made with ‘big pharma’ and overseas conglomerates.

For example, Cynata’s 2017 partnership agreement with FujiFilm (like Kyocera, another Japanese giant) for their stem cell therapy product targeting graft versus host disease included a 9 per cent equity and potential future milestone payments. In the time since the announcement, Cynata’s share price has risen almost 19 percent and is now a company worth ~$100M.

Similarly, Mesoblast’s strategic partnership with Grünenthal announced last year to develop an allogenic therapy for low back pain was well received by the market, and the company’s share price has since risen 28 per percent with the company now worth more than $1.2 billion dollars.

Of course, each of these regenerative medicine companies is further along their commercialisation journey. However, it is clear that at just 6 cents, Regeneus is currently under-appreciated by the market despite the significant addressable opportunity for Progenza OA.

Regeneus: closer to commercialisation

This deal moves the under-the-radar regenerative medicine company close towards commercialisation.

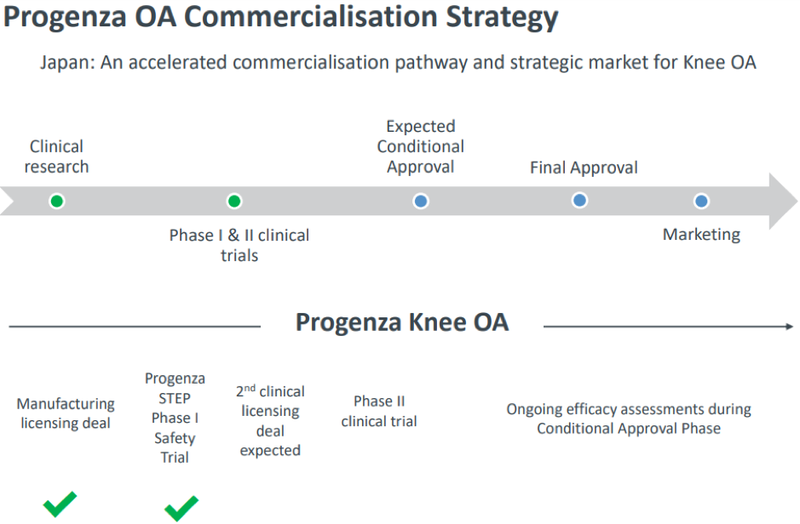

As outlined by management in November 2019, the following was the state of play at that stage, indicating that the company has been quick to deliver on its strategy.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.