Mandrake will be first to drill just kms from Chalice discovery

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

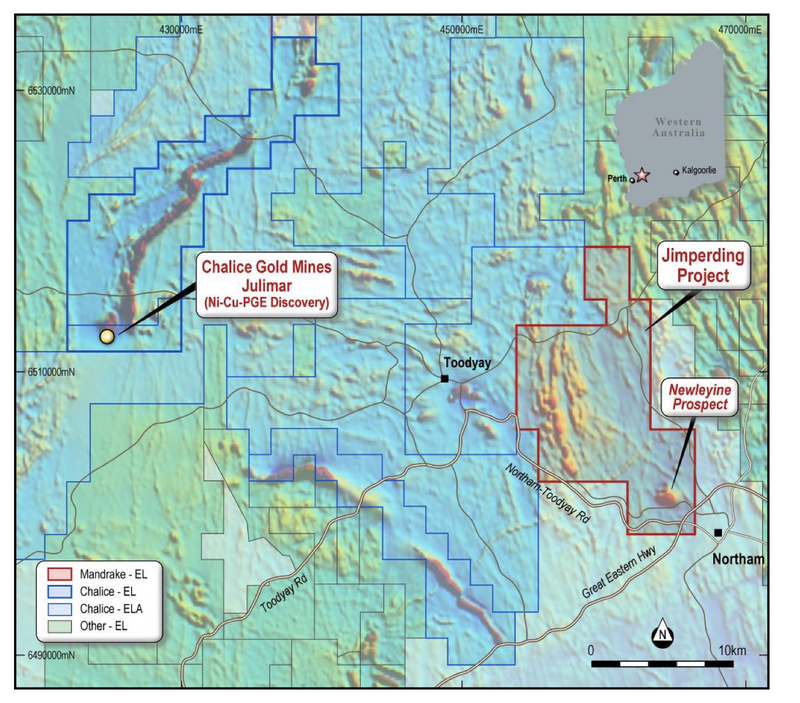

Mandrake Resources Limited (ASX:MAN) will be the first ASX company to drill a Julimar-style target, following the Chalice discovery situated just 30km west of MAN’s Jimperding Project.

This news comes after Mandrake entered into a binding Land Access Agreement with the private owner of the property that hosts the promising Newleyine nickel-copper-PGE prospect, part of The Jimperding Project, where MAN will start its drilling program this quarter.

Mandrake controls 100% of a 140km2 exploration licence prospective for Ni/Cu/PGEs in the exciting Jimperding Metamorphic Belt, 70km NE of Perth.

Interestingly, Mandrake applied for the licence that comprises the Jimperding Project, prior to Chalice’s Julimar discovery and prior to Chalice pegging over 2,000km2 of ELAs contiguous to the Jimperding Project.

Those familiar with the Chalice story will know that the $1.56BN capped Chalice is one of the top performing companies on the ASX – up over 1,600% since January 2020 after its billion dollar discovery.

Chalice’s discovery was Australia’s first major palladium discovery, coming in an entirely new minerals province that has shaped as a major deposit of critical metals for a clean energy future and includes palladium, nickel and copper.

You can see the proximity of Jimperding and Newleyine to Chalice in the map below.

The Land Access Agreement gives Mandrake continued access to Newleyine, where it will conduct exploration activities including this quarter’s drilling.

As stated, this will be the first drilling opportunity in the same geological terrane

since the Chalice discovery.

Mandrake has identified multiple similarities to Julimar at Newleyine, including the presence of several large electromagnetic (EM) conductor plates that will be tested as part of the upcoming drilling program.

Pursuant to the Land Access Agreement, Mandrake will pay the property owner $20,000 for access for the first year, with an option to secure a second year for a further $20,000.

Mandrake has option to purchase Newleyine

Mandrake also has the option to purchase the ~377-hectare Newleyine property and the associated mineral rights (with the exception of gold, silver and other precious metals).

The Property Purchase Option is vital to Mandrake should it make a commercial discovery at Newleyine.

The purchase of Newleyine would eliminate any obstacles in the development of the project. It is important to note that this option will only be exercised in the event of a commercial discovery.

Mandrake will pay a non-refundable option fee of $230,000 per annum (for a maximum of 2 years) for the exclusive option to purchase the Newleyine property and associated mineral rights.

The option also includes an $8,000,000 or 5% royalty on base metals and a 1.25% royalty on PGEs.

Outstanding EM conductors

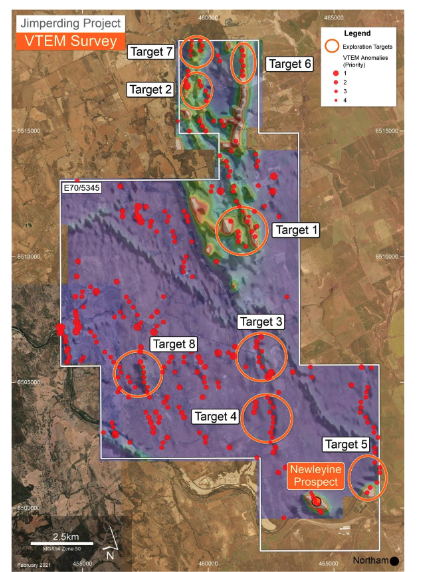

The Land Access Agreement comes just days after Mandrake announced it had identified several strong EM conductors across the Jimperding Project.

The results confirmed a distinct high conductance EM response at Newleyine.

‘The airborne EM across Mandrake’s Jimperding EL is a crucial baseline dataset that allows for the identification of bedrock conductive sources such as nickel sulphide mineralisation,” said Mandrake Managing Director James Allchurch.

“Several very promising late-time conductors have been identified coincident with rocks and magnetic anomalies that demand immediate follow-up.

“Field surveys will look to characterise any outcrop in the area with ground EM and drilling to follow.”

The targets are laid out below:

The objective of the survey was to generate targets prospective for “Julimar-style” mineralisation.

The AEM survey has successfully identified a large number of late-time EM conductors that require immediate field reconnaissance work and mapping.

The company sees Targets 1 and 2 (as above) in the north of the Jimperding Project as compelling targets given their relatively strong conductance, proximity to known metamorphic rocks and association with adjacent magnetic responses.

Drilling will commence this quarter.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.