Numerous share price catalysts on the horizon for Kingston Resources

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

There is plenty of positive news emerging from Kingston Resources Limited on multiple fronts (ASX:KSN) as it prepares for exploration and progresses a prefeasibility at two of its projects, and the highly prospective nature of upcoming news has attracted the attention of brokers.

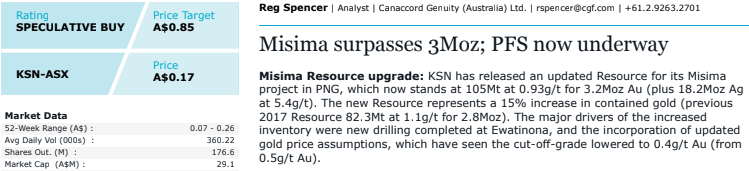

Reg Spencer from Canaccord Genuity is particularly upbeat on the company, recently reaffirming his speculative buy recommendation and price target of 85 cents per share.

This implies share price upside of more than 400% from the company’s current price of 16.5 cents.

On one hand, the quantum of such a rerating may seem a stretch, but on the other, one only has to view the extensive newsflow that is imminent, particularly the PFS and reserve estimation work to understand that these could be the foundation for a significant rerating.

Macroeconomic conditions couldn’t be better for the company with the gold price at near-record highs, and the volatile economic environment suggesting there will be further support for the traditional safe haven precious metal.

Crunching the numbers, Spencer said, ‘’Kingston’s enterprise value to resource multiple of A$9 per ounce is well below the peer group weighted average of $58 per ounce which we consider unwarranted given Misima’s (PNG project) scale and near-term development potential.

‘’A positive outlook for the gold price and relative dearth of advanced gold projects of scale on the ASX further supports our favourable view.’’

5000 metres resource definition drilling program imminent

Management has just advised that a 5000 metre resource definition reverse circulation (RC) drilling program is set to commence next month at the Kingsley prospect in Western Australia.

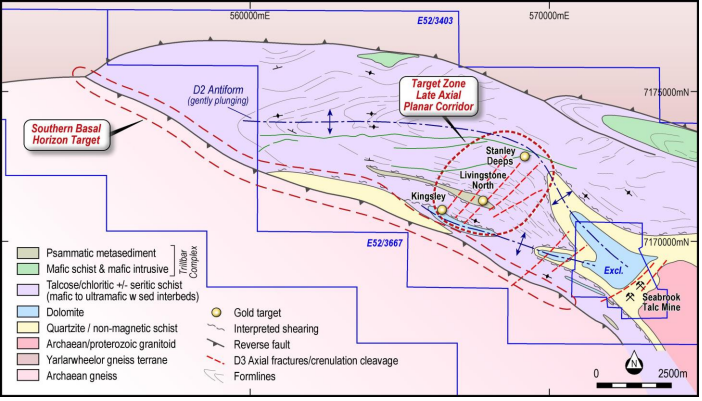

The prospect is situated within the company’s 75%-owned Livingstone Gold Project, 140 kilometres north-west of Meekatharra within the Bryah Basin.

The upcoming drilling program has been designed from knowledge gained from the structural review conducted over the wider Livingstone Project, including Kingsley, in late 2019.

The Livingstone Project, including the Kingsley prospect can be seen on the map below.

The aim of the program is to define shallow oxide mineralisation that will contribute towards an initial Maiden JORC Compliant Resource Estimation.

Several holes have also been designed to further test potential depth extensions to the known mineralisation.

The program is fully permitted with mobilisation and drilling anticipated to commence by mid-July and concluding in August.

Final assays are expected from Livingstone by September.

Assays from Livingstone and drilling at Misima in September quarter

Kingston has also been successful in securing co-funding for a further 1000 metres of deep RC drilling at the Stanley Deeps prospect (see above) through R21 of the WA Government Exploration Incentive Scheme.

This drilling will be undertaken following completion of the resource definition program at Kingsley.

As we mentioned, Kingston should benefit from numerous share price catalysts over the next three months with one of the main ones being progress on the PFS for the group’s Misima Gold Project in PNG.

This work has already commenced and is now in full swing, with the appointment of a dedicated Study Manager in early June, together with the appointment of mining, geotechnical, metallurgical and environmental consultants.

Engineering consultants have been short-listed with an appointment anticipated in early July.

Commenting on these developments, Kingston Resources managing director, Andrew Corbett said,

“With this next round of drilling at Kingsley we are aiming to define a shallow oxide resource, as a base from which we can grow the project.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.