Latin Resources on cloud nine following impressive resource estimate

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

In a development that could lead to a significant share price rerating based on peer comparisons, Latin Resources Limited (ASX:LRS) has finalised the Maiden Inferred Mineral Resource for the 100% owned Noombenberry Halloysite-Kaolin Project where the company has named its first deposit the Cloud Nine Deposit.

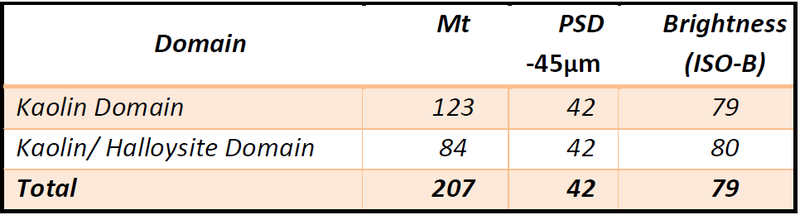

A global Inferred Mineral Resource estimate for the Cloud Nine Deposit of 207 million tonnes of kaolinised granite has been reported by RSC, using an ISO Brightness (“ISO-B”) R457 cut-off of 75.

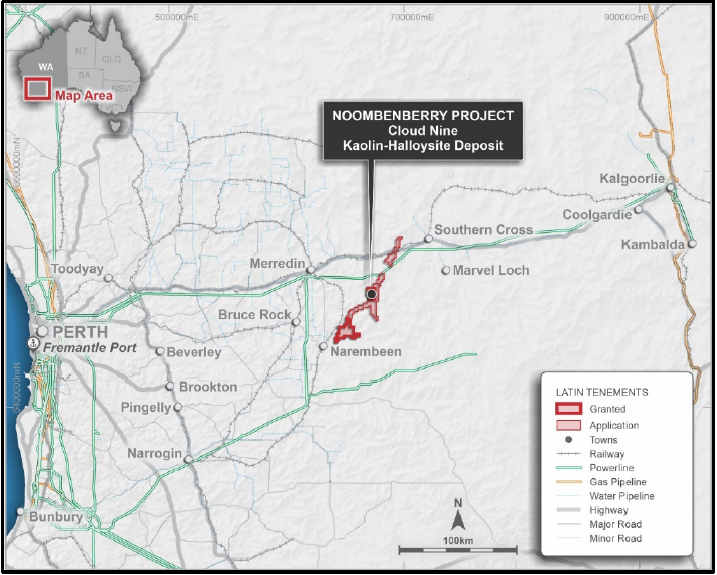

As indicated below, the Could Nine deposit is located on the company’s 100% owned exploration licence E70/2622, which is situated approximately 350 kilometres to the east of Perth and to the south-east of the town of Merredin.

The global Inferred Mineral Resource of 207 million tonnes of kaolinised granite comprises two separate domains as indicated below.

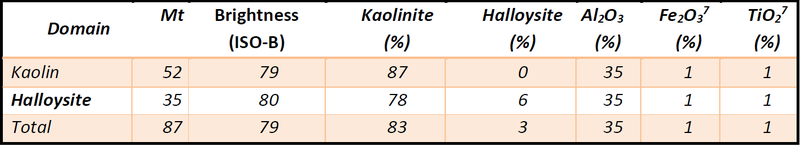

The Kaolin Domain granite Resource contains a total of 73 million tonnes of bright white (+75 ISO-B) Kaolin product with an ISO-B of 79 in the -45 μm size fraction, or 29 million tonnes of ultra-bright white (+80 ISO-B) kaolin product with an ISO-B of 82.

Both of these are considered high quality product specifications, potentially suitable for a wide range of industrial applications.

The global resource also contains a relatively contiguous halloysite domain within the kaolinised granite estimated at 50 million tonnes at an average grade 6% halloysite using a 1% halloysite cut-off, or 35 million tonnes at an average grade of 6% halloysite using a +75 ISO-B cut-off it equates to 27 million tonnes at an average grade of 8% halloysite using a +5% halloysite cut-off.

Shallow economical resource assists in quick resource estimate

Within only 18 months of identifying the opportunity for halloysite, Latin Resources has been able to rapidly define this maiden MRE because of the very shallow nature of the resources (average of less than 4 metres from the surface.

Importantly, exploration has demonstrated that the resource has substantial potential to grow, being open in all directions.

Latin Resources has an extensive tenement package (560 square kilometres – strike length of over 105 kilometres) with additional high grade halloysite, and ultra-bright kaolin occurrences already identified less than 10 kilometres away along strike, effectively providing drill-ready targets for at least two additional occurrences.

Management intends to expedite the next round of drilling to elevate some of the Resources to the Indicated or Measured classification for the purposes of a PFS, which can all be funded with existing cash of more than $4 million at end of March 2021.

Peer comparisons indicate that LRS is significantly undervalued

While quality halloysite deposits are less than abundant in Australia, Cloud Nine compares well with its peers where the material often needs to be accessed at greater depths and is spread across broader deposits.

One of the most notable points of comparison in this regard is Andromeda Metals (ASX: ADN) which has a market capitalisation of about $475 million, representing a significant premium to Latin Resources, capped at approximately $95 million.

There is little variation between the sizes of the group’s resources, but the Noombenberry Project offers a combination of benefits that in the main have the potential to lead to cheaper production.

It is worth noting that Andromeda has between 7 metres and 62 metres of overlying hard silcrete caprock, compared with Noombenberry’s unconsolidated soil cover of less than 4 metres.

Consequently, LRS would appear to offer lower mining costs with a lower strip ratio as ADN has significant overburden to remove before the ore can be accessed, ordinarily translating to higher mining costs.

On the other hand, LRS can employ simple, fast, low cost exploration due to minimal cover, while also not having outcrop and thick hard caprock cove, making drilling more costly and time-consuming as the only exploration method.

The high-grade Noombenberry Kaolin-Halloysite Project benefits from being located adjacent to existing road, rail, port, power and water infrastructure.

The project’s proximity to a mining service centre in Kalgoorlie also compares well with the ADN project location, as it is remote and distal from existing infrastructure.

Investors in Latin Resources should be buoyed by today’s news as it may trigger a bridging of the valuation gap between it and Andromeda Metals.

Addressing the issue of valuation, executive director Chris Gale said, ‘’This massive result adds enormous value to LRS and will elevate the company to a new level.

"We will now look to fast track the deposit through to development as quickly as possible to take advantage of the buoyant mineral prices.

"I would also like to extend my sincere thanks to the landowners in Merredin for being so accommodating during the exploration and drilling process."

Benefits of easily accessible resource will be evidenced in PFS

There appears to a reasonable degree of confidence regarding the potential for resource expansion beyond the current parameters as the deposit is open in all directions with areas to the north looking particularly promising.

Resource numbers have been smoothed due to the large block size used (limited by the current drill spacing) and Inferred classification.

Additional drilling and closer spaced drill density will increase confidence/JORC classification and allow LRS to report more selectively bringing out the high grade zones.

Management will immediately commence technical studies to feed into a Pre-Feasibility Study (PFS), along with its next round of drilling to commence in July 2021.

This is aimed at extending the Resource to the north and increasing the confidence of the MRE to a JORC Indicated and Measured classification.

The PFS will consider supply to a range of traditional end-users of kaolin-halloysite, as well as investigating the potential for downstream marketing of the high-grade halloysite to emerging new applications, including the carbon-capture and hydrogen storage markets.

This would see Latin Resources join a host of other companies that have recently flagged their intention to assess green options in terms of project development, making them very attractive to investors focused on companies that are cognisant of environmental and social (ESG) ramifications.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.