Highflying Invictus preparing for promising 2021

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Invictus Energy Limited (ASX:IVZ), has provided an update on progress at its 80% owned and operated Cabora Bassa Project in Zimbabwe ahead of high impact drilling planned for 2021.

The company successfully concluded its recent field operations and reconnaissance program in the Cabora Basa Basin.

The Cabora Bassa Project encompasses the Mzarabani Prospect, a multi-TCF and liquids-rich conventional gas-condensate target, which is potentially the largest, undrilled seismically defined structure onshore Africa.

The prospect is defined by a robust dataset acquired by Mobil in the early 1990s that includes seismic, gravity, aeromagnetic and geochemical data.

Additional detailed traversing and mapping across the area have been completed and identified the optimal acquisition routes.

The company is making significant progress on executing the first seismic acquisition program in the country for 30 years and is working closely with the seismic contractors on a planned acquisition campaign in 2021 to commence once the rainy season has concluded.

This will be followed by a high impact basin opening drilling campaign to test the petroleum potential of the Cabora Bassa Basin.

The progress that has been made in 2020 has been value accretive for the group with the company’s shares increasing more than six-fold since March.

Positive geological observations in areas not previously studied

From a geological perspective, the recent reconnaissance field program revealed additional exposure of the Jurassic-Cretaceous aged Dande Formation and possibly younger sediments approaching the southern basin edge.

In technical terms, a significant sequence of mudrock interbedded with sandstone, giving rise to typical ‘ridge and furrow’ topography, was observed for several kilometres along a section coincident with the traverse completed along proposed seismic line L35.

The conclusion drawn by management from this observation is that the post-Dande Formation, in this locality and possibly elsewhere, contains a significantly larger proportion of mudrock than previously recognised.

Such developments could have significant intra-formational seal potential for this sequence and de-risk a key element of the petroleum system for this play.

The observation of these significant mudrock sequences within this unit is consistent with the interpretation of better developed seals moving basinward.

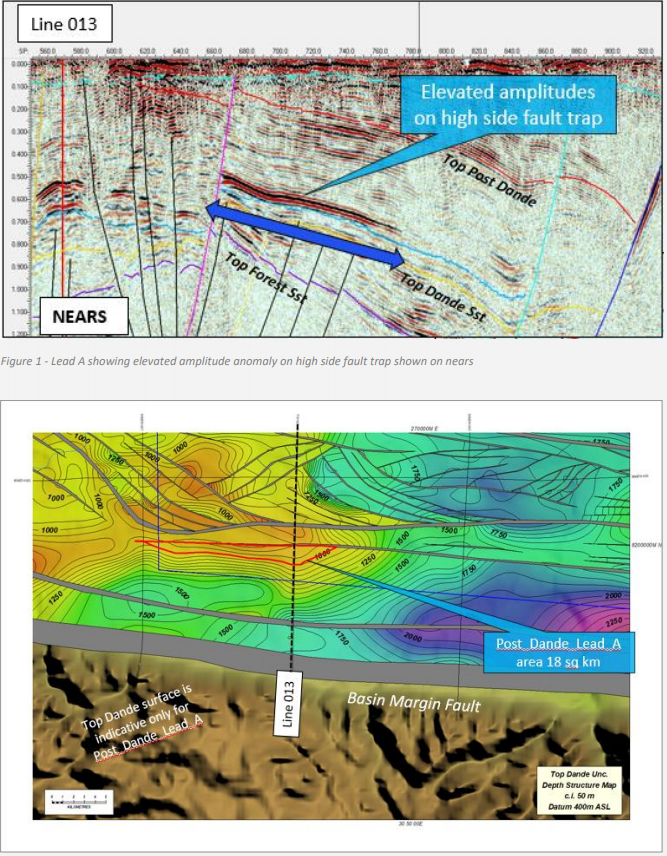

The interpretation is further supported by the elevated amplitude anomalies which may indicate the presence of hydrocarbons on the high side fault trap.

As illustrated below, this potential presence of hydrocarbons is coincident with the previously identified Lead A feature in the post-Dande formation and could indicate a competent seal and reservoir pair.

These younger sequences (Dande and post-Dande) were not the focus of previous studies or operators and as a result little information on the potential of this sequence has been gathered until now.

The reconnaissance program has also identified additional locations for further geochemical sampling and analysis which is being undertaken.

In the interim, the Production Sharing Agreements with the Republic of Zimbabwe continue to progress and are now in the approval process.

Updates to the market regarding progress in finalising the PSA and any associated government approvals could provide further share price momentum.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.