Newcomer Manuka Resources lists at substantial premium to IPO price

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Manuka Resources Ltd (ASX:MKR) commenced trading on Tuesday with its shares hitting a high of 28.5 cents, representing a premium of approximately 40% relative to the IPO price of 20 cents.

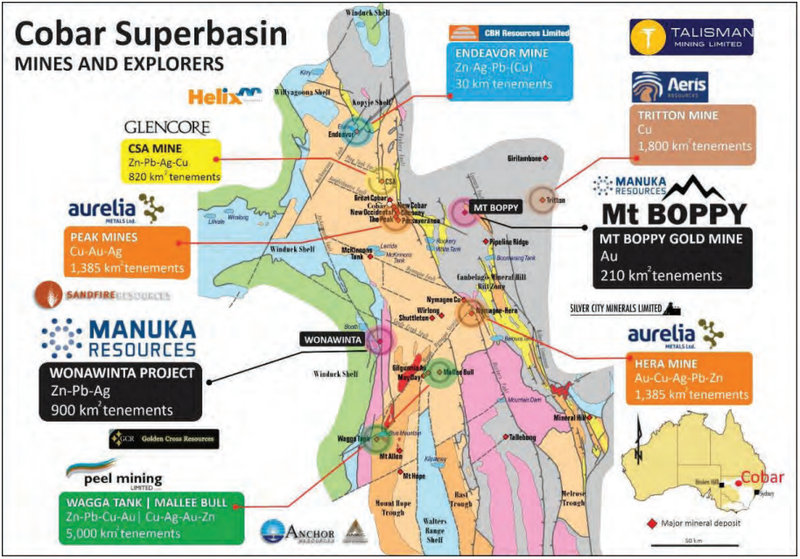

The company is the owner of the Wonawinta Silver Project and is also the owner of Mt Boppy Resources, the entity which holds the Mt Boppy Gold Project.

Both of the company’s projects are located near Cobar in central New South Wales, Australia.

Manuka has to this point in time secured sufficient funding to take it through to production, which commenced in April 2020.

During the month of April 2020, Manuka produced over 800 ounces gold (in carbon).

Furthermore, the company is also currently in the process of commissioning a modular elution circuit which will allow it to produce gold doré onsite at the Wonawinta Silver Project.

Silver mineral resource of 52 million ounces

The Cobar region is renowned for its silver production, and the Wonawinta Silver Project comprises a granted mining lease and a 52 million ounce silver Mineral Resource.

The group has a 920 square kilometre portfolio of highly prospective exploration tenements, and the Wonawinta Processing Plant has annual processing capacity of up to approximately 850,000 tonnes.

Since the acquisition of the Wonawinta Silver Project in August 2016, the company has identified near term revenue opportunities, including processing the existing silver oxide stockpiles of approximately 500,000 tonnes on the Wonawinta Silver Project run of mine.

Given previous operational problems, management has designed a comprehensive plant refurbishment program and work closely with regulatory bodies to rectify any legacy environmental issues associated with the previous owners.

This has resulted in the lifting of all environmental licence suspensions that occurred in October 2018.

Manuka has made significant progress in refurbishing the processing plant as shown below, and management is confident that it will be ready to operate in the September quarter of 2020.

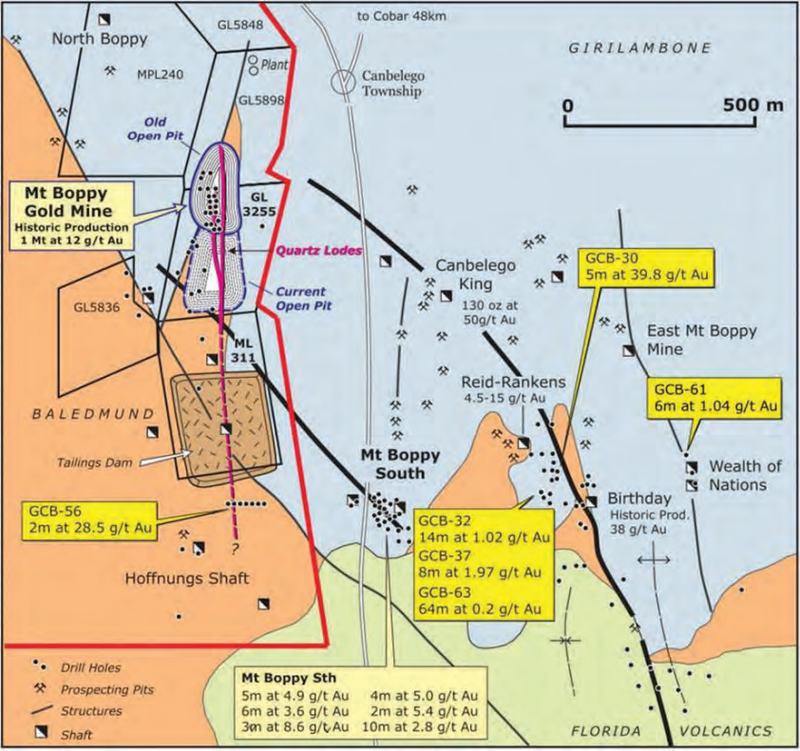

In June 2019, Manuka completed the purchase of Mt Boppy Resources, which included mining leases and exploration licences covering an area in excess of approximately 210 square kilometres, a 40 person mine camp and the historically significant open-pit Mt Boppy Gold Mine.

The Mt Boppy Gold Project has a JORC Reserve of 320,000 tonnes at 3.0 g/t for 31,000 ounces gold.

However, historical production has been fairly robust, and since 1895 approximately 500,000 ounces of gold at an average grade of 15 g/t has been produced.

Interestingly, since the mine was acquired in June 2019 the gold price has increased from US$1400 per ounce to more than US$1800 per ounce, equating to an uptick of about AU$570 relative to the current AUD:USD exchange rate.

Mt Boppy gold ore being stockpiled at Wonawinta Processing Plant

In April 2020, Manuka began processing stockpiled Mt Boppy gold ore at the Wonawinta Processing Plant, and the company is also currently processing gold loaded carbon offsite at a third-party facility.

This offsite carbon processing will cease following the commissioning of the company’s modular elution circuit referred to above as all processing will then be able to take place onsite at the Wonawinta Silver Project.

Management is planning to conduct a three-phase processing activity in the short to medium term.

Firstly, it will continue processing stockpiled and mined Mt Boppy gold ore for approximately the next 12 months with the intention of recovering up to about 22,000 ounces to 24,000 ounces gold.

Management then intends to begin processing the silver oxide stockpiles at the Wonawinta Silver Project.

The company expects to start this second phase of activity in the second quarter of 2021.

It is anticipated that phase 3 could begin in the September quarter of fiscal 2022, and this would mark the beginning of mining and processing of the shallow silver oxide resource at the Wonawinta Silver Project.

Exploration at Wonawinta and Mt Boppy

In tandem with these operational initiatives, Manuka intends to begin a number of exploration pursuits, including an infill drilling program at the Wonawinta Silver Project which will incorporate planning studies on the existing shallow oxide resource which is believed to be at depths of less than 60 metres.

Management also intends to start drilling high conviction targets at the Mt Boppy Gold Project, including areas comprising a number of under-explored brownfield opportunities.

Exploration will also include the targeting of other greenfield areas.

Consequently, Manuka shapes up as a news flow driven story with a mix of operational milestones and exploration results likely to be key share price drivers from here on in.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.