Investors welcome Comet’s proposed acquisition of copper project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shares in Comet Resources Ltd (ASX:CRL) soared 13% after the company announced its intention to acquire a new copper exploration project in New South Wales.

The company’s shares have now increased nearly 40% in the space of a fortnight.

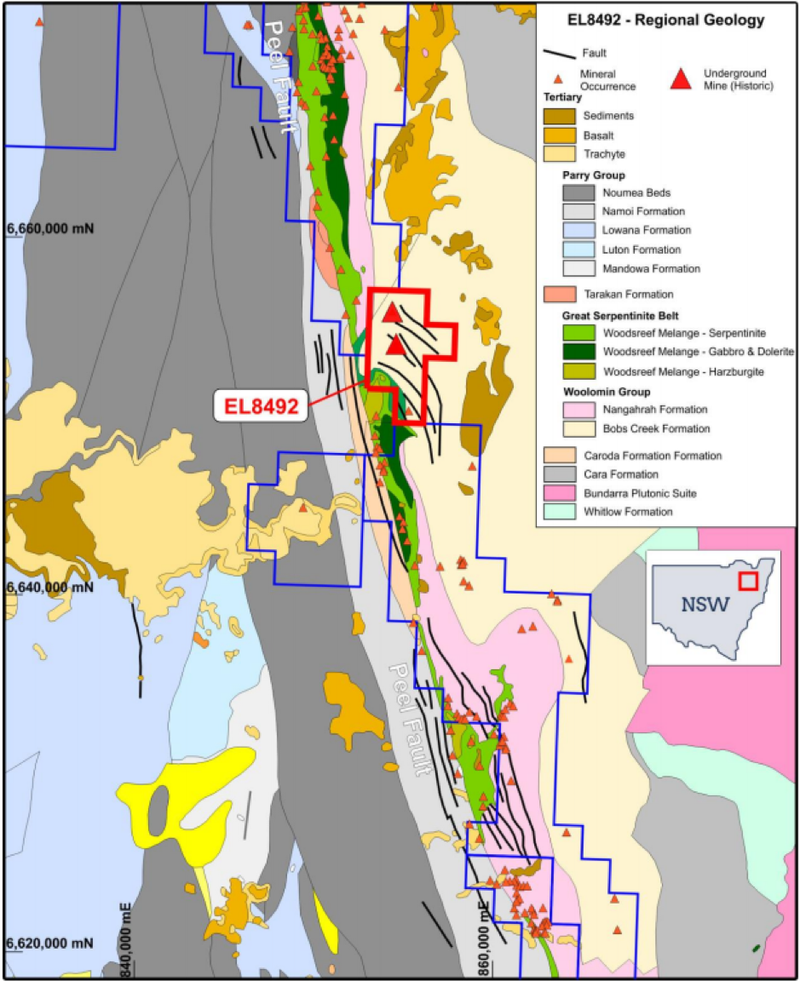

The 2,375 hectare exploration license that covers the project area EL8492 is located near the town of Barraba, approximately 550 kilometres north of Sydney.

It sits along the Peel Fault line and encompasses the historic Gulf Creek and Murchison copper mines.

The region is known to host volcanogenic massive sulphide (VMS) style mineralisation containing copper, zinc, lead and precious metals.

Historical workings at Gulf Creek produced high-grade copper and zinc for a short period around the turn of the 19th century, and this area will form a key part of the initial exploration focus.

Highlighting, Comet’s intention to accelerate its exploration campaign at the site, managing director Matthew O’Kane said, “It is an exciting opportunity for Comet to be able to acquire the Barraba Project as it is in a prospective location and hosts a number of drill ready targets.

We will be working hard to be in a position to test the project’s prospectivity as soon as possible after completion.”

Comet can move to 100% ownership

The proposed transaction allows for an acquisition of up to 100% of the project.

Comet has a conditional right to acquire an 80% interest for a consideration of $150,000 in cash and $450,000 in shares and a commitment for the completion of a minimum drilling and exploration expenditure programme over the 18 months from date of acquisition.

The minimum exploration commitment is $600,000 with a minimum of 1,250 metres of reverse circulation or diamond drilling to be completed to earn the 80% interest.

Comet has the option to purchase the remaining 20% interest in the first 36 months for $2.5 million.

The company is required to raise a minimum of $2 million to fund exploration as a Condition Precedent of the transaction and, if the capital raising is to be completed by way of placement, Comet will be required to seek shareholder approval for the issue of these shares.

This funding will support an exploration programme, including geophysics (surface and downhole) as well as targeted RC or diamond drilling.

The initial phase of drilling will focus on testing for extensions of known mineralisation around historic copper-zinc lodes.

Provides diversification but maintains electric vehicle focus

Comet believes that copper is set to see an increase in demand due to the global efforts to reduce emissions from the transport industry and also from the generation of electricity.

Copper is not only an important part of the batteries used in battery electric vehicles (BEVs), but is also used extensively in the electric motors that drive the wheels of BEVs, and is also used intensively in the generation of electricity from renewables, such as solar and wind.

Management believes that the Barraba copper project complements its existing Springdale Graphite Project (Western Australia) due to their shared end uses in batteries for BEV’s, and better utilises available board and management resources with the aim of driving shareholder value.

Even setting aside the electric vehicle theme, gaining exposure to base metals provides healthy diversification and based on this morning’s share price performance this appears to have been acknowledged.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.