GTI targets multiple uranium targets in Henry Mountains

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

GTI Resources Ltd (ASX:GTR) has completed planning and permitting for the first phase of exploration after the settlement of the acquisition and transfer of two State of Utah mineral leases from Anfield Energy Inc.

The purchase of the leases serves to join the Jeffery and Rats Nest projects and to consolidate ownership across a contiguous 5.5 kilometres of the interpreted mineralised trend.

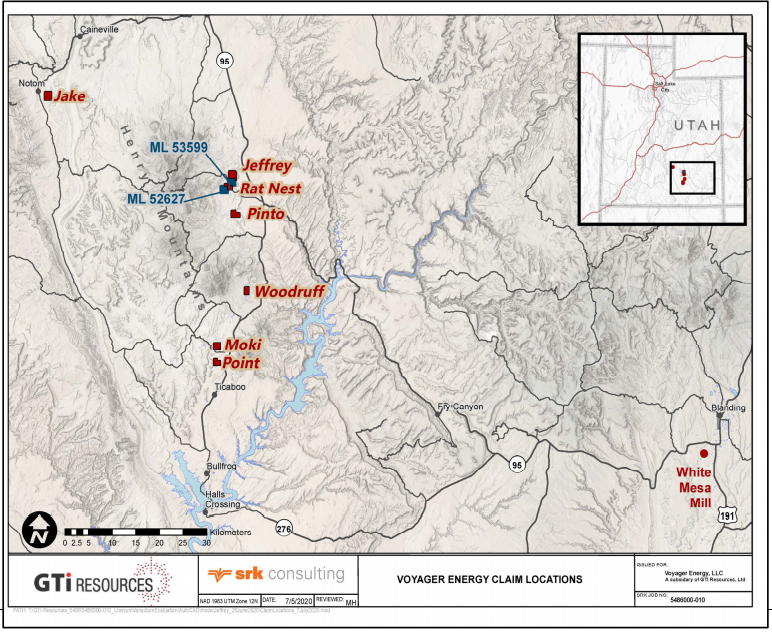

GTI has approximately 1,500 hectares of land holdings in the Henry Mountains region of Utah, within the Garfield and Wayne Counties.

The region forms part of the prolific Colorado plateau uranium province which historically provided the most important uranium resources in the US.

Sandstone-hosted ores have been mined in the region since 1904 and the mining region has historically produced in excess of 17.5 million tonnes at 2,400ppm U3O8 (92 million pounds U3O8) and 12,500ppm V2O5 (482 million pounds V2O5).

The region benefits from established infrastructure and a mature mining industry.

Review of acquired data confirms prospectivity

A full review of a data package was conducted in 2020, supporting management’s decision to acquire the data with a view to guiding exploration activities on the leases.

This data further confirmed the excellent prospectivity of the acquired land package.

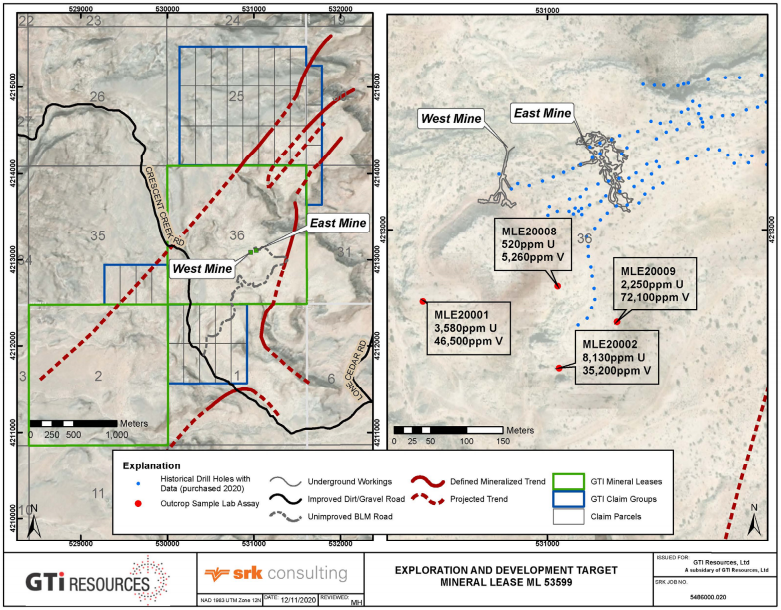

Exploration activities conducted during the December quarter of 2020 focused on a significant exploration and development target within the Section 36 mineral lease, one of the two newly acquired leases.

This lease includes historical underground production from two mines operated into the late 1970s as well as numerous small prospect adits that pre‐date larger-scale mining.

Underground mapping was completed on two historical developments as shown below at the East Mine and the West Mine.

Completion of the surveys required installation of over 50 new survey stations within the workings to ensure the accuracy of the mine maps.

Both mines were operated into the late 1970s and show evidence of more modern mining techniques than seen in much of the Henry Mountains uranium district.

Although idle for 50 years, both mines are in very good condition attesting to the excellent ground conditions and they have existing declines for access.

The prospectivity of this area was previously demonstrated by pXRF data and sample assays reported by the company in 2020.

As a follow-up to this work, GTI completed underground mapping of the two prominent underground developments, coupled with high volume pXRF screening throughout these workings to define local characteristics of the mineralisation.

Through this work program GTI has mapped over 1,300 metres of underground development, and pXRF screening has provided results as high as 19.64% U3O8 and 6.08% V2O5.

Management believes that this early stage exploration work is only beginning to show the prospectivity of the project, strongly validating the acquisition of the leases, as well as the overarching strategy to develop a uranium and vanadium project within the Henry Mountains Uranium District.

Commencement of field work imminent

GTI has finalised exploration permitting and management expects field work to start during March or April once weather allows.

The company will leverage the existing underground developments to aid in rapid advancement of the project.

Planned exploration activities will include geophysical logging of the numerous exploration drill holes to confirm prior exploration activities, and advancement of numerous underground core drill holes (horizontal drilling) to test continuity of mineralisation between open underground workings and distal historical exploration drill holes advanced from surface.

The results of this program will allow for study of the controls and distribution of grade material, as well as generating data for construction of a possible mineral resource, work that is planned for the June quarter of 2021, with a follow-up program in the September quarter based on results.

Additional small‐scale exploration and sampling activities will also be completed on an ongoing basis.

GTI aims to produce high-quality, low-cost data

GTI has continuously generated high‐quality, low‐cost data to enhance the company’s understanding of the potential of the expanded Jeffrey and Rats Nest project area over the past 12 months.

In addition, management continues to seek additional value accretive opportunities to expand its US portfolio.

GTI has engaged an experienced engineering firm with a history of uranium exploration, mining and land reclamation to conduct the 2021 exploration plan.

Commenting on these developments, executive director of GTI Bruce Lane said, “GTI is excited about the results of recent exploration activity on the newly acquired leases and sees real potential in the district for mine redevelopment and the production of high‐grade uranium and vanadium ores.

‘’We look forward to commencing our exploration program soon and will provide more details and results as work progresses.”

Indeed, GTI has numerous opportunities to work with given both the East Mine and the West Mine have identified ore-grade mineralisation along their full peripheral extents, indicating significant potential for mineral continuity beyond the current developments.

While shares in GTI have retraced slightly in 2021, they are still trading at a 300% premium relative to where they were 12 months ago.

Consequently, there appears to be a good degree of confidence in management’s exploration strategy in 2021, suggesting the recent pullback may represent an opportunistic entry point.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.