More ‘outstanding’ high grade vanadium results from Tando

Published 27-MAR-2019 15:29 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Tando Resources (ASX: TNO, Tando or the Company) has reported further outstanding high grade drilling results from its SPD Vanadium Project in South Africa.

The SPD Project is one of the highest grade Mineral Resources reported across the globe (using whole-rock or unprocessed grades) and positions Tando with a unique opportunity to initiate a low-cost, early cash flow operation.

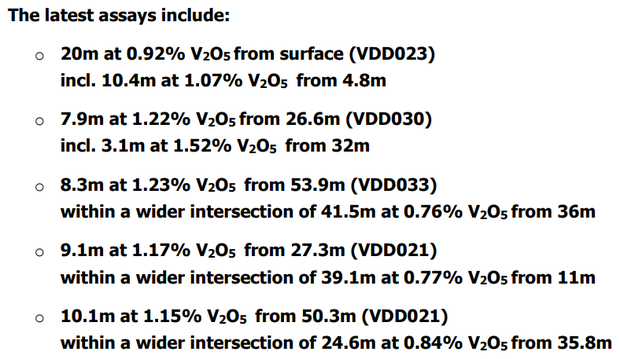

The intersections reported are from drilling completed to infill and extend the high grade zone of 87Mt at 1.07% vanadium oxide (V2O5) which lies within the global Mineral Resource at SPD of 588 million tonnes at a whole rock grade of 0.78% V2O5.

This high-grade zone is the focus of the current Scoping Study with a view to selectively mining it and producing a concentrate for sale.

The receipt of these assays will enable the new Mineral Resource for the SPD Vanadium Project to be completed and published. This will then be fed into the Scoping Study which is due to be finalised in coming weeks.

Given the consistency of high grade results along with the excellent continuity of mineralisation it’s anticipated that the updated Mineral Resource should contain a high proportion of material in the Indicated category.

Add to that the increased detail from the infill drilling that will enable the higher-grade massive magnetite layers to be better delineated, increasing the potential for selective mining to meet offtake specifications.

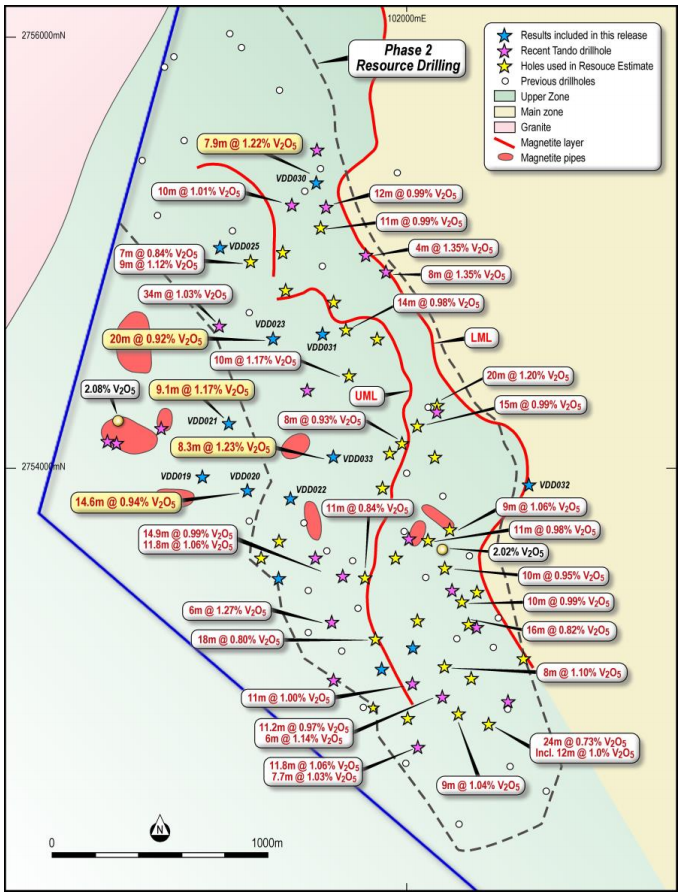

Here are the drillhole locations:

Vanadium

Vanadium is largely used in strengthening steel via various alloys. Consumption is currently increasing with the recent implementation of stricter standards on the strength of steel to be used in construction (specifically rebar). Vanadium use in steel making accounts for over 90% of current vanadium demand.

Additionally, the global move towards renewable energy solutions will require a vast increase in energy storage installations. This is forecast to include an additional increase in the usage of vanadium redox flow batteries (VRFB) for large scale energy storage which provides additional longer term demand for vanadium.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.